Record net selling since the beginning of the year on HOSE

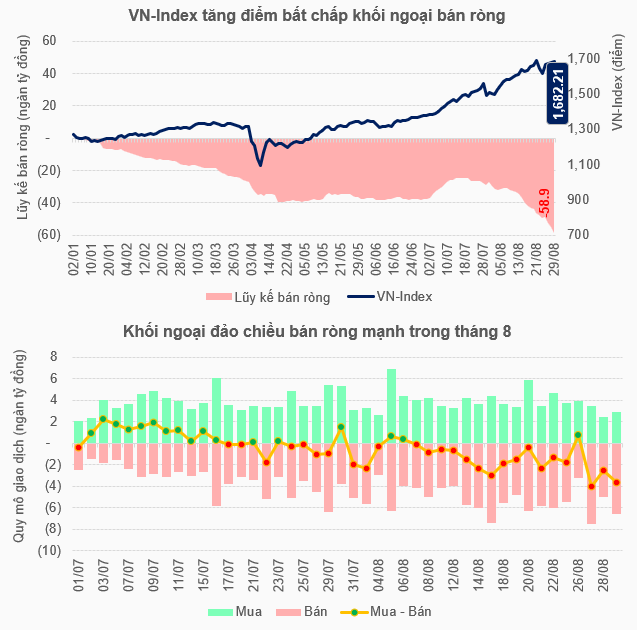

Following the positive developments in recent months, the VN-Index in August continued to bring joy to investors, extending its upward trajectory and closing at 1,682.21 points, a 12% increase from the end of July.

However, on this journey of rising points, there was a hiccup when foreign investors turned to net selling, even on a large scale since the beginning of the year, demonstrating a completely different move compared to their actions in the previous months.

On the HOSE, after continuously balanced trading in May and June and then exploding with a net buy of more than VND 8.1 trillion in July, opening up many expectations for a long-term net buying trend to officially return, foreign investors unexpectedly net sold nearly VND 29.6 trillion in August, pushing the accumulated scale to more than VND 58.9 trillion – the highest since the beginning of the year and very close to the accumulated scale of nearly VND 64 trillion at the same period last year.

In August, foreign investors made 18 net selling sessions, including a chain of 13 consecutive net selling sessions (August 7-25), while only net buying in 3 sessions with an insignificant scale.

Source: VietstockFinance

|

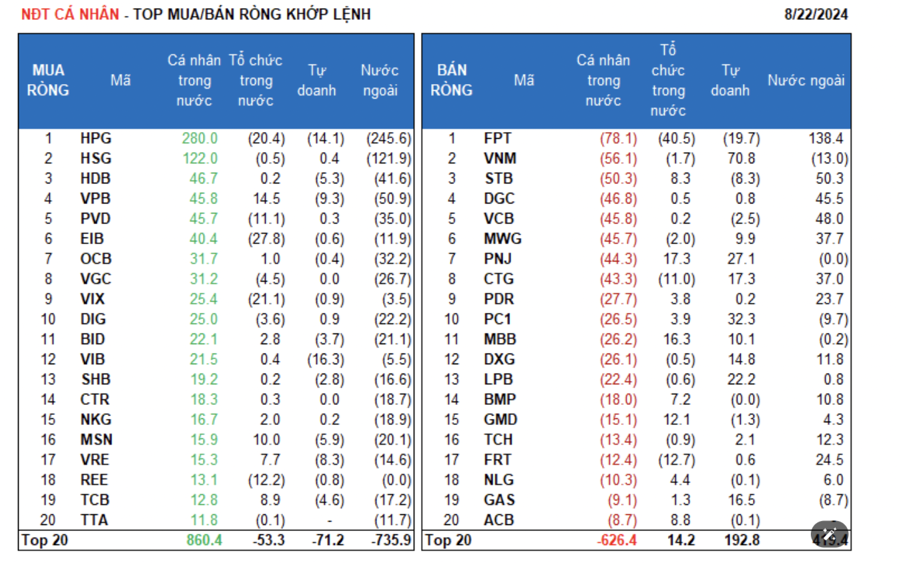

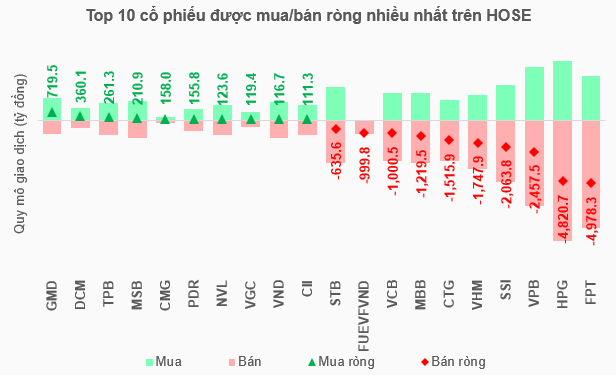

HOSE recorded up to 8 cases of net selling of thousands of billions of VND, with the top two positions belonging to FPT with nearly VND 5 trillion and HPG with more than VND 4.8 trillion, followed by VPB, SSI, VHM, CTG, MBB, and VCB. With continued strong selling in August, FPT also led in net selling scale since the beginning of the year, reaching nearly VND 14.8 trillion.

On the other hand, the stock that was net bought the most in August was GMD, but the scale was only about VND 720 billion.

