Son of Bầu Đức increases ownership in Hoang Anh Gia Lai to nearly 5%

During the August 28 session, Mr. Doan Hoang Nam, son of Mr. Doan Nguyen Duc, Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (HOSE: HAG), completed the purchase of 27 million HAG shares through a put-through transaction, with a value of approximately VND 395 billion. As a result, his ownership increased from 2.55% to 4.92%, equivalent to 52 million shares. Together with other related parties, Bầu Đức’s family now holds a total of 34.98% of HAG‘s capital.

Prior to the August 28 transaction, Mr. Nam had spent VND 426.6 billion to purchase 27 million HAG shares through a put-through transaction on August 22, also at a price of VND 15,800 per share. In contrast, Bầu Đức sold 25 million HAG shares through put-through transactions between August 18 and August 22, 2025.

Major HSL shareholder divests entirely

Ms. Nguyen Thi Tuyet Nhung, former Chairman of the Board of Directors of Hong Ha Food Joint Stock Company (HOSE: HSL) and the largest shareholder of the company, sold her entire 12.44% stake, equivalent to nearly 4.8 million shares. Following this transaction, Ms. Nhung no longer holds any shares in HSL.

During the period of Ms. Nhung’s divestment, HSL recorded nearly 6.7 million shares traded through put-through transactions at an average price of VND 13,639 per share. Based on this price, Ms. Nhung could have earned a minimum of VND 65 billion from the sale.

Another major shareholder exits SEA

Gelex Group Joint Stock Company (HOSE: GEX) sold nearly 8.9 million shares of Seaprodex, the Vietnam Seafood Corporation – Joint Stock Company (UPCoM: SEA), on August 22. Following this transaction, Gelex’s ownership decreased from 9.52% to 2.42%, equivalent to more than 3 million shares, and they are no longer a major shareholder of Seaprodex. Based on the average put-through transaction price of VND 34,000 per share, Gelex is estimated to have earned nearly VND 302 billion from this deal.

During the same period, Red Capital Investment Fund Management Joint Stock Company (Red Capital) also sold its entire holding of 18 million SEA shares, or 14.4% of the capital, through put-through transactions between August 14 and August 22. The transaction value is estimated at VND 618 billion. Red Capital has a close connection to SEA as Ms. Do Thi Phuong Lan, General Director of Red Capital, is also a member of the Board of Directors of Seaprodex.

On August 22, S.S.G Group Joint Stock Company reported the purchase of more than 14.9 million SEA shares, or 11.92% of the capital, becoming a major shareholder of Seaprodex. The number of shares purchased matched the volume of shares traded through put-through transactions on the same day, with a value of nearly VND 507 billion.

It is likely that S.S.G was the buyer of the shares sold by the Gelex and Red Capital groups.

STH Chairman intends to purchase more than 18% of the capital, returning as a major shareholder

After selling her entire stake of over 11% in June, Ms. Nguyen Thi Vinh, Chairman of the Board of Directors of Publishing House of Books and Educational Equipment of Thai Nguyen Province Joint Stock Company (UPCoM: STH), has just registered to buy 3.5 million STH shares from September 3 to October 2, equivalent to more than 18% of the capital. The purpose of this transaction is to restructure her investment portfolio.

This move comes just three months after Ms. Vinh divested her entire holding of nearly 2.2 million STH shares, or 11.05% of the capital, on June 5, through put-through transactions at an average price of VND 20,400 per share, which was 7% higher than the closing price on the same day. Based on the current price of VND 20,000 per share, it is estimated that the Chairman of STH will need to spend VND 70 billion to complete this new purchase.

Chairman of City Auto and Tan Thanh Do’s family intends to increase ownership to over 55% of CTF‘s capital

Mr. Tran Lam, a member of the Board of Directors of City Auto Joint Stock Company (HOSE: CTF), has just registered to buy 2.4 million CTF shares from September 5 to October 3. After the transaction, he is expected to increase his ownership from 8.4% to 10.91%, equivalent to more than 10.4 million shares.

At the same time, Tan Thanh Do Group Joint Stock Company (New City Group), where Mr. Lam serves as General Director, has registered to purchase 3 million CTF shares from August 28 to September 26. If successful, the company’s ownership will increase from 15.21% to 18.35%, equivalent to 17.55 million shares.

