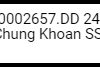

The morning session closed with the VN-Index down 2.83 points to 1,678.47, notably dropping from nearly 1,689 points to 1,676 points, a range of almost 13 points.

Source: VietstockFinance

|

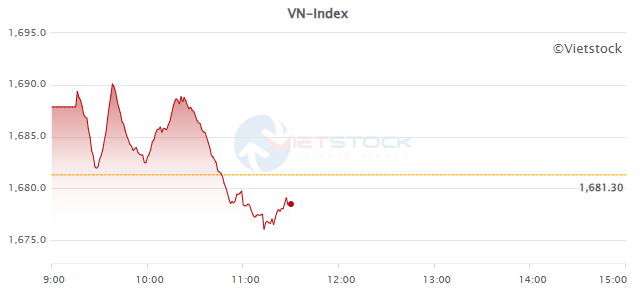

Real estate was the market’s worst-performing sector, falling by 1.07%. The VIC, VHM, and VRE trio, which declined by 1.2%, 2.92%, and 0.5%, respectively, were the main contributors to this drop. The remaining stocks displayed mixed performances, with several decliners, including BCM, KDH, NVL, PDR, DXG, and NLG, but also some gainers such as KSF, SJS, VPI, DIG, SIP, CEO, SNZ, and TCH.

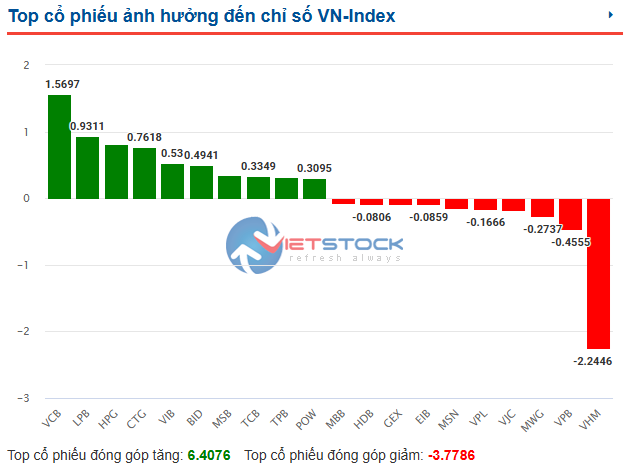

Among the top 10 stocks negatively impacting the market, VHM led the way, wiping off more than 2.2 points.

The second-worst performing sector was consumer services, dragged down by another Vin Group member, VPL, which fell by 0.62%.

In the other declining sectors, although securities and banking recorded relatively minor losses, their large market capitalization still had a significant impact on the market. Many stocks in these sectors traded lower during the morning session, including VPB, SHB, TCB, MBB, EIB, STB, ACB, BID, and HDB from the banking industry, and VIX, VND, MBS, and AAS from the securities sector.

Source: VietstockFinance

|

In terms of foreign trading, net selling in the morning session amounted to nearly VND 830 billion, indicating a fifth consecutive session of net selling. VPB, VHM, MWG, and MSN were the top net sold stocks in the morning session, with net selling values of over VND 192 billion, VND 153 billion, VND 142 billion, and VND 125 billion, respectively.

10:40 AM: Continuous fluctuation within a narrow range

VN-Index continued to fluctuate during the morning session, mostly trading within a range of 1,682 – 1,688 points. The performances of securities and banking stocks were mixed, while VHM from the real estate sector exerted the most pressure on the index.

Among the top 10 stocks positively influencing the VN-Index, eight were from the banking sector, with VCB contributing nearly 1.6 points, followed by LPB, CTG, VIB, BID, MSB, TCB, and TPB. However, four banking stocks also appeared among the top 10 negative influencers, namely VPB, EIB, HDB, and MBB. Additionally, the Vin Group duo of VHM and VPL also subtracted a certain amount of points from the VN-Index, with losses of over 2.2 points and nearly 0.2 points, respectively.

