Masan High-Tech Materials’ Stock Surges on Improved Business Performance

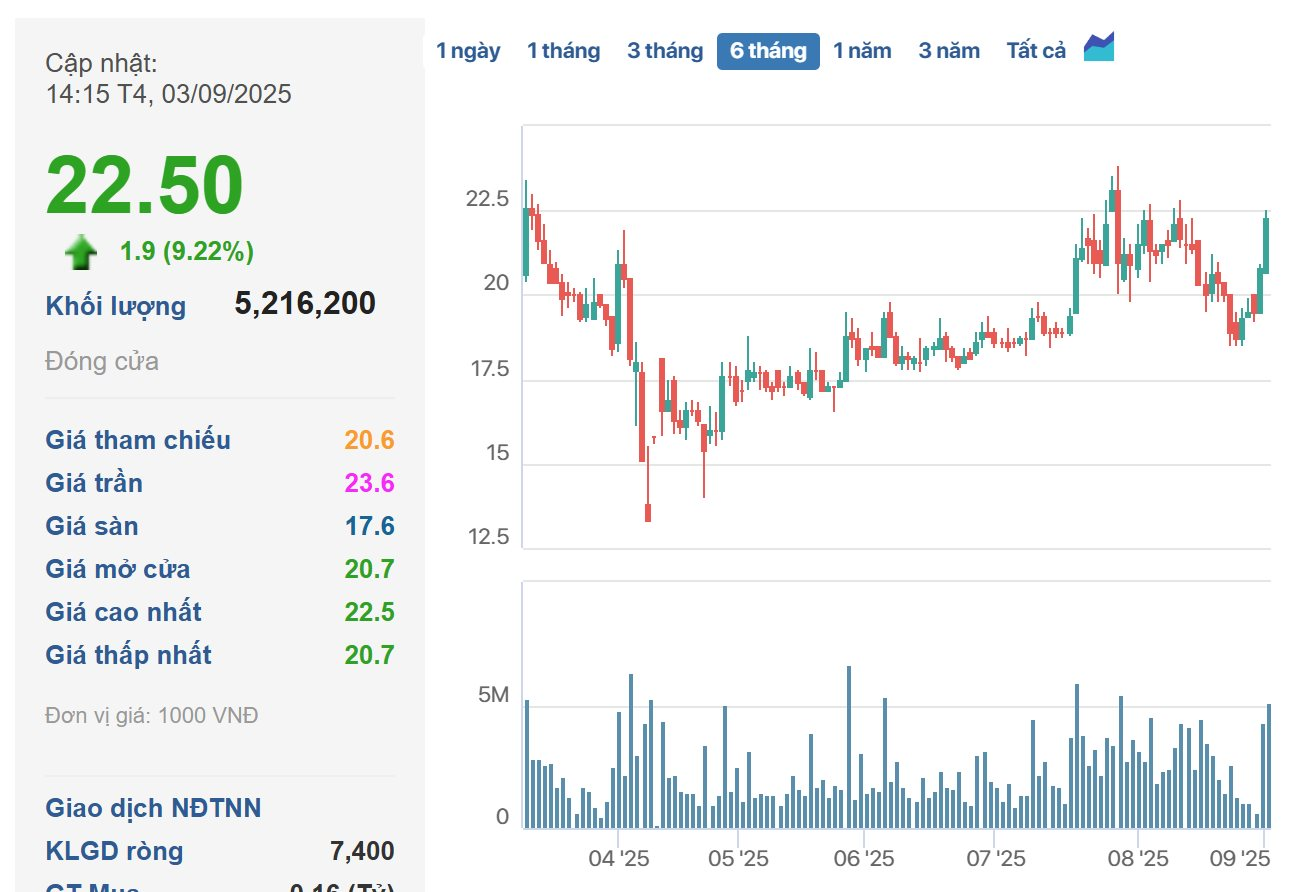

In the last two trading sessions on August 29 and September 3, Masan High-Tech Materials’ (MSR) stock attracted attention with a strong breakout, surging 15% from 19,500 to 22,500 VND, accompanied by abnormal trading volume of 4-5 million units per session.

MSR’s stock performance

Vietcap Securities attributes this positive momentum to the favorable business conditions currently enjoyed by Masan High-Tech Materials. The price of APT products, an intermediate material used in the production of tungsten products, has been on an upward trajectory, recently peaking at ~630 USD/mtu (with MSR’s estimated average selling price for 2024 being ~318 USD/mtu). This represents a 50% increase from the 410-420 USD/mtu range at the beginning of the year, following China’s implementation of tungsten export controls on February 4, 2025, which led to a 17% decrease in China’s export volume as of July 2025. This price level is the highest in over 13 years.

As a result of the 25% tariff imposed by the US on certain tungsten products from China, along with restrictions on the US Department of Defense’s procurement of tungsten originating from certain countries, businesses in the US, EU, and Japan have been actively diversifying their supply sources beyond China, including Vietnam. According to Vietcap, Vietnam is the second-largest tungsten producer in the world, with an estimated output of 3,400 tons in 2024, accounting for approximately 22% of the US’s tungsten imports.

