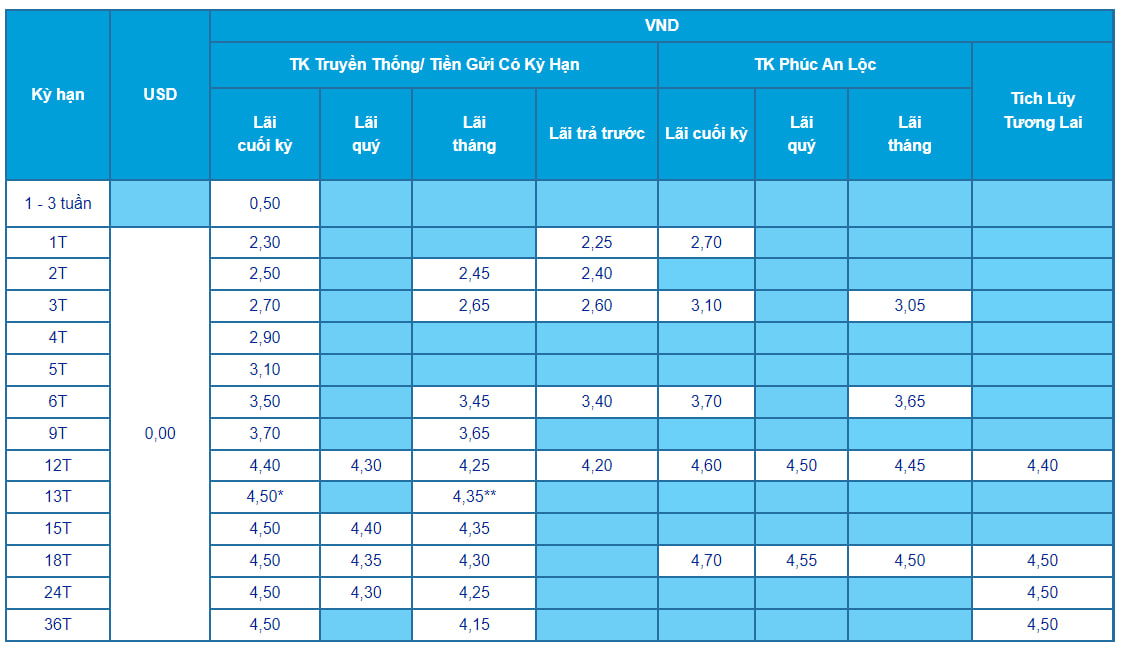

ACB’s Deposit Interest Rates for Over-the-Counter September 2025

According to a survey at the beginning of September, Asia Commercial Joint Stock Bank (ACB) continues to apply the deposit interest rate for customers depositing at the counter, with interest payable at the end of the term ranging from 0.5 – 4.5%/year.

Specifically, ACB offers an interest rate of 0.5%/year for terms of 1-3 weeks; 1-month term with an interest rate of 2.3%/year; 2-month term at 2.5%/year; 3-month term at 2.7%/year; 4-month term at 2.9%/year; 5-month term at 3.1%/year; 6-month term at 3.5%/year; 9-month term at 3.7%/year; and 12-month term at 4.4%/year.

ACB offers an interest rate of 4.5%/year for long-term deposits ranging from 13 to 36 months. For the 13-month term, customers depositing 200 billion VND or more will receive a preferential interest rate of 6.0%/year.

ACB’s Over-the-Counter Deposit Interest Rate Table for September 2025

Source: ACB

In addition to the end-of-term interest payment, ACB continues to offer other flexible interest payment options: Quarterly interest payment: Interest rates range from 4.30% to 4.4%/year; Monthly interest payment: Interest rates range from 2.45% to 4.35%/year (For the 13-month term, a minimum deposit of 200 billion VND will receive an interest rate of 5.9%/year); Advance interest payment: Interest rates range from 2.25% to 4.2%/year

ACB also offers the Phúc An Lộc and Tích Lũy Tương Lai savings packages for customers to choose from, with the highest interest rate of up to 4.7%/year.

