Figure 1: TV2’s Financial Report for the First Half of 2025

According to the audited semi-annual financial report for 2025 of Construction Electric Consulting Joint Stock Company 2 (TV2), the company’s net revenue was nearly VND 516 billion, identical to the self-prepared report. However, the company’s net profit for the first six months of 2025 was over VND 33 billion, a 63% increase compared to the self-prepared report (over VND 20 billion).

The company explained that the discrepancy was due to their establishment of a subsidiary, PECC2 Port Operation and Maintenance Joint Stock Company (PPOM), on April 23, 2025. Per the regulations of Circular No. 202/2014/TT-BTC of the Ministry of Finance, TV2 was required to prepare and submit consolidated financial statements from that date onwards, operating as a parent-subsidiary entity.

Regarding the self-prepared report, TV2 applied the equity method to their investment in an associate company for the consolidated financial statements for the second quarter of 2025. This was based on the quarterly accounting period used for preparing self-prepared financial statements for disclosure purposes by listed companies. The business results for the six-month period presented are a cumulative result of the consolidated (first quarter of 2025) and consolidated (second quarter of 2025) financial statements.

For the audited report, the mid-year consolidated financial statements have been adjusted assuming that the equity method was applied from the date TV2 started investing in the associate company. As a result, the business results for the first quarter of 2025 are now presented on a consolidated basis.

With the results shown in the audited semi-annual financial report for 2025, TV2 has achieved 60% of its after-tax profit plan for the year 2025.

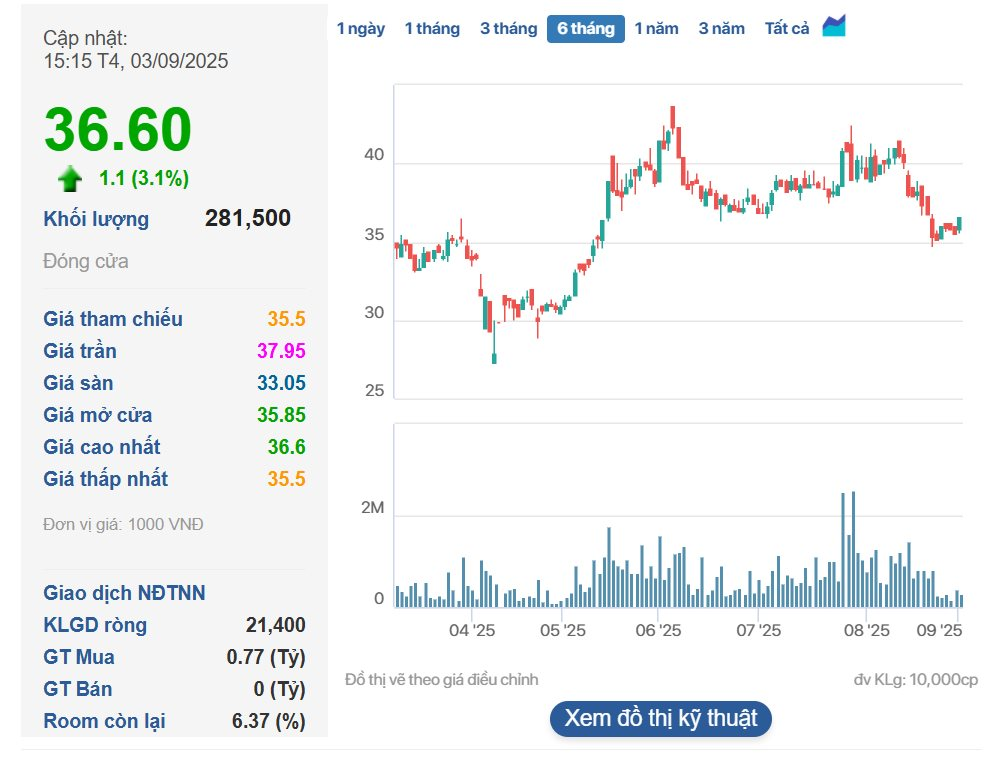

In the stock market, TV2 shares are currently trading at VND 36,600 per share. TV2’s share price has been on a downward trend since August 12, dropping by nearly 11% in the past three weeks.

Figure 2: TV2’s Share Price Movement

The Real Estate Renaissance: Navigating the Market with Financial Savvy

The real estate market has been through a tumultuous time, and many property businesses have had to get creative to weather the storm. With core operations struggling, these enterprises have had to look beyond their traditional realms to stay afloat, turning to financial maneuvers to navigate these challenging times.

“ESOP Bonanza: 313 SHS Employees Bag Shares at a Whopping 66% Discount to Market Price”

SHS announces the issuance of 5 million ESOP shares to 313 employees at a price of 10,000 VND per share, an incredible 66% discount on the market price.

“IPA Seeks Buyers for 50 Million Privately Placed Shares”

Introducing IPA’s latest venture: a proposed private placement of 50 million shares, with a vision to revolutionize the market. The funds raised from this offering are intended to be utilized for the sole purpose of redeeming bonds previously issued in 2024. This strategic move showcases IPA’s commitment to financial prudence and paves the way for a robust future.

“Brewery Giant Pours 30% Cash Dividends, Yet Profits Evaporate by 74% Despite Record-Breaking Semiannual Revenue”

With over 3.1 million shares in circulation, the company anticipates shelling out nearly VND 9.4 billion for the upcoming payment on October 17th.