Source: VietstockFinance

|

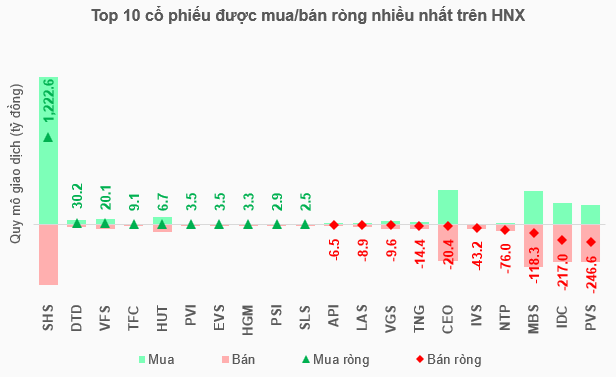

On the HNX, the situation was opposite as foreign investors net bought more than VND 505 billion in August, marking the second consecutive month of net buying, thereby narrowing the net selling accumulation to nearly VND 257 billion.

SHS was the most notable net bought stock in August with more than VND 1,200 billion, far surpassing the stocks in second place. In contrast, the three names that were net sold the most were PVS with nearly VND 147 billion, IDC with more than VND 217 billion, and MBS with more than VND 118 billion.

Source: VietstockFinance

|

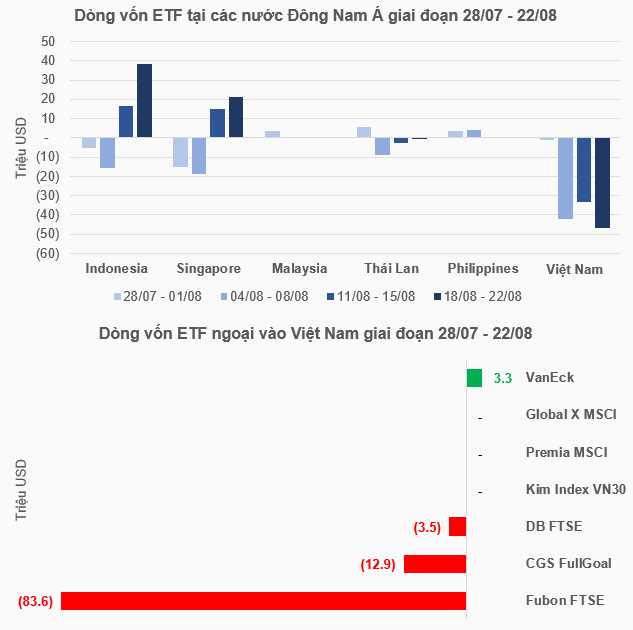

ETF capital continuously net withdrew, Fubon is the highlight

Considering the foreign ETF capital flow into Vietnam in the 4-week period (July 28 – August 22), it is clear that the net withdrawal trend has been maintained throughout. In which, the main selling force came from Fubon FTSE with a cumulative net withdrawal of 83.6 million USD, followed by CGS FullGoal and DB FTSE. VanEck was the only ETF with a net inflow, but the scale was insignificant. Looking at a broader perspective, the Vietnamese stock market also stood out in Asia in terms of net withdrawals in August. Or if we consider only the ETF capital flow in Southeast Asia, Vietnam maintained its net withdrawal trend, despite the positivity present in other countries such as Indonesia, Singapore, and the Philippines.

Source: Bloomberg, compiled by the author

|

Is it worrying?

Regarding the net selling of foreign investors, Mr. Tran Duc Anh – Director of Macroeconomics and Market Strategy, KBSV Securities Company (KBSV) opined that foreign investors are still concerned about many factors such as exchange rates, tax rates for transitional goods, etc., which leads to their hesitation in net buying. These are also the factors that need to be monitored and evaluated in different scenarios in the last months of the year.

However, the KBSV expert emphasized that the decisive factor is individual domestic investors, as evidenced by the fact that the market has been performing well despite net selling by foreign investors.

Sharing the same view, at the Vietnam and the Indices program on August 18, Mr. Nguyen Viet Duc – Director of Digital Business, VPBank Securities Company (VPBankS) stated that the net selling action of foreign investors is not too worrying.

Specifically, in the past, the trading volume of foreign investors accounted for 16-20% of the market, so even a small selling action from them could cause a stir in the market. But in the last 1-2 years, the trading volume of foreign investors has decreased to only 6-8%. Therefore, their selling actions do not significantly affect the market sentiment. Instead, domestic investment flows are the decisive factor for the current VN-Index trend.

– 08:03 09/03/2025

“Market Winds of Change: Anticipating the Big Shift”

The VN-Index recovered towards the end of the trading session, forming a long lower shadow candle. This indicates that buyers stepped in during a period of correction, suggesting underlying strength in the index. However, to surpass the previous peak of 1,680-1,693 points achieved in August 2025, an improvement in trading volume is necessary in the upcoming sessions.

“Aggressive Foreign Sell-Off Ahead of Holiday Lull”

The Vietnamese stock market witnessed another volatile session on August 29th. The VN-Index ended the day slightly higher, gaining just over 1 point. Domestic funds made a strong comeback, boosting liquidity, while foreign investors continued to offload Vietnamese shares, with net sell orders totaling more than VND 3,500 billion.

“Stock Market Update: Resist the Urge to Chase Surging Stocks”

The stock market on August 29 could be highly volatile. Investors are advised to exercise caution and refrain from chasing stocks that are experiencing a sharp surge in prices.