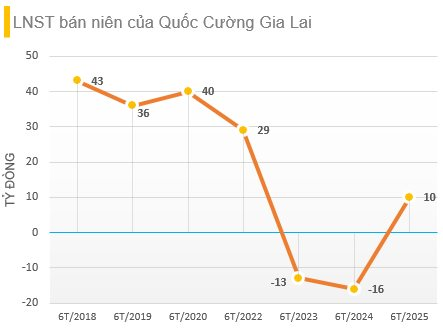

QCG Joint Stock Company (QCG) has released its reviewed consolidated semi-annual financial statements for 2025, reporting impressive growth. With a revenue of 242.56 billion VND, the company witnessed a remarkable 271.9% surge compared to the same period last year. Additionally, a notable improvement was seen in net profit, which stood at 10 billion VND, a significant turnaround from the 16.62 billion VND loss incurred in the previous year.

For 2025, QCG has set ambitious business plans with a targeted revenue of 2,000 billion VND and a pre-tax profit of 300 billion VND. However, with a pre-tax profit of 20.46 billion VND in the first half of 2025, the company has achieved only 6.8% of its annual plan.

Notably, the auditing firm, WHY Audit and Consulting Company Limited, has raised concerns about the company’s ability to continue as a going concern. This is due to two main reasons. Firstly, a payment of 74.3 billion VND related to the Apartment and Commercial Area project along the Tan Phong river (Ho Chi Minh City) awaits an official decision from the Ho Chi Minh City People’s Committee, leaving the project’s progress uncertain.

Secondly, as of June 30, 2025, QCG’s current assets totaled 1,844 billion VND, while current liabilities stood at 3,814 billion VND. A significant portion of this liability is the 2,782 billion VND debt owed to a company associated with Ms. Truong My Lan, arising from a promised purchase-sale contract for the Bac Phuoc Kient urban area project in Phuoc Kient, Nha Be District, Ho Chi Minh City.

These factors introduce a material uncertainty that may cast significant doubt on the company’s ability to continue as a going concern. However, QCG’s management assures that they have identified the issues and developed business and cash flow plans for 2025 and beyond. They are confident in their ability to meet debt obligations and maintain continuous operations.

The Real Estate Renaissance: Navigating the Market with Financial Savvy

The real estate market has been through a tumultuous time, and many property businesses have had to get creative to weather the storm. With core operations struggling, these enterprises have had to look beyond their traditional realms to stay afloat, turning to financial maneuvers to navigate these challenging times.

“IPA Seeks Buyers for 50 Million Privately Placed Shares”

Introducing IPA’s latest venture: a proposed private placement of 50 million shares, with a vision to revolutionize the market. The funds raised from this offering are intended to be utilized for the sole purpose of redeeming bonds previously issued in 2024. This strategic move showcases IPA’s commitment to financial prudence and paves the way for a robust future.