APT product prices over the past month

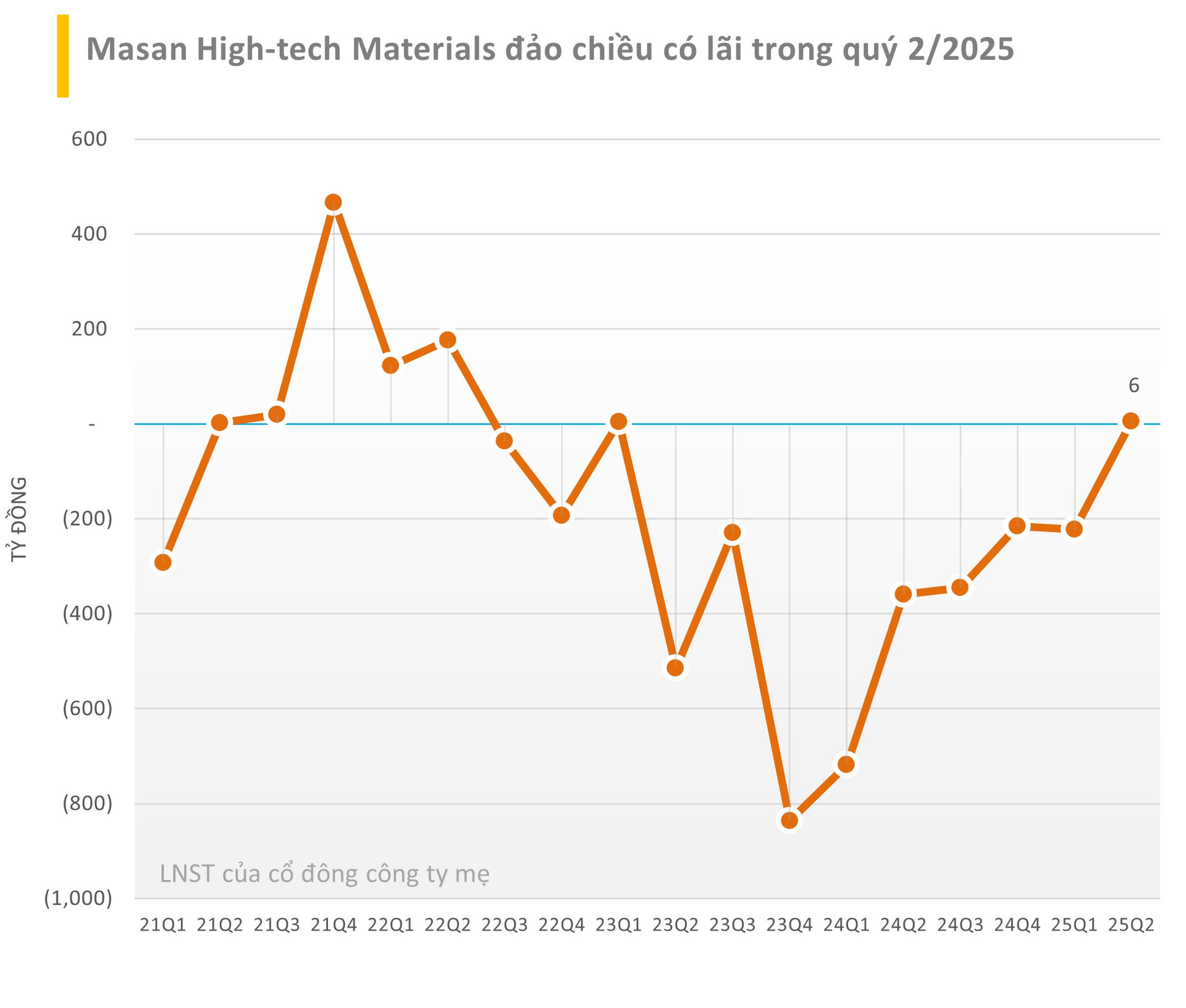

The improved selling prices of APT, copper, and fluorspar products have had a positive impact on Masan High-Tech Materials’ financial performance. In the second quarter of 2025, the company returned to profitability after incurring significant losses in previous quarters. For the first half of 2025, Masan High-tech Materials narrowed its net loss by 860 billion VND compared to the same period last year.

Masan High-tech Materials’ financial performance

This turnaround in Masan High-Tech Materials’ operations has also contributed to the improved consolidated financial results of Masan Group. According to Vietcap, Masan High-Tech Materials is expected to account for approximately 6.5% of Masan Group’s operating profit in 2025, a significant improvement from the loss incurred in the previous year.

