I. MARKET ANALYSIS OF SECURITIES ON SEPTEMBER 03, 2025

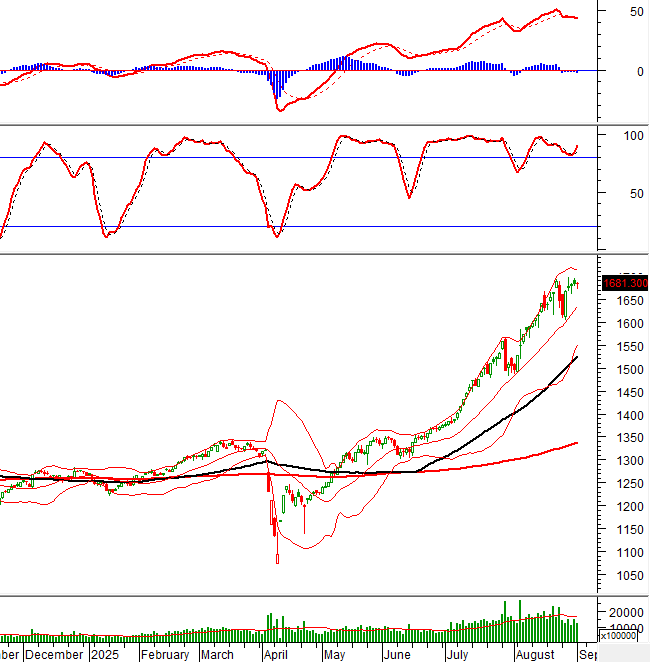

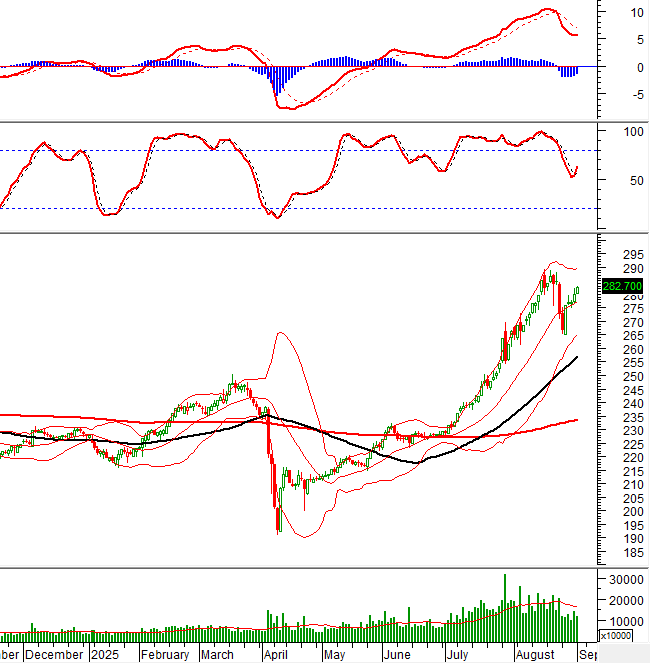

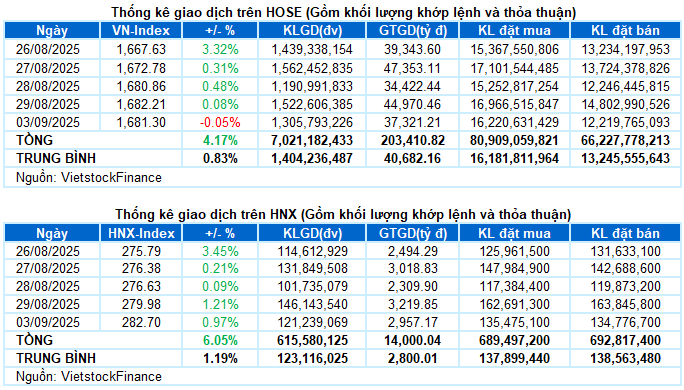

– The main indices moved in opposite directions during the trading session on September 03. VN-Index slightly decreased by 0.05%, reaching 1,681.3 points; meanwhile, HNX-Index continued to increase by 0.97%, reaching 282.7 points.

– The trading volume on the HOSE decreased by 15%, reaching over 1.2 billion units. Similarly, the HNX also recorded a decrease of 19%, with more than 117 million units traded.

