The six-month financial statement for the first half of 2025 of the IDICO Corporation – JSC (IDC code) shows that net revenue reached VND 3,556 billion, a 23% decrease compared to the same period last year. More notably, profit after tax plummeted by 43%, standing at only VND 832 billion.

With these results, the company has only achieved approximately 40% of its full-year revenue and profit plans.

The main reason for this decline stems directly from the “backbone” business of leasing land in industrial parks (IPs).

Revenue from this activity decreased by 62% in the first half of the year, and the core reason lies in the significantly lower land area handed over to customers. According to a recent analysis report by VCBS Securities Company on IDICO, this figure reached only 28 ha compared to 65 ha in the same period in 2024.

This decrease reflects two significant trends: the intensifying competition in the industry and the shifting structure of FDI capital. However, there is a silver lining as the total area of new leases in the first half of 2025 still witnessed a 10% growth rate compared to the same period, reaching 47.8 ha, mainly due to strong performance in the first quarter.

In contrast to IDICO’s performance, its peers Becamex (BCM) and Kinh Bac (KBC) experienced booming first halves. Specifically, BCM’s profit after tax soared by 4.5 times, reaching over VND 1,833 billion, while KBC impressed with a profit growth of 6.4 times, earning VND 1,250 billion.

According to VCBS, IDICO’s recent projects have expanded further north, attracting significant FDI in the electricity and electronics sectors. As shared by the management board, after the news about countervailing duties, the number of Chinese enterprises interested in IDICO’s projects increased significantly, indicating a strong trend of supply chain relocation due to tax concerns for transhipment goods.

Despite the immediate challenges, IDICO’s potential is still highly regarded, thanks to its solid foundations built over the years.

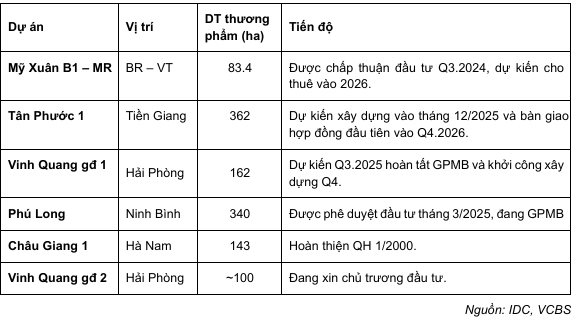

First, a strategic and ever-expanding industrial park land fund. IDICO is one of the leading industrial park developers with numerous large-scale projects in prime locations. The company is actively expediting the progress of strategic keystone projects. For Tan Phuoc 1 Industrial Park, IDICO plans to commence infrastructure construction by the end of 2025 and start land handover from Q4 2026. Meanwhile, the Vinh Quang Industrial Park (Hai Phong) project is also expected to break ground in Q4 2025.

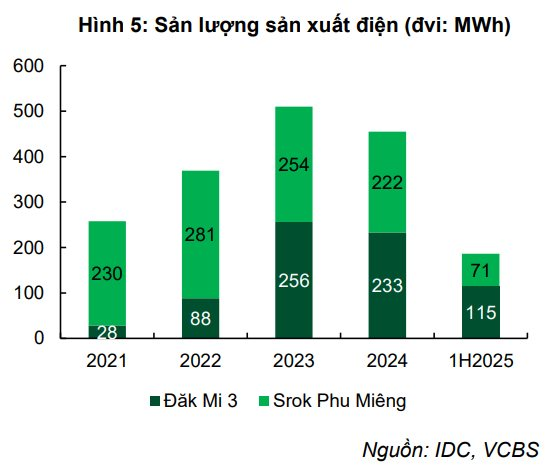

Second, a “tripod” structure with expansion into seaports. Apart from industrial parks, IDICO also enjoys consistent revenue streams from other business segments, including hydropower, BOT toll roads, and electricity distribution. These segments serve as crucial “pillars” of support, especially given the 18% growth in electricity distribution revenue in the first half of the year.

Most recently, IDICO increased its ownership in the My Xuan A Port project to 100%, a strategic move indicative of its ambition to expand into the logistics and seaport sector.

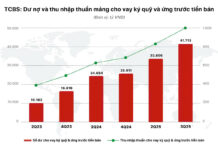

Third, a reserve of over VND 6,400 billion. An important highlight in IDICO’s financial picture is the “unearned revenue” item, often referred to as a “reserve.” As of the end of June 2025, this amount stood at VND 6,417 billion. This represents advance payments from customers, which will be recognized as revenue in the future.

Coupled with a substantial cash balance of nearly VND 4,659 billion, IDICO is well-positioned financially to navigate through volatile times.

Ms. Nguyen Thi Nhu Mai – Chairman of the Board of IDICO

Fourth, expectations from the planned move to the HOSE. At the 2025 Annual General Meeting of Shareholders, IDICO’s management affirmed their commitment to the full-year business plan with a profit-before-tax target of nearly VND 2,600 billion, reflecting their confidence in the company’s performance this year.

Notably, the company has submitted a listing application to the Ho Chi Minh City Stock Exchange (HOSE). A successful transfer is expected to enhance the prestige of the IDC stock, improve liquidity, and attract investments from large funds.

Unlocking the Power of Words: “336 Million Shares Set Free: Escaping the Confines of Caution”

“The unqualified opinion rendered in the 2025 interim financial report review for Tien Phong Securities showcases a pristine financial standing. This comprehensive review affirms the company’s financial health and stability, instilling confidence in investors and stakeholders alike.”

“TV3 Recalibrates: Scaling Down 2024 Profit Target by 21%”

Assuming that it would be challenging to achieve the business plan targets for 2024 as assigned by the General Meeting of Shareholders, Construction Electricity Consultancy Joint Stock Company (HNX: TV3) is seeking to adjust its business plan by lowering the targets.