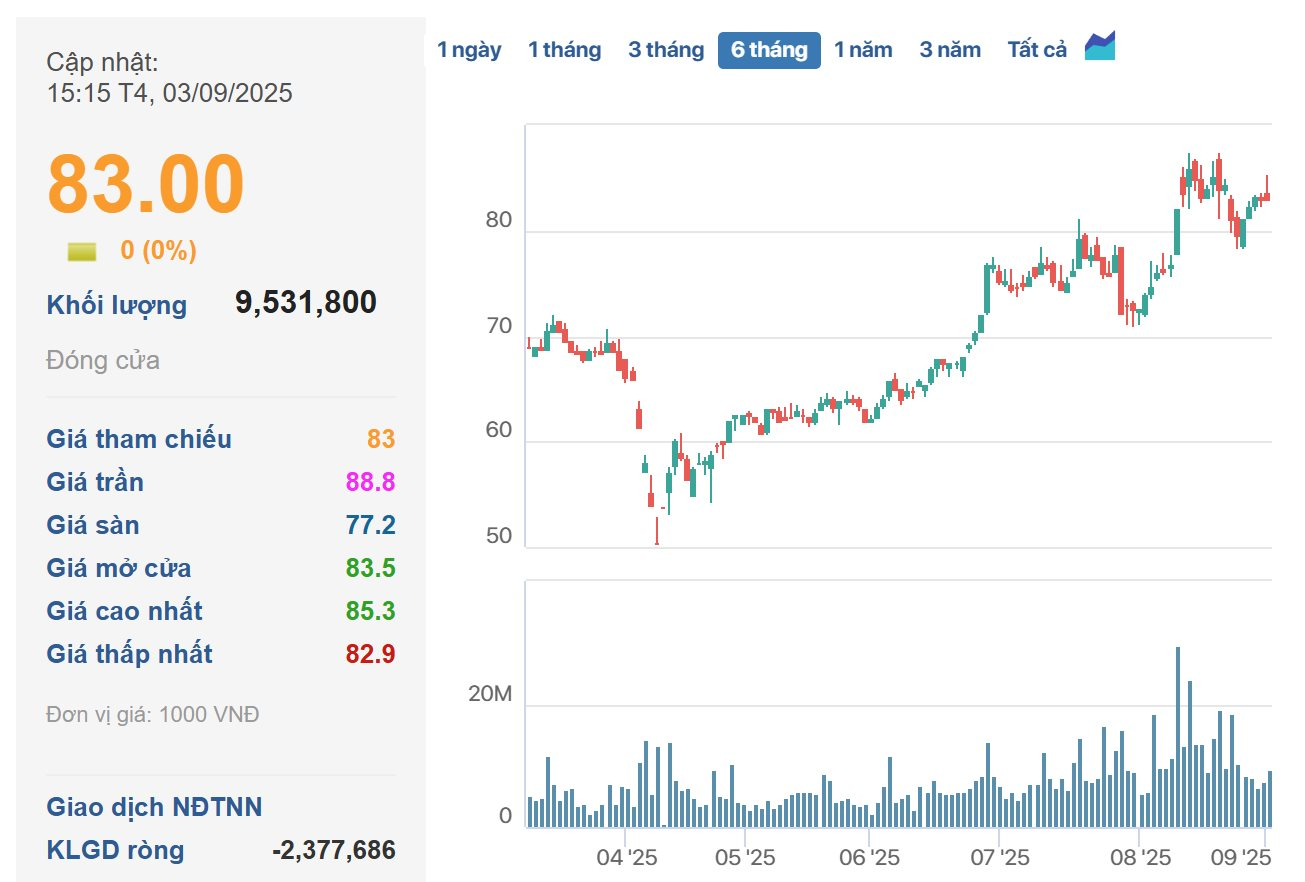

Vietcap has set a target price of 101,000 VND per share for MSN, representing a 22% upside from its current market price of 83,000 VND. Along with the market’s upward trend, MSN stock has been on a strong upward trajectory since the beginning of April.

MSN’s stock performance since April 2025

“LPBank Securities Offers 878 Million Shares to Boost Chartered Capital.”

LPBank is set to offer its existing shareholders a lucrative opportunity to invest in its growth journey. The company is offering a rights issue of 878 million shares at an attractive price of VND 10,000 per share, with a subscription ratio of 1000:2258.23. Mark your calendars, as the record date for this offering is September 8, 2025.

“An Cuong Wood Elects New Board Member, Expanding Business Operations”

The Ho Chi Minh City Stock Exchange-listed An Cuong Wood JSC (HOSE: ACG) has announced the appointment of Ms. Vu Hau Giang to its Board of Directors, replacing Mr. Phan Quoc Cong, who has stepped down. The Company has also approved an expansion of its business operations into the industrial machinery and equipment sector.

The Power of Vietnam’s Largest Bank: Vietcombank’s Market Capitalization Surges by a Whopping Amount, Outperforming Thousands of Listed Companies

The stock market in Vietnam witnessed an unprecedented event as Vietcombank’s market capitalization surged by a staggering $1.5 billion in a single trading session on August 27. This remarkable feat, a first in the nation’s stock market history, underscores the bank’s formidable presence and highlights the potential for significant growth in the country’s equity market.

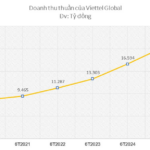

Viettel Global’s Post-Tax Profit Surpasses $139 Million in H1 2023

Viettel Global (VGI), a leading international investment corporation, announced its audited consolidated business results for the first half of 2025. The company witnessed impressive growth in both revenue and profit.