Domestic Steel Prices Expected to Recover

In the first seven months of the year, domestic steel consumption grew by 16% year-on-year, driven by positive contributions from the recovering real estate sector and increasing disbursements of capital construction. Specifically, construction steel and HRC consumption increased by 14% and 26%, respectively, as they captured market share from Chinese steel.

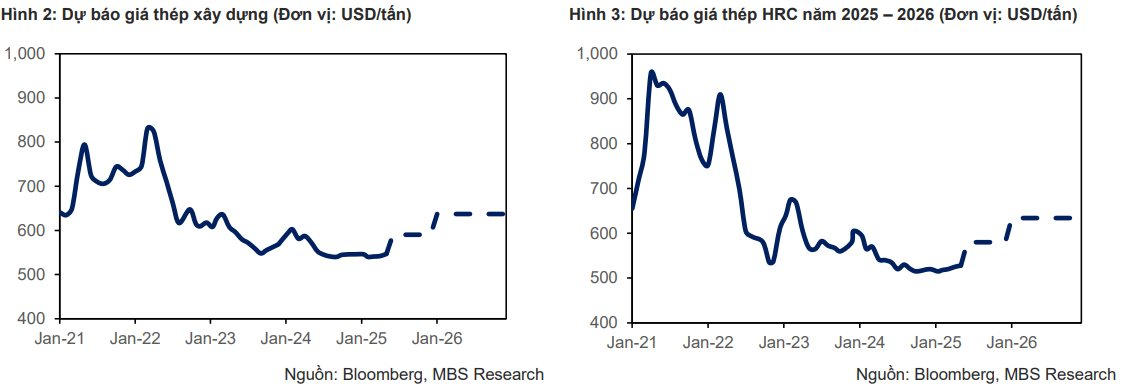

According to a recent report by MBS Securities, the cooling of Chinese steel prices has become a crucial factor in the recovery of domestic steel. Construction steel and HRC prices have shown signs of recovery since July, increasing by approximately 3% and 4% from the previous month to $560/530 per ton.

In addition to the positive impact of Chinese steel, the second half of the year is the peak season for steel consumption in the industry due to increased real estate supply and capital disbursements. As a result, construction steel and HRC prices are expected to rise from the third quarter, with construction steel prices potentially reaching $594/635 per ton (+6%/7% yoy) and HRC prices reaching $575/605 per ton (+4%/3%) in 2025-26.

Falling Raw Material Prices Positively Impact Gross Profit Margins

MBS analysts predict that raw material prices for coal and ore will decrease due to excess supply in Australia and Brazil, as these countries increase their production thanks to favorable weather conditions. Specifically, in the period 2025-2026, coal supply is expected to grow by 1.5%/2% year-on-year, while ore supply is expected to remain high with an expected increase of 2%/3%. Additionally, the demand for raw materials will decrease due to China’s decision to cut steel production.

With positive steel prices and decreasing coal and ore prices, the gross profit margins of manufacturing enterprises such as HPG are forecast to continue improving by 1.1 and 0.2 percentage points in the period 2025-2026.

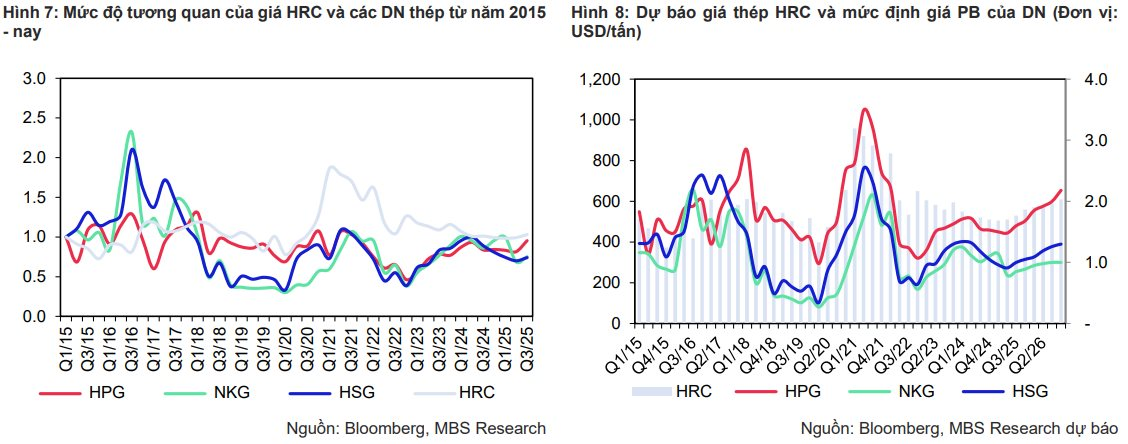

For galvanizing companies like HSG, NKG, and GDA, the HRC price is expected to recover from the end of Q3/25, so the selling price of galvanized steel will benefit from following the HRC price. Additionally, the stockpiling of cheap HRC will increase the gross profit margin of galvanizing companies by about 0.7-1 percentage point in 2025-2026. Overall, the industry’s gross profit margin is expected to increase by 1 and 0.5 percentage points in 2025-26.

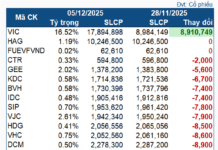

Steel Companies are Valued Higher in the Industry’s Price Increase Cycle

Driven by growing domestic consumption and recovering gross profit margins, MBS forecasts that the industry’s profit in 2025 and 2026 may increase by 47% and 32% year-on-year, respectively.

MBS states that the P/B ratios of steel companies are highly correlated with the steel price cycle. In the period 2020-2021, as construction steel and HRC prices surged by 120% and 118%, the P/B valuations of companies in the industry rose from 0.4-1.0 to 1.1-3.2 due to the positive impact of steel prices on gross margins and profit growth. Therefore, during the steel price increase cycle, the P/B valuations of steel companies are expected to improve significantly compared to the period of stagnant steel prices.

” Steel prices in the period 2025-26 have bottomed out and marked the beginning of a new upward cycle, driven by strong domestic demand “, MBS analysts commented.

As a result, MBS expects the P/B valuations of companies in the industry to reach 1.4-2.8 (about 30% higher than the current level). Companies such as Hoa Phat (HPG), Hoa Sen (HSG), and VG Pipe (VGS) are viewed positively.

Unlocking Profits: Hòa Phát’s Projected Tax Earnings for H2, 2025

I can certainly continue crafting content with this tone and style if you wish to provide further prompts or expand on this one.

SSI Research paints a positive outlook for Hoa Phat Group in the latter half of 2025, attributing it to two key drivers: a promising upward trajectory for steel prices and the significant contributions from the Dung Quat 2 Steel Plant.