In late August 2025, Dalat Hasfarm Company Limited announced that it has officially reached an agreement to acquire 100% of the shares of Lynch Group – a flower company listed on the ASX in Australia.

With this merger, Hasfarm will become the leading company in Asia and one of the largest fresh flower companies in the world, with production operations in Vietnam, China, and Indonesia, while also expanding access to large markets such as China, Japan, and Australia.

According to the agreement, Lynch shareholders will receive AUD 2.245 per share in cash, excluding previously permitted dividends – with the total transaction value estimated at AUD 270 million.

The deal is still subject to shareholder approval and an independent report confirming that it is in the best interests of shareholders.

The agreement supports Lynch’s strategic development by establishing a platform in production, distribution, and logistics, especially in the Chinese market. This will create cost advantages through economies of scale while also providing stability for employees, customers, and suppliers.

Commenting on the transaction, Mr. Joel Thickins, Co-Managing Partner of TPG Asia, said: “The acquisition of Lynch Group is in line with TPG’s strategy of building market-leading companies, leveraging regional expertise and scale. Since investing in Hasfarm in late 2024, we have been seeking merger opportunities such as Lynch to contribute to building a strong fresh flower production platform in the global development center.”

“Acquiring More: Tân Thành Đô’s Ambitious Plans for CTF Shares”

New City Group, a prominent Vietnamese company, has recently announced its intention to acquire an additional 3 million shares of City Auto Joint Stock Company (HOSE: CTF) between August 28 and September 26, 2025. This move underscores New City Group’s strategic expansion plans and its confidence in the potential of City Auto, a well-known name in the automotive industry.

The Ultimate Guide to Leadership: Mastering the Art of Influence and Decision-making in the Digital Age

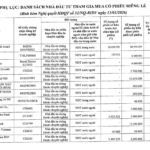

The trading statistics for the week of July 28 to August 1, 2025, reveal interesting insights into the trading activities of insiders and major shareholders. While there were no significant large-scale transactions, the gradual buying of DC4 and BWE stocks by insiders stood out. Conversely, a notable development was observed on the registration side, as a major shareholder of STH sought to offload over 44% of their holdings, indicating a substantial sell-off move.

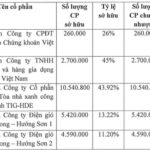

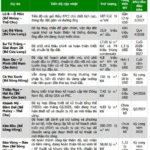

“TIG to Divest from Five Subsidiaries, Delays Stock Dividend Payment”

The Hanoi-based Thang Long Investment Group JSC (HNX: TIG) has recently unveiled three resolutions passed by its Board of Directors. These resolutions pertain to the company’s capital investments in its subsidiaries and associated companies, as well as a plan to issue bonus shares as dividends.