“HPX Extends Bond Maturity with 11% Interest Rate; Repayment Strategy Outlined”

As per the approved terms at the bondholder meeting, an 11% annual interest rate will be applied during the extension period. Additionally, HPX is required to pay the outstanding interest by August 25, and no other fees or penalties, including but not limited to late payment charges, will be imposed.

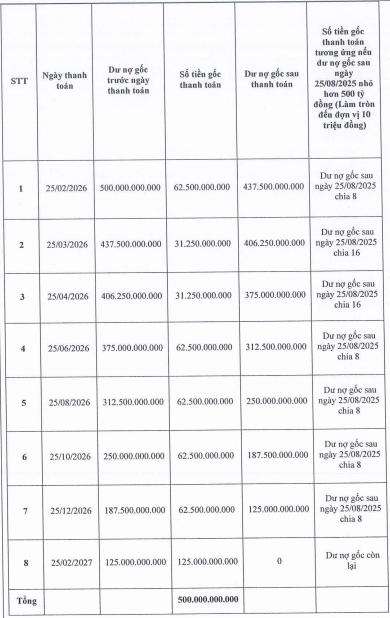

From February 25, 2026, to February 25, 2027, HPX will make eight principal payments to reduce the debt to zero by the end of February 25, 2027.

|

HPX’s Bond Repayment Schedule

Source: HPX

|

HPX has the right to make early repayments at any time before the aforementioned dates, with a minimum value equivalent to the expected amount for each period. The interest accrued during the extension period will be paid in a lump sum on February 25, 2027. The current collateral for the HPXH2125007 series will continue to be utilized during the extended period.

HPXH2125007 was issued in August 2021 with a value of VND 500 billion and an 11% interest rate. The collateral includes eight commercial floors in the Trade, Service, and Apartment Complex project named Hai Phat Plaza (commercial name Roman Plaza) owned by Chau Son Real Estate Joint Stock Company – an HPX member; five Roman Plaza kiosks owned by individuals; and a project in Tuy Hoa, Phu Yen province.

With the VND 500 billion raised, HPX allocated VND 250 billion to increase its operating capital and VND 250 billion for investment in regular expenditure programs.

However, due to challenges in the real estate market, coupled with tightened real estate credit and reduced liquidity, HPX’s cash flow from projects was affected. As a result, in 2023 and 2024, the company managed to pay only approximately VND 21 billion in interest. Specifically, in 2024, HPX was unable to make any interest payments for all four interest periods, totaling nearly VND 67 billion.

Where Can the VN-Index Go?

Short-term volatility is inevitable, but many analysts believe that the stock market is on a significant upward trend, with the potential to push the VN-Index to unprecedented levels.

What is the Outstanding Bond Debt of the Aqua City Project Investor?

With a successful redemption of VND 502 billion in bonds (code TPACH2025004) on July 1st, the developer of Aqua City still has VND 1,600 billion in outstanding bond debt.