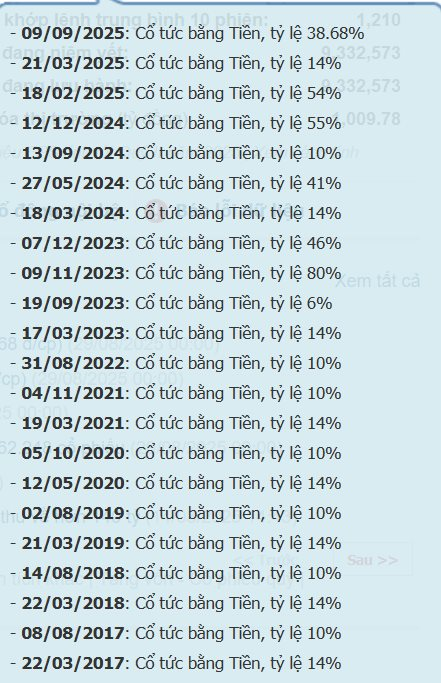

On August 26, Pharmedic JSC (PMC) announced the record date for the payment of the remaining 2024 dividends in cash.

Accordingly, PMC will pay dividends in cash at a ratio of 38.68%/share (equivalent to VND 3,868 per share). The record date is September 10. The payment is expected to be made on September 22.

With over 9.33 million shares outstanding, PMC will have to spend over VND 36 billion in dividends to shareholders.

At the 2025 Annual General Meeting of Shareholders, Pharmedic adjusted its 2024 dividend payout plan from 24% to 62.68%. Previously, the company had paid two cash dividend installments from the source of post-tax profit of the 2024 business plan with a total ratio of 24%.

In addition, PMC has paid cash dividends from undistributed post-tax profits after the recovery of the Development Investment Fund at a dividend rate of 109%.

According to the resolution of the Board of Directors in July, PMC plans to pay an interim cash dividend for 2025 with a ratio of 10% in November 2025.

Previously, on August 15, Saigon-Hanoi Securities JSC (SHS) divested its entire stake of over 1.36 million PMC shares (equivalent to 14.6% ownership) through a matched trade, no longer holding shares in PMC.

In the first half of 2025, PMC’s net revenue reached nearly VND 258 billion, up 8% over the same period last year, due to the promotion of customer appreciation programs and the utilization of domestic raw materials to reduce costs. Post-tax profit reached VND 45 billion, up more than 16% over the same period.

On the stock market, PMC shares are currently trading at VND 108,200/share.

“A Surprising Turnaround: Stock Surges with a 63% Post-Tax Profit Jump Post-Audit”

With the release of its 2025 half-year audited financial report, TV2 has achieved a remarkable feat, surpassing 60% of its annual net profit plan for the year.

MSN – Strengthening its Position for Sustainable Growth (Part 1)

The Masan Group Corporation (HOSE: MSN) is Vietnam’s leading consumer-retail company, with a diverse portfolio spanning fast-moving consumer goods (FMCG), food and beverage retail, branded meat products, financial services, and high-tech industrial materials. MSN’s core businesses continue to deliver positive results, showcasing their adaptability to market fluctuations and reinforcing their prospects for sustainable growth.

The Power of Vietnam’s Largest Bank: Vietcombank’s Market Capitalization Surges by a Whopping Amount, Outperforming Thousands of Listed Companies

The stock market in Vietnam witnessed an unprecedented event as Vietcombank’s market capitalization surged by a staggering $1.5 billion in a single trading session on August 27. This remarkable feat, a first in the nation’s stock market history, underscores the bank’s formidable presence and highlights the potential for significant growth in the country’s equity market.

“Brewery Giant Pours 30% Cash Dividends, Yet Profits Evaporate by 74% Despite Record-Breaking Semiannual Revenue”

With over 3.1 million shares in circulation, the company anticipates shelling out nearly VND 9.4 billion for the upcoming payment on October 17th.