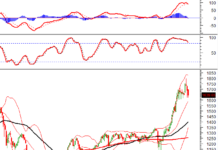

Technical Signals for the VN-Index

During the trading session on September 4, 2025, the VN-Index retested the old peak from August 2025 (corresponding to the 1,680-1,696 point range).

The appearance of a Black Body candle with a short body indicates a tug-of-war market and is not pessimistic as the long-term uptrend has been firmly established.

The writer assesses that the process of testing historical peaks could extend into next week before a clear outcome emerges, given the regular trading volume has been below the 20-day average.

Technical Signals for the HNX-Index

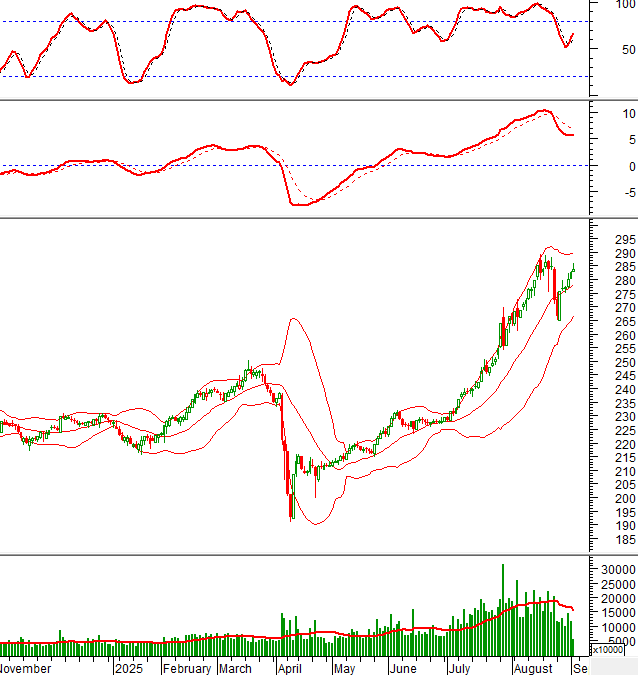

In the trading session on September 4, 2025, the HNX-Index continued to grow, marking the sixth consecutive session of price increases.

However, the emergence of a Long Upper Shadow candle signals a warning about profit-taking pressure as the HNX-Index is very close to the strong resistance zone of 285-289 points (corresponding to the August 2025 peak).

The Middle line of the Bollinger Bands (corresponding to the 277-279 point zone) has provided strong support in recent sessions and is expected to remain resilient.

POW – Vietnam Oil and Gas Power Joint Stock Company

In the trading session on September 4, 2025, the POW share price rose with volume exceeding the 20-session average, indicating active trading by investors.

Additionally, the POW price has surpassed the 100% Fibonacci Projection threshold (corresponding to the 16,600-16,900 zone) while the MACD indicator has signaled a buy again. This suggests that the medium-term uptrend remains intact.

Currently, the stock’s price has successfully broken out of the neckline of the Rounding Bottom pattern while the MACD continuously forms higher highs and higher lows. If these positive technical factors are maintained, the potential long-term price target is the 21,700-22,200 zone.

TCH – Hoang Huy Financial Services Investment Joint Stock Company

The TCH share price surged in the trading session on September 4, 2025, forming a Rising Window candlestick pattern with increased volume above the 20-session average, indicating investors’ optimism.

Additionally, the Stochastic Oscillator continued to rise after signaling a buy again, further supporting the stock’s medium-term uptrend.

Currently, the TCH price has successfully broken out of the neckline of the Double Bottom pattern and continues to closely follow the upper band of the Bollinger Bands. If the positive outlook is maintained, the potential short-term price target is the 27,000-27,600 zone.

(*) Note: The analysis in this article is based on real-time data up to the end of the morning session. Therefore, the signals and conclusions are only for reference and may change when the afternoon session ends.

Technical Analysis Department, Vietstock Consulting

– 12:03, September 4, 2025

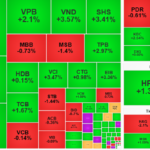

“Market Winds of Change: Anticipating the Big Shift”

The VN-Index recovered towards the end of the trading session, forming a long lower shadow candle. This indicates that buyers stepped in during a period of correction, suggesting underlying strength in the index. However, to surpass the previous peak of 1,680-1,693 points achieved in August 2025, an improvement in trading volume is necessary in the upcoming sessions.

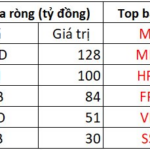

“Aggressive Foreign Sell-Off Ahead of Holiday Lull”

The Vietnamese stock market witnessed another volatile session on August 29th. The VN-Index ended the day slightly higher, gaining just over 1 point. Domestic funds made a strong comeback, boosting liquidity, while foreign investors continued to offload Vietnamese shares, with net sell orders totaling more than VND 3,500 billion.