Source: VietstockFinance

|

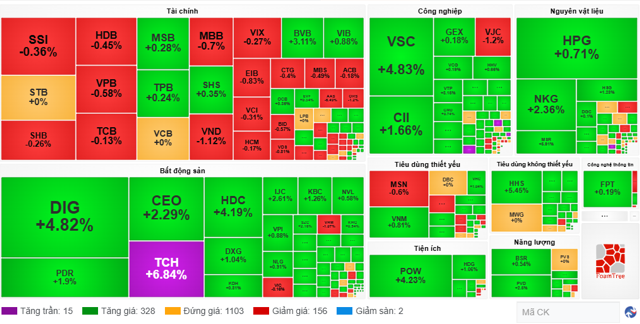

Looking at the market map, the colors green and red were clearly divided among the banking and securities sectors. Meanwhile, most other sectors were dominated by green, although some notable names traded against the trend, including VHM, down 2.63%; DXG, down 0.42%; GEX, down 1.08%; VJC, down 0.77%; MSN, down 0.48%; and MWG, down 1.06%…

Market Open: A volatile start

VN-Index began the day with an enthusiastic ATO session, rising over 8 points at one point. However, pressure quickly mounted, narrowing the gains significantly. As of 9:30 am, the VN-Index was up 0.94 points to 1,682.24.

Green also dominated the HNX-Index and UPCoM, which rose by 1.83 points and 0.28 points, respectively.

Across the market, 328 stocks advanced, including 15 that hit the daily limit, significantly outnumbering the 158 declining stocks. Examining the market map, green prevailed in many sectors, including real estate, with notable gainers such as DIG, up 4.82%; CEO, up 2.29%; HDC, up 4.19%; and TCH, which quickly hit the daily limit. The industrial sector also stood out, with VSC up 4.83% and CII up 1.66%…; while in the materials sector, NKG rose 2.36% and HPG climbed 0.71%…

On the downside, banking and securities stocks faced a challenging start, with most stocks in these sectors trading lower. In the banking sector, SHB, HDB, VPB, TCB, MBB, EIB, CTG, BID, and ACB all posted slight losses. Meanwhile, the securities sector witnessed declines in several stocks, including SSI, VND, VIX, VCI, HCM, and MBS…

|

Market map as of 9:30 am

Source: VPBankS

|

In terms of liquidity, nearly 170.6 million shares changed hands, equivalent to a value of over VND 4.4 trillion.

Asian markets presented a mixed picture at the opening, with the All Ordinaries, Nikkei 225, and Singapore Straits Times indices rising by 0.79%, 1.27%, and 0.22%, respectively. In contrast, the Hang Seng and Shanghai Composite indices declined by 0.44% and 1.23%, respectively…

On Wall Street overnight, the S&P 500 rose thanks to technology stocks after a federal court ruling in the Alphabet antitrust case. This event sparked optimism that tech giants would be able to overcome legal challenges.

At the close of the trading session on September 3, the S&P 500 gained 0.51% to 6,448.26, while the Nasdaq Composite climbed 1.03% to 21,497.73. Conversely, the Dow Jones lost 24.58 points (equivalent to 0.05%) to finish at 45,271.23.

– 12:00 09/04/2025

Technical Analysis for Session on September 04: Re-testing the August 2025 Highs

The VN-Index and HNX-Index showed contrasting movements in the morning session. The VN-Index retested the old peak of August 2025 (equivalent to the 1,680-1,696 range) and fluctuated with the emergence of a Black Body pattern.

Should Investors Be Concerned About the Record Outflow from the Block?

The VN-Index continued its upward trajectory in August, closing at 1,682.21 points and instilling a sense of optimism in the market. However, domestic investors are now questioning the motives of foreign investors, as they witnessed the largest net-selling month since the beginning of the year, with cumulative outflows surpassing VND 58.9 trillion.

[IR AWARDS] September 2025 Disclosure Calendar: Mark Your Diaries

The upcoming periodic information disclosures in September encompass notable events in the stock market. These encompass the Effective Portfolio (MSCI, FTSE ETF, VNM ETF), the release of the PMI, the announcement of the constituents (FTSE ETF, VNM ETF), the socio-economic report for August, the maturity of VN30F2509, the outcome of the FOMC (Fed) meeting, the market ranking report (FTSE), and the 15th IR Awards ceremony.

“Market Winds of Change: Anticipating the Big Shift”

The VN-Index recovered towards the end of the trading session, forming a long lower shadow candle. This indicates that buyers stepped in during a period of correction, suggesting underlying strength in the index. However, to surpass the previous peak of 1,680-1,693 points achieved in August 2025, an improvement in trading volume is necessary in the upcoming sessions.

![[IR AWARDS] September 2025 Disclosure Calendar: Mark Your Diaries](https://xe.today/wp-content/uploads/2025/09/T9_NoiDung-150x150.png)