This week, from 25/08 to 29/08, the SBV offered a total of VND 77,000 billion in 7-day, 14-day, 28-day, and 91-day bills at a fixed interest rate of 4.0% via the open market operations channel. The auction results showed a total of VND 41,552.01 billion in successful bids across all tenors, while VND 58,822.36 billion in bills matured during the week. The SBV did not offer any treasury bills during this period. As a result, the net withdrawal from the market through the open market operations channel amounted to VND 17,270.35 billion. The outstanding amount of bills in the pawning channel stood at VND 181,663.7 billion.

In the interbank market, interest rates for VND loans with tenors of one month or less decreased across the board. By the end of August 29, VND interbank rates were as follows: overnight rate at 3.84% (down 1.12 percentage points), one-week rate at 4.39% (down 0.77 percentage points), two-week rate at 4.99% (down 0.61 percentage points), and one-month rate at 5.33% (down 0.37 percentage points). These developments indicate a surplus in the banking system’s liquidity, significantly easing short-term interest rate pressures and allowing credit institutions to stabilize funding costs as the year draws to a close.

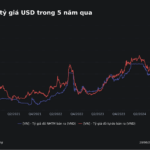

Why Are Exchange Rates Constantly Rising?

The State Bank of Vietnam (SBV) announced the reference exchange rate for August 28 at 25,268 VND per USD. Bank USD selling prices remained at the ceiling level of 26,531 VND/USD. The free market saw record highs for USD at 26,720 VND. Since the beginning of 2025, the Vietnamese dong has depreciated by 3.8% against the US dollar in the banking system and 3.4% in the free market.