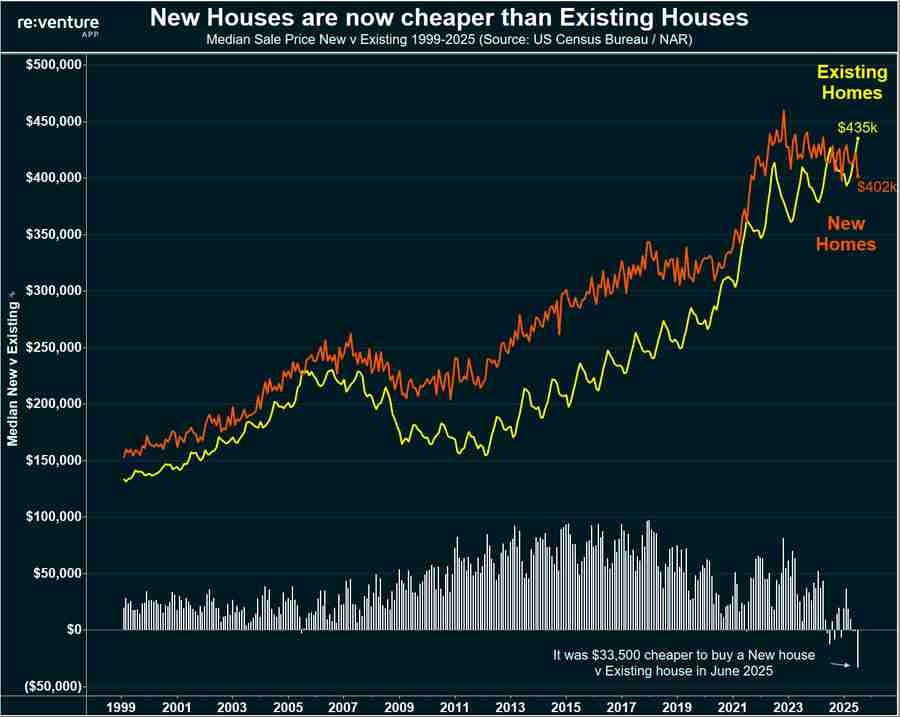

In June 2025, the median price of a newly built home in the US was $402 thousand USD, about $33 thousand USD less than a previously-owned home – the widest gap in at least 25 years. By July, this gap narrowed to $19 thousand USD (or 4%), but it was still a significant discount.

This phenomenon reverses decades-long market trends, leaving many investors puzzled about the future of the US real estate and financial markets. Against this backdrop, Warren Buffett’s investment of over $1 billion in residential real estate companies has attracted attention.

June 2025: New home prices are $33,000 USD lower than used homes. Source: Re:venture app.

|

Market Dynamics: Why New Homes Are Usually Pricier Than Old Ones

Since comparative data became available in 1999, newly constructed homes have almost always been more expensive than previously-owned ones. This is quite reasonable, similar to how a new car typically costs more than a used one with the same specifications. There are three main reasons for this phenomenon.

Firstly, new homes generally have fewer maintenance issues, come with brand new fixtures, and feature contemporary designs that cater to modern tastes.

Secondly, new homes tend to have better insulation, more robust construction standards, energy-saving systems, and smart features, resulting in lower utility bills and reduced repair needs.

Thirdly, buyers can customize designs and choose materials according to their personal preferences, creating a more suitable living space from the start.

These factors contribute to the higher value of new homes, reflecting convenience, modernity, and the avoidance of future expenses.

A Shift in Dynamics

In 2025, the US real estate market experienced a surprising reversal in price trends. New home prices peaked at the end of 2022 and have been declining since, while prices for older homes continued to climb to new records. This created an unusual situation where new homes became more affordable than previously-owned ones. So, what explains this anomaly?

