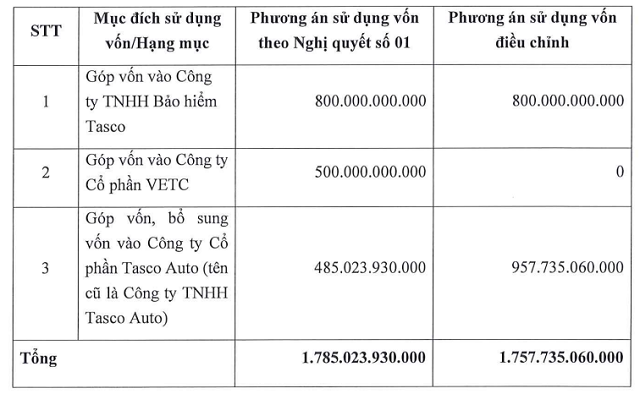

Instead of investing 500 billion VND in JSC VETC as initially planned, Tasco decided to redirect the entire amount to Tasco Auto. As a result, Tasco Auto will receive nearly 958 billion VND in additional capital, while Tasco Insurance will maintain its allocated investment of 800 billion VND.

Tasco redirects funds from existing shareholders to its subsidiary, Tasco Auto. Source: Tasco

|

This strategic shift follows VETC’s successful acquisition of 500 billion VND from IFC, a member of the World Bank Group, through the issuance of convertible bonds. The investment from IFC is expected to boost VETC’s development of smart transportation projects in Vietnam, expand its digital ecosystem, and enhance its range of services. These include cashless toll collection in parking lots, integrated towing with ETC, fee collection at airports and seaports, fuel payment, and payment gateways for transportation-related public services.

According to Tasco, IFC’s involvement brings not only financial resources but also opportunities for international connections and the adoption of advanced technology and governance standards. Therefore, Tasco chose to withdraw its planned investment in VETC to focus on the automotive sector, which is identified as the core business of the Group.

In its previously announced detailed plan, Tasco intended to allocate 485 billion VND to Tasco Auto, including 385 billion VND for expanding the network of 52 Geely car dealerships and 100 billion VND for increasing the charter capital of Tasco Auto Distribution Company. With this adjustment, the allocated capital for Tasco Auto has doubled compared to the initial plan.

Tasco Auto (formerly known as SVC Holdings), the parent company of Saigon General Service Corporation (Savico, HOSE: SVC), has been a part of the Tasco Group since 2023. Savico is currently one of the largest automobile distributors in the country.

Tasco’s share offering concluded on August 20, with over 175 million shares issued at a price of 10,000 VND per share, resulting in an increase in charter capital to nearly 10.7 trillion VND.

In terms of financial performance, Tasco recorded revenue of over 8.2 trillion VND in the second quarter of 2025, a 26% increase compared to the same period last year. The automotive segment contributed nearly 7.6 trillion VND, a 23% rise. The toll and insurance segments also experienced growth, and the improved gross profit margin led to an increase in gross profit. However, high interest expenses due to significant capital requirements resulted in a net profit to the company’s shareholders of only about 6 billion VND, the lowest in the last four quarters, while the minority interest earned over 70 billion VND.

For the first half of the year, Tasco’s net profit was over 34 billion VND, achieving nearly 20% of the yearly plan.

| Tasco’s shareholders’ profit remains low despite tens of trillions in revenue |

Despite generating tens of trillions of VND in revenue annually, Tasco’s profit remains modest due to thin profit margins in the automotive industry. The company aims to address this challenge through expansion strategies, including distributing additional brands such as Geely, Lynk & Co, and Volvo, and investing in a car assembly plant in Thai Binh province.

At the 2025 Annual General Meeting, Tasco’s leadership acknowledged the low profit margins in traditional car retail and emphasized the need to develop vertically, encompassing both upstream (import, distribution, and CKD assembly) and downstream (full life-cycle services) activities. Statistics show that new car sales contribute only about 25% of revenue, while the remaining 75% comes from value-added services such as insurance, repairs, used car sales, and leasing. This is the direction that Tasco Auto aims to exploit to improve its profit margins.

The management has set ambitious targets for 2030, aiming for a gross profit margin of approximately 14% (compared to 7% in 2024 and 10% in the first quarter of 2025) and a pre-tax profit of over 3 trillion VND.

IFC Invests 500 Billion VND in VETC to Boost Smart Transportation

HUT to Offer Nearly 180 Million Shares, Increasing Capital to Over 10 Trillion VND

Tasco Plans to Invest 385 Billion VND in 52 Geely Dealerships

– 10:08 04/09/2025

“Profits Choked by Expenses as Revenue Grows for Asset Management Firms”

The Vietnamese stock market is a bustling arena, with 43 active fund management companies trading and driving the economy. Despite a promising 9% growth in revenue, primarily fueled by dynamic trust activities, the industry faced a challenging period with a decline in net interest margins, resulting in a 3% contraction due to various factors.

“Which Province Becomes Vietnam’s Automotive Manufacturing ‘Bigwig’ Post-Merger?”

Hưng Yên has emerged as the epicenter of automotive manufacturing in Vietnam, housing three industry giants and taking the lead in the number of car factories across the nation.

The Sugarcane Industry Under the Twin Pressures of Oversupply and Smuggled Goods

The Vietnamese sugar industry faced a challenging second quarter in 2025 due to a perfect storm of excess supply and illicit imports. This led to a significant drop in profits and rising inventories for many businesses. However, a handful of enterprises maintained their growth trajectory by strategically managing costs and consumption strategies. With a keen eye on expenses and a focused approach to sales, these resilient companies navigated the turbulent market conditions with relative stability.