Vietnam’s manufacturing sector continued to expand in August, but at a slower pace amid weakening demand. In fact, new orders fell after a brief rebound in July, contributing to a further decline in employment as excess capacity became evident.

Some companies mentioned material shortages, which led to the longest supplier delivery times and sharpest input cost inflation so far this year.

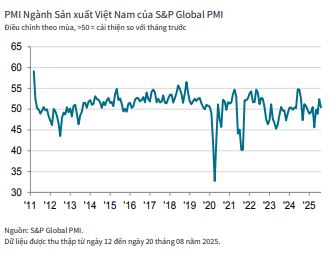

The S&P Global Manufacturing Purchasing Managers’ Index™ (PMI®) for Vietnam remained above the 50.0 no-change mark in August, signaling a second consecutive monthly improvement in business conditions. However, with a reading of 50.4, down from 52.4 in July, the latest data indicated only a modest improvement.

The main positive from the survey was that output continued to rise, extending the current sequence of growth to four months. The rate of expansion in August was solid, although it eased from July’s recent high. Panels often attributed higher production to greater new orders, while the slowdown reflected reports of softening demand.

New orders fell in August, following a brief return to growth in July. Panels reported lower demand, partly linked to US tariffs. Tariff-related issues also caused new export orders to fall for the tenth month running, and the rate of reduction quickened in August and outpaced that seen for total new work.

As new orders fell, companies continued to trim their workforce at the end of the third quarter. Employment has now fallen in each of the last 11 months, although the latest reduction was marginal. Nonetheless, a sharp fall in new orders led to underutilized capacity across the sector. Backlogs of work decreased markedly, and to the greatest extent since last April.

Finished goods inventories also fell as companies reported reluctance to hold stocks in the face of falling new orders and as goods were dispatched to clients.

While manufacturers reduced their workforce and holdings of finished goods, purchasing activity increased for the second month running, reportedly due to higher production needs and inventory building amid expectations of improved demand.

However, pre-production inventories fell as imports declined. Material shortages affected efforts to secure inputs, and supplier delivery times lengthened.

Shortages of materials, tariffs, and transportation costs led to a further increase in input prices during August. The rate of inflation quickened and was the sharpest since the start of 2025, although it remained weaker than the survey history average.

Output charges rose for the third month running in August, as tax hikes and the passing on of greater input costs to clients were reported. Output prices rose marginally, and the rate of inflation was similar to that seen in July.

Finally, business confidence strengthened to a six-month high in August but remained below the survey history average. Some panels expected new orders to rise over the coming year, supporting optimism towards output. However, concerns about the global economic situation limited confidence.

Andrew Harker, Economics Director at S&P Global Market Intelligence, said:

“Although it is encouraging that output continued to rise in August, the further fall in new orders raises questions about how long companies can maintain this growth. New business fell as exports continued to decline sharply, with tariff issues continuing to impact the manufacturing sector.

Firms were at least more confident about the outlook for the year ahead, partly based on hopes of stronger demand, which would encourage greater purchasing activity. However, manufacturers have, to some extent, been affected by material shortages.

With the path of tariffs seemingly more stable, it is hoped that improvements in demand will be realized in coming months, helping to sustain manufacturing output growth.”

– 08:10 03/09/2025

July 2025 PMI: New Orders Rise for the First Time in Four Months

The S&P Global Manufacturing Purchasing Managers’ Index (PMI) for Vietnam stood at 52.4 in July, up from 48.9 in June and above the 50-point threshold for the first time in four months. This indicates an improvement in the overall health of the manufacturing sector. Indeed, the strengthening of business conditions was the most notable in nearly a year.

“PMI Surges Past 52: Vietnam’s Manufacturing Sector Booms Despite US Tariff Turbulence”

The Vietnamese manufacturing sector rebounded in July 2025, with the PMI index reaching an impressive 52.4 points. This marks the first time in four months that the index has crossed the 50-point threshold, indicating a return to growth. Notably, this expansion occurred despite ongoing weaknesses in export activity due to US tariff impacts.