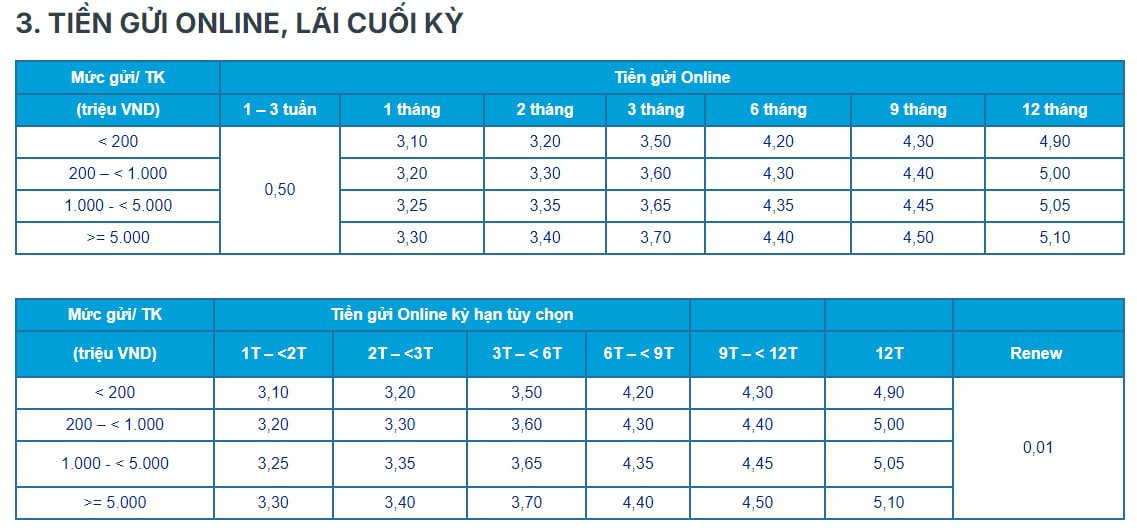

ACB’s Online Deposit Interest Rates for September 2025

For online deposits via the banking app, ACB’s interest rates range from 0.5 – 5.1%/year for end-of-term interest payment.

Specifically, ACB applies an interest rate of 0.5%/year for terms of 1-3 weeks. For other terms, ACB offers different interest rates based on the amount deposited. Here are the details:

For deposits below 200 million VND: The interest rate for a 1-month term is 3.1%/year; 2-month term at 3.2%/year; 3-month term at 3.5%/year; 6-month term at 4.2%/year; 9-month term at 4.3%/year; and 12-month term at 4.9%/year.

For deposits from 200 million VND to less than 1 billion VND: The interest rate for a 1-month term is 3.2%/year; 2-month term at 3.3%/year; 3-month term at 3.6%/year; 6-month term at 4.3%/year; 9-month term at 4.4%/year; and 12-month term at 5.0%/year.

For deposits from 1 billion VND to less than 5 billion VND: The interest rate for a 1-month term is 3.25%/year; 2-month term at 3.35%/year; 3-month term at 3.65%/year; 6-month term at 4.35%/year; 9-month term at 4.45%/year; and 12-month term at 5.05%/year.

For deposits of 5 billion VND or more: The interest rate for a 1-month term is 3.3%/year; 2-month term at 3.4%/year; 3-month term at 3.7%/year; 6-month term at 4.4%/year; 9-month term at 4.5%/year; and 12-month term at 5.1%/year.

Thus, the highest online deposit interest rate offered by ACB for a 12-month term ranges from 4.9% to 5.1%/year, depending on the deposit amount.

ACB’s Online Deposit Interest Rate Table for September 2025

Source: ACB

The Electric Revolution: Unveiling Honda’s Upcoming E-Bike Models for Vietnam

These are the electric motorcycles that Honda could be bringing to the Vietnamese market in the near future. With their cutting-edge technology and sleek designs, these models are set to revolutionize the way we commute and perceive electric vehicles in Vietnam. Stay tuned as we uncover more about these exciting additions to the country’s automotive landscape.