In early July 2025, Tan Thanh Do Group purchased an additional 6.5 million CTF shares through put-through transactions at an average price of VND 21,500 per share, increasing their ownership to the current level. This enterprise used to be the parent company of City Auto, holding 58.33% of its capital in 2017, before reducing it to 13.26% in 2020 and then to 8.42% before starting to buy again.

PDR Chairman intends to sell 88 million shares at the highest price in the past year

Mr. Nguyen Van Dat, Chairman of the Board of Directors of Phat Dat Real Estate Development Joint Stock Company (HOSE: PDR), has registered to sell 88 million shares at a price range that is currently at its highest level in the past year.

The sale will be conducted through put-through transactions between September 5 and October 3, 2025, to address personal financial needs. If the transaction is successful, Mr. Dat’s ownership in PDR will decrease from 36.72% to 27.7%, equivalent to nearly 272 million shares. Based on the closing price of VND 24,550 per share on August 29, the value of this transaction is estimated at nearly VND 2.2 trillion.

MB intends to sell more than 10% of MBS‘s capital to increase its public holding

On August 27, Military Commercial Joint Stock Bank (MB, HOSE: MBB) announced its intention to sell 60 million shares of Military Bank Securities Joint Stock Company (HNX: MBS) between September 3 and October 2, expecting to reduce its ownership from nearly 437.4 million shares (76.35%) to nearly 377.4 million shares (65.9%). Notably, MB stated that the purpose of this transaction is to increase the public holding of MBS.

|

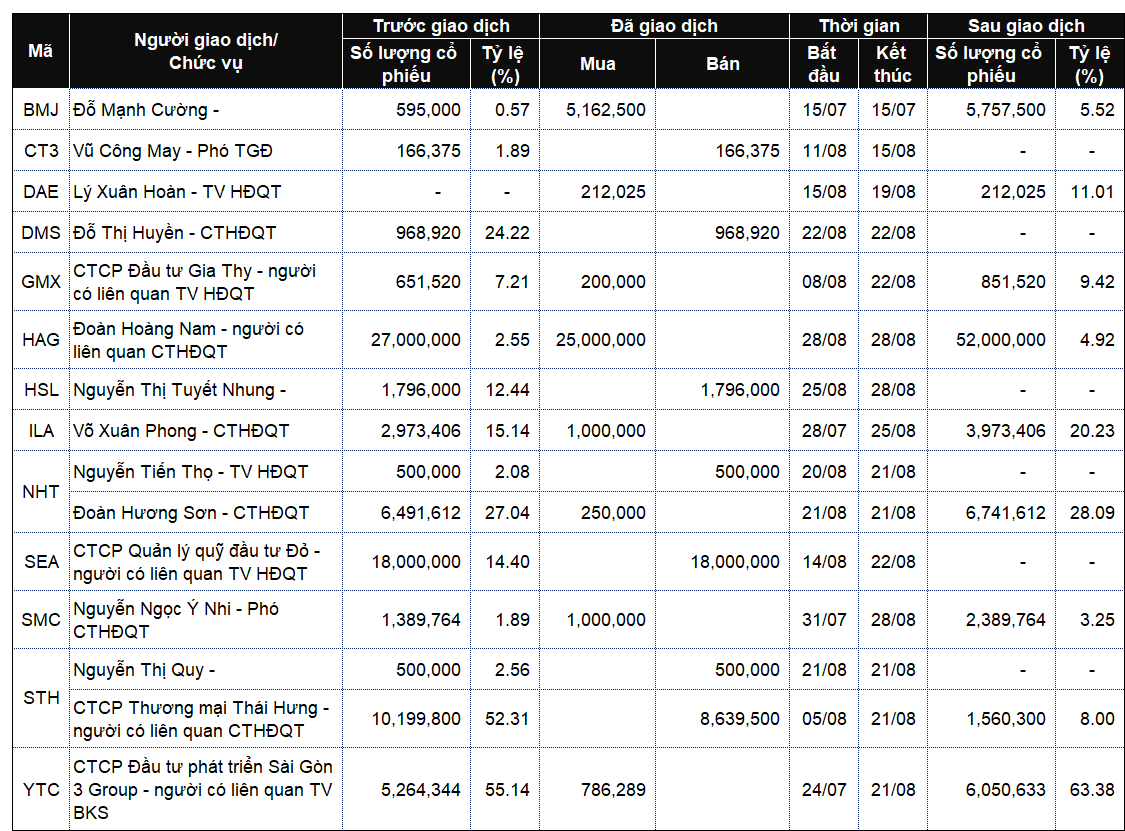

List of transactions by corporate leaders and their relatives from August 25 to August 29, 2025

