On August 25, Home Credit released its semi-annual financial report to the Hanoi Stock Exchange (HNX) and its bondholders.

Source: VietstockFinance

|

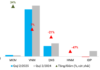

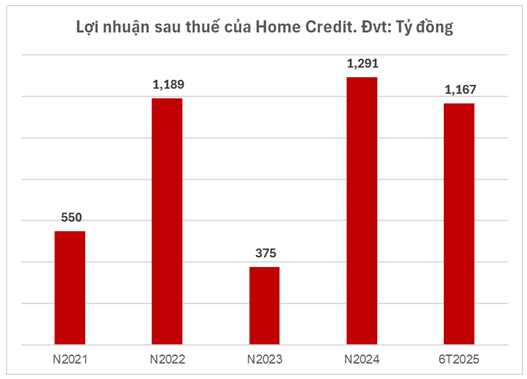

According to the report, the consumer finance company recorded a net profit of nearly VND 1,167 billion, 2.5 times higher than the same period last year. This figure is only VND 124 billion lower than the profit for the whole of 2024 and has surpassed the profit of 2023.

As of the end of June 2025, Home Credit’s equity reached more than VND 8,100 billion, up 12% from the beginning of the year, thanks to a 33% increase in accumulated profit to nearly VND 4,756 billion. Chartered capital remained unchanged at VND 2,050 billion. Profitability ratios also improved significantly: ROE increased from 6.77% to 14.4%, and ROA increased from 1.67% to 3.48%.

Source: VietstockFinance

|

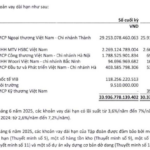

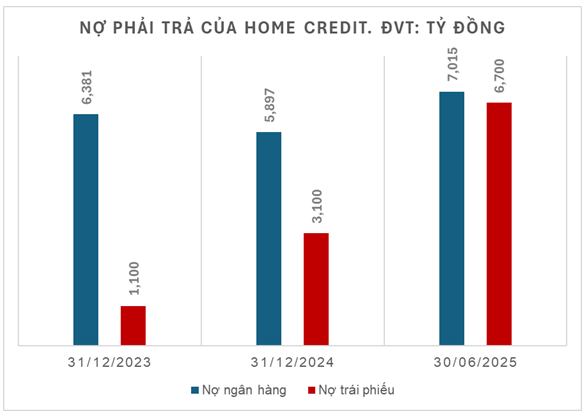

Total loan balance exceeded VND 25,400 billion, up 26% from the beginning of the year. Of this, bond debt reached VND 6,700 billion, 2.2 times higher, and bank debt exceeded VND 7,000 billion, up 19%.

|

Home Credit issued 9 batches of bonds in the first half of 2025

Source: HNX

|

In just the first six months, Home Credit successfully issued 9 batches of bonds worth a total of VND 3,600 billion. These are all non-convertible, non-warrant, and unsecured bonds, with interest rates ranging from 6.8% to 7.1% per annum, payable semi-annually.

Notably, Home Credit’s 30-day VNĐ solvency ratio remained negative, improving from -36.09% at the end of 2024 to -24.19% as of June 30, 2025, while the minimum requirement is 20% (applicable only to positive values).

The improved business results came after more than a year of Home Credit being acquired by a Thai company. In February 2024, Home Credit Group completed the transfer of 100% of its capital in its Vietnamese subsidiary to The Siam Commercial Bank Public Company (SCB), a member of SCBX Public Company (SCBX), one of Thailand’s largest financial institutions, for approximately EUR 800 million (USD 865 million).

– 09:58 09/03/2025

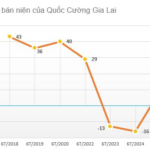

“Doubts Cast on Quoc Cuong Gia Lai’s Ability to Continue Operations by Auditors”

QCG’s short-term assets stand at VND 1,844 billion, while its short-term liabilities amount to a staggering VND 3,814 billion.

The Real Estate Renaissance: Navigating the Market with Financial Savvy

The real estate market has been through a tumultuous time, and many property businesses have had to get creative to weather the storm. With core operations struggling, these enterprises have had to look beyond their traditional realms to stay afloat, turning to financial maneuvers to navigate these challenging times.

“ESOP Bonanza: 313 SHS Employees Bag Shares at a Whopping 66% Discount to Market Price”

SHS announces the issuance of 5 million ESOP shares to 313 employees at a price of 10,000 VND per share, an incredible 66% discount on the market price.