4-Day Queues at Gold Shops: A Holiday Rush for Precious Metals

During the 4-day National Day holiday, Ms. Ha Minh, a resident of Saigon ward, spent most of her time queuing at gold shops instead of enjoying leisure activities. She believed that many people would be traveling or visiting their hometowns during the holidays, leaving the city less crowded and making gold shopping a more manageable task. However, she soon realized that others shared her mindset, resulting in long queues at gold shops as people waited patiently for their turn to buy.

Ho Chi Minh City residents queue for gold purchases.

After a long day of waiting, Ms. Minh finally managed to buy five units of gold rings. She felt fortunate compared to others who had queued before her but left empty-handed when the gold supply ran out. Meanwhile, Ms. Thu Tra, a resident of Thanh My Tay ward, rushed from one authorized gold shop to another, determined to buy gold bars. She always kept a substantial sum in her account, ready to purchase gold at a moment’s notice. However, despite her efforts, she could only acquire two units of plain gold rings over an entire week.

“I bought gold rings at a price of just VND 122 million per tael a few days ago, and the price has already increased by VND 1 million the next day. As of now, it has surged to over VND 128 million per tael. The later I buy, the higher the price, but I want to purchase a larger quantity at a lower price,” Ms. Tra said, expressing her frustration.

Gold shops face a shortage of gold bars and rings, with only 5-unit and 1-tael options available. Customers are limited to purchasing a maximum of one tael of gold rings.

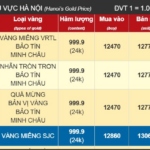

On September 3, following the National Day holiday, gold prices soared to new heights. Major brands like SJC and PNJ maintained their high price points, with gold bar transaction prices reaching VND 131.9-133.4 million per tael (buying-selling). Gold rings also witnessed significant fluctuations. Specifically, SJC listed gold ring prices at VND 125.1-127.7 million per tael (buying-selling), while PNJ increased its selling price by VND 2.1 million compared to the previous day, reaching VND 128.5 million.

Over the previous week, SJC gold prices rose by VND 3.5 million per tael for buying and VND 4 million per tael for selling. Gold ring prices also increased by VND 3.7 million per tael for both buying and selling.

The Allure of Silver Bars: A Viable Alternative Investment

As gold prices soar and availability becomes scarce, making purchases challenging even with sufficient funds, silver bars are gaining traction due to their affordability and ready availability.

Silver is gaining traction as a viable investment option.

At a prestigious jewelry company on Nam Ky Khoi Nghia Street in Xuan Hoa ward, Ho Chi Minh City, customers are flocking to inquire about silver bars and ingots. Ms. Phuong Vy, a resident of An Lac ward, shared that she had never considered investing in silver before, but with gold prices skyrocketing and limited purchasing options, she decided to give silver a try on her husband’s advice. “A one-tael silver bar costs just under VND 1.6 million. I’m not sure about the profitability of this investment yet, but it seems interesting, so I bought a few taels to try. Silver transactions are also more straightforward than gold, as they don’t require proof of origin documentation,” Ms. Vy explained.

According to the jewelry shop staff, silver bar selling prices were only VND 1.115 million per tael at the beginning of 2025, but by the end of July, they had surged to VND 1.55 million per tael, representing a nearly 40% increase. During July, domestic silver selling prices even witnessed a nearly 5% spike within a few days.

Many investors are turning to silver as a more accessible alternative to gold.

Silver offers a diverse range of products for investors to choose from, including one-tael, five-tael, and ten-tael silver bars, as well as silver bullion coins and one-kilogram silver bars (26.66 taels), currently priced at around VND 42.6 million.

“Many products, such as silver bars and ingots, are not readily available, and customers must place orders and make advance payments before scheduling an appointment to receive their purchases,” the staff member added.

Our investigation revealed that silver purchases at this shop are transacted similarly to gold, with proper invoices and the option to resell silver to the shop at the listed price.

Currently, one tael of gold is equivalent to approximately 84 taels of silver, significantly higher than the historical average of 65-70. This indicates that silver is undervalued and has significant growth potential. The current price of around VND 1.6 million per tael of silver is also considered accessible for those looking to invest smaller amounts and gradually build their portfolio, as opposed to the higher price of VND 130 million per tael of gold.

Another crucial factor is silver’s increasing liquidity. With low prices, a growing network of dealers, and convenient over-the-counter transactions, silver hoarding is becoming increasingly prevalent. Long queues of people waiting to buy gold and returning empty-handed have become a common sight, while silver is readily available in most cases.

Today, September 2, Gold Ring Prices Soar by VND 2 Million, While Gold Bars Remain Unchanged.

The precious metal witnessed a significant surge this morning, with gold jewelry prices at various businesses skyrocketing by up to 2 million VND per tael.

No More Waiting to Buy Gold, Now It’s Silver’s Turn

Amid the relentless surge in global gold and silver prices, domestic prices of these precious metals have also skyrocketed to unprecedented levels. In a notable development, following the frenzy of gold buyers queuing up, a similar scene is now unfolding with long lines of people eagerly waiting to purchase silver.