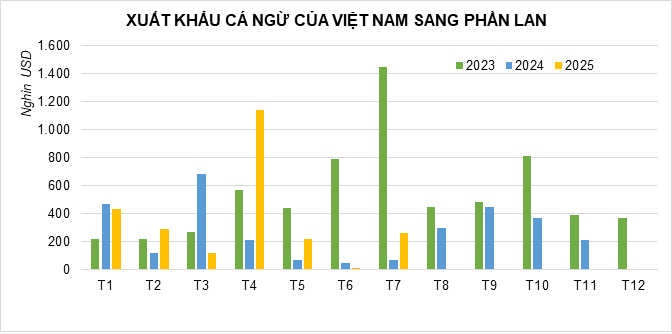

Vietnam’s tuna exports to Finland in recent years have made significant strides. According to statistics, tuna export turnover to Finland has consistently increased, from 1.7 million USD in 2021 to almost 4 million USD in 2023.

Information from the Vietnam Association of Seafood Exporters and Producers (VASEP) reveals that after a decline in 2024, Vietnam’s tuna exports to Finland rebounded in 2025, with remarkable growth in several months.

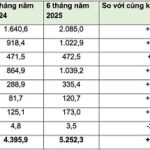

According to statistics from Vietnam Customs, Vietnam’s tuna exports to Finland in the first seven months of 2025 reached nearly 2.5 million USD, a 49% increase compared to the same period in 2024. This indicates the market’s interest and acceptance of Vietnamese tuna products. With a nearly 50% increase in the first seven months, Finland emerges as a promising market for Vietnamese tuna in the coming years.

The main tuna export products from Vietnam to this market are canned tuna, along with some processed and frozen tuna products. Canned and frozen tuna from Vietnam is highly regarded for its competitive pricing compared to other traditional suppliers, thanks to tariff advantages under the EVFTA agreement.

According to VASEP, the global tuna market in 2025 is influenced by fluctuating raw material prices, logistics costs, and tighter consumer trends in Europe following the inflationary period. However, processed seafood products, such as tuna, which are rich in protein and reasonably priced, remain attractive.

The demand from the Nordic countries (Finland, Sweden, and Denmark) is expected to remain stable, especially in the retail consumer goods segment. Additionally, Finland could serve as a gateway for Vietnamese businesses to expand into neighboring Nordic countries, leveraging the common consumption trends in the region.

In recent times, Vietnamese enterprises have made efforts to boost exports to the Finnish market. Nevertheless, tuna exports to Finland still account for a small proportion of Vietnam’s total tuna export turnover.

This indicates significant growth potential, but it also requires businesses to work harder to improve product quality, meet market standards and requirements, and build reputable brands.

However, similar to other EU markets, Vietnam’s exports to Finland will also face intense competition from major suppliers such as Spain, Portugal, and Thailand. Moreover, the increasingly stringent requirements for sustainability certifications (MSC, IUU certificates) will pose a significant challenge for Vietnam.

Tuna is a strategic agricultural export product for Vietnam. In Vietnam’s seas, tuna is mainly found in the central coastal waters and the central region of the East Sea. Vietnam’s tuna resources are estimated at over 600,000 tons, with yellowfin tuna being the primary species, accounting for more than 50% of the total pelagic fish resources.

Vietnam has become the world’s fifth-largest tuna exporter in terms of turnover, only behind Thailand, Ecuador, Spain, and China. Vietnam’s tuna exports reached nearly 1 billion USD in 2024. In the first seven months of 2025, they reached nearly 542 million USD, a 3% decrease compared to the same period last year.

According to VASEP, in the last few months of the year, it will be challenging for Vietnamese tuna to break through and maintain its market share due to the US imposing new countervailing duties on each country. Additionally, geopolitical instability, logistics issues, and fluctuating demand in key markets such as Russia, Israel, and Chile are also significantly impacting exports to these destinations.

The Great Export Conundrum: Why Are Domestic Supermarkets a Tough Sell for Export Powerhouses?

The representative from the Vietnam Association of Seafood Exporters and Producers (VASEP) highlighted an interesting issue faced by export-oriented businesses: their struggle to sell their products in the domestic market.