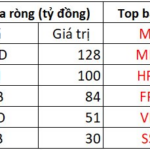

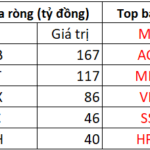

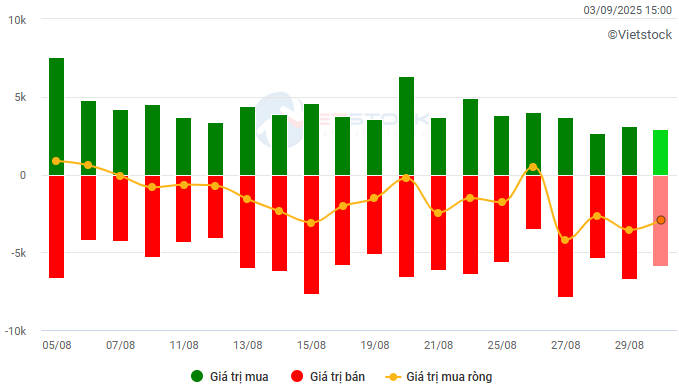

– Foreign investors continued to strongly net sell with a value of nearly VND 2.9 trillion on the HOSE and VND 52 billion on the HNX.

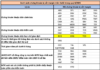

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

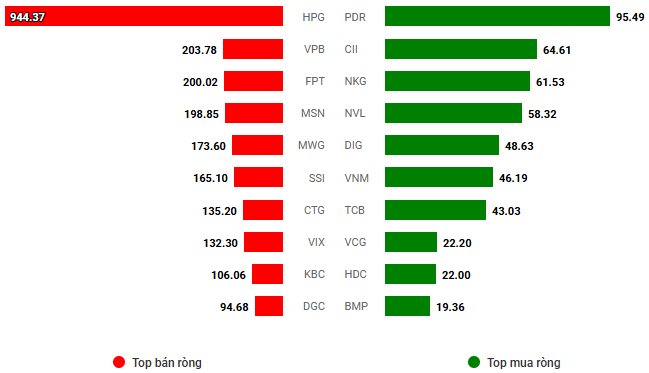

Net trading value by stock code. Unit: VND billion

– The market was divided in the first trading session after the National Day holiday. Liquidity has not improved compared to the pre-holiday period, indicating that investors remain cautious. The weakness of large-cap stocks made it difficult for the VN-Index to maintain its green color, despite the impressive breakout of medium and small-cap stocks. However, the index promptly recovered with strong buying power towards the end of the session, helping the VN-Index narrow its loss and close just below the reference level, reaching 1,681.3 points.

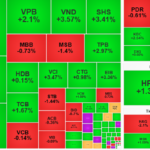

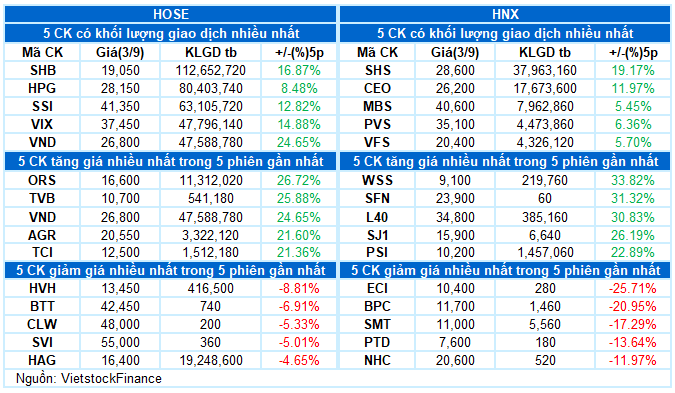

– In terms of impact, VCB, VIC, and VHM were the biggest hindrances, taking away a total of 7.6 points from the VN-Index. On the other hand, HPG, BID, and MBB acted as supports, contributing more than 3 points and preventing the index from falling further.

– VN30-Index decreased by 0.31%, reaching 1,859.59 points. The breadth of the basket was balanced with 15 decreasing stocks, 12 increasing stocks, and 3 stocks remaining unchanged. On the decreasing side, MWG, VIC, VCB, and SSI all adjusted by more than 2%. On the other hand, MBB, HPG, VNM, FPT, and BID maintained positive momentum, increasing from 1.5-2.5%.

Energy led the industry groups with a 2.62% increase, as many stocks traded positively from the beginning of the session, such as BSR (+3.96%), PVS (+3.54%), PVD (+3.29%), PLX (+1.25%), PVT (+1.11%), and PVC (+4.35%).

In addition, the materials group also made a strong impression today with the outstanding performance of MSR (+9.22%), KSB (+2.9%), NTP (+4.57%), CSV (+1.78%), DDV (+1.96%), especially steel stocks, which simultaneously broke out impressively, including NKG and HSG hitting the ceiling price, HPG (+2.36%), VGS (+4.33%), TVN (+4.88%), GDA (+4%), and TLH (+3.33%).