Source: VietstockFinance

|

|

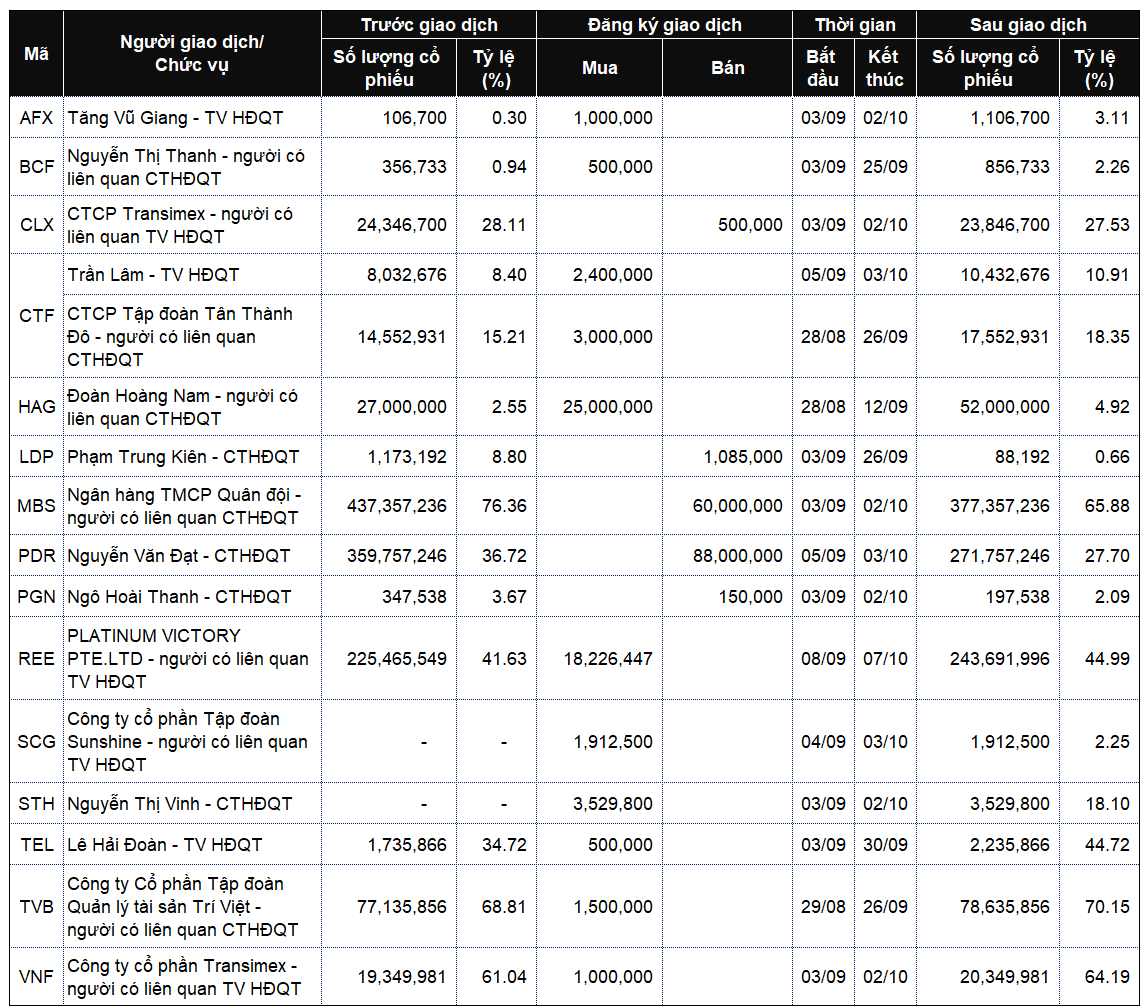

List of registered transactions by corporate leaders and their relatives from August 25 to August 29, 2025

Source: VietstockFinance

|

– 7:00 PM, September 01, 2025

“MBS Shareholders Approve Plan to Sell 60 Million Shares via Auction”

“Upon successful transaction, MB will reduce its ownership in MBS to 377.3 million shares, equivalent to a 65.9% stake.”

A Stock Soars to 10-Year Highs After Shedding its Warning Label

With its accumulated losses now a thing of the past, this stock has successfully been removed from the warning list of the Ho Chi Minh Stock Exchange.