Firstly, oversupply in new construction and the rate-lock effect with older homes:

As of July 2025, the supply of existing homes was sufficient for 4.7 months of sales, while the supply of new homes reached 9.2 months. Real estate businesses, as motivated sellers with thousands of homes to offload, had to offer more attractive prices to stimulate demand during the typically slow summer season.

In contrast, individual homeowners typically own just one property and are less inclined to sell due to the rate-lock effect. According to Yahoo Finance, as of Q4 2024, about 82% of homeowners with mortgage debt were paying interest rates below 6% annually, and 54% enjoyed rates of 4% or lower. These individuals likely locked in lower rates during the Covid era.

However, if someone were to take out a mortgage in 2025, they would typically face interest rates between 6-7%, a significant increase compared to previous years. As a result, families currently paying lower interest rates on their existing homes are reluctant to sell and take on new loans with higher rates.

Secondly, a shift in construction strategies:

Real estate companies have been building smaller homes, reducing the average selling price of new constructions amid buyers’ constrained purchasing power. Although new homes are still generally larger than older ones, the listed price per square meter for new homes has become more competitive ($218.66/m2 vs. $226.56/m2 for older homes).

Thirdly, demographic changes and the dominance of large real estate players:

The average age of homebuyers has increased from 31 in 1981 to 56 in 2025. Older buyers often prefer single-story homes in established neighborhoods with larger gardens and fewer stairs, making older homes more appealing to them.

Meanwhile, large construction companies have been gaining market share. The top 10 residential real estate companies held only 8.7% of the market in 1989, but by 2024, their collective share had risen to 44.7%. These giants have the financial muscle to offer lower prices and promotions that smaller competitors struggle to match.

Illustration – TM

|

Warren Buffett’s Perspective

Amidst the volatile US real estate market, with new home prices dipping below those of older homes, Warren Buffett’s Berkshire Hathaway made a notable investment by acquiring substantial stakes in three major residential real estate companies, totaling over $1 billion. The firm invested $800 million in Lennar, $191.5 million in DR Horton, and $82 million in NVR.

This investment, announced in August 2025, immediately boosted the share prices of these companies. Berkshire Hathaway’s move is directly linked to the unusual price dynamic between new and old homes.

With many current homeowners reluctant to sell due to low-interest rates, the market supply primarily consists of new constructions, reducing competition for large real estate companies.

Additionally, the US faces a shortage of nearly 4 million homes, and the only solution is to build more. Berkshire’s investment signals optimism about a housing market recovery and an expected boost in new home sales. The company believes that the current challenges, such as affordability and high-interest rates, are temporary.

Moreover, Buffett’s long-term investment style often involves buying stocks at attractive prices during difficult market conditions. With his extensive experience in the home construction industry, as demonstrated by Berkshire’s acquisition of Clayton Homes in 2003, Buffett likely recognizes the opportunity presented by the aggressive pricing and promotions offered by builders like Meritage Homes, NVR, KB Home, and Lennar, despite their shrinking profit margins.

– 09:43 03/09/2025

“T&T Group Proposes to Invest in a Series of Major Projects in Ca Mau”

With a vision to foster dynamic growth in the region, T&T Group proposes a strategic investment plan in Ca Mau. The group aims to initiate a series of groundbreaking projects, each designed to be a catalyst for positive change and local development in the near future.

The Ultimate Milk: Nutifood Invests a Whopping $6 Billion in Gia Lai Dairy Farm

Nutifood has taken a giant leap forward by signing a collaboration agreement with the People’s Committee of Gia Lai, aiming to elevate their dairy cow herd to an impressive 30,000 heads. This strategic move involves a substantial investment of 6,000 billion VND, focusing on expanding their farms and factories to secure an extended raw material region.

The Mighty Mississippi: Unveiling the Expressway’s $40 Million Makeover

The My Thuan – Can Tho Expressway project, Phase 1, has been approved for additional funding of nearly VND 1,000 billion for the construction of interchanges and collector roads. However, the progress of these constructions has faced challenges, particularly in terms of land clearance in the province of Vinh Long.