On the opposite side, the two large-cap pillars of finance and real estate have not yet recovered due to the strong sell-off of VCB (-2.33%), VPB (-1.43%), CTG (-1.36%), ACB (-1.08%), SSI (-2.01%); VIC (-2.57%), VHM (-1.72%), and VRE (-0.82%). However, many bright spots were still interspersed, indicating a divided market, such as MBB (+2.52%), SHB (+1.33%), BID (+1.52%); CEO (+6.5%), NVL (+2.98%), TCH (+3.42%), DXG (+5.26%), HDC (+3.93%), along with PDR, DIG, and DXS hitting the ceiling price.

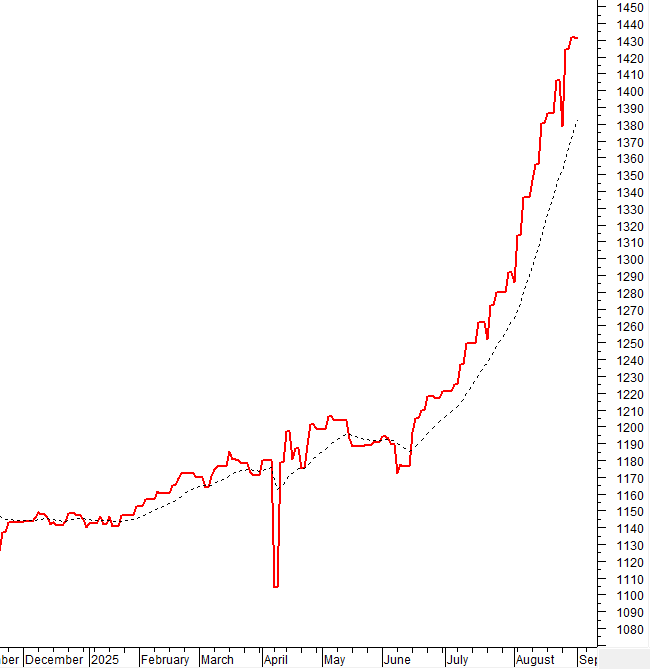

VN-Index recovered towards the end of the session and formed a Long Lower Shadow candlestick pattern. This indicates that buying power is still present when the index enters a corrective state. However, to surpass the old peak of August 2025 (equivalent to 1,680-1,693 points), liquidity needs to improve soon in the coming sessions.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Long Lower Shadow candlestick pattern appears

VN-Index recovered towards the end of the session and formed a Long Lower Shadow candlestick pattern. This indicates that buying power is still present when the index enters a corrective state.

However, to surpass the old peak of August 2025 (equivalent to 1,680-1,693 points), liquidity needs to improve soon in the coming sessions.

HNX-Index – Stochastic Oscillator indicator gives a buy signal

HNX-Index remained well above the Middle line of the Bollinger Bands and continued its upward trend for the 5th consecutive session.

In the context that the Stochastic Oscillator indicator has given a buy signal again, the index is likely to retest the old peak of August 2025 (equivalent to 283-290 points) in the coming sessions.

Analysis of Capital Flows

Changes in smart money flow: The Negative Volume Index indicator of VN-Index is currently above the EMA 20 days. If this state continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Changes in foreign capital flow: Foreign investors continued to net sell in the trading session on September 03, 2025. If foreign investors maintain this action in the coming sessions, the situation will become more pessimistic.

III. MARKET STATISTICS ON SEPTEMBER 03, 2025

Economic and Market Strategy Analysis Department, Vietstock Consulting and Research

– 17:11 09/03/2025

“Aggressive Foreign Sell-Off Ahead of Holiday Lull”

The Vietnamese stock market witnessed another volatile session on August 29th. The VN-Index ended the day slightly higher, gaining just over 1 point. Domestic funds made a strong comeback, boosting liquidity, while foreign investors continued to offload Vietnamese shares, with net sell orders totaling more than VND 3,500 billion.

“Stock Market Update: Resist the Urge to Chase Surging Stocks”

The stock market on August 29 could be highly volatile. Investors are advised to exercise caution and refrain from chasing stocks that are experiencing a sharp surge in prices.

Stock Market Update for Week of August 25-29, 2025: Foreign Investors Apply Pressure at Peak Levels

The VN-Index concluded its fourth consecutive week of gains despite facing substantial pressure at the peak. However, the recent strong selling trend among foreign investors is a notable concern. August 2025 witnessed the largest foreign net-selling since the beginning of the year, which could hinder the market’s upward trajectory in the short term if the situation doesn’t improve promptly.