The Evolution of Vietnam’s Banking Industry: Embracing Digital Transformation and AI

The first half of 2025 witnessed a significant reduction in staffing across Vietnamese banks at an unprecedented rate. Behind these numbers lies a shift in business models, an ongoing digital transition, and the growing influence of artificial intelligence (AI).

Cost-Cutting Takes Priority

Financial reports from 28 parent banks revealed a total system-wide staff of nearly 280,000, a decrease of almost 3,000 from the beginning of the year. This reduction reflects a widespread trend of downsizing within the industry. LPBank took the lead in downsizing, letting go of 1,986 employees, accounting for nearly 18% of their total workforce. VIB and Sacombank also reduced their headcount by over 1,000 each within the same period, a significant increase compared to the previous year.

Other notable reductions include ACB with 607 fewer employees, ABBank with a decrease of 469, and Agribank, which let go of 273 staff members. Even Vietcombank, once an aggressive recruiter, reduced its headcount by 191, leaving them with 23,347 employees.

According to bank strategy analyst Le Hoai An, the downsizing trend is more prominent in retail banks. “The personal lending sector, which previously required a large number of direct employees, has now been automated. Processes such as home and auto loans and eKYC (electronic Know Your Customer) have gone digital, significantly reducing the need for tellers,” Mr. An explained. He illustrated this with an example: a loan officer who previously handled only a few auto loan applications a month can now manage a much higher volume thanks to automation. As a result, banks no longer need to maintain a large physical staff.

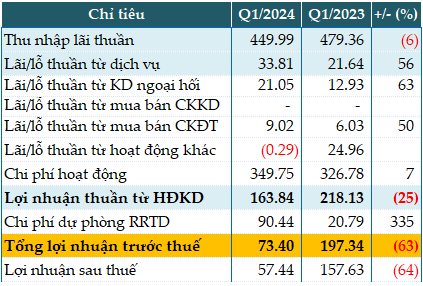

Mr. Nguyen Tan Tai, a representative of a commercial bank, candidly shared, “In the context of declining interest rates, cost-cutting has become a top priority. While technology and AI enhance efficiency, they also threaten to replace various traditional positions.”

Mr. Tai cited examples from the US and Europe, where major banks have witnessed an exodus of employees due to AI. In Vietnam, these effects are just beginning to emerge, but the trend is clear.

Ms. Tran Thi Nguyet Oanh, HR Director of HSBC Vietnam, referred to a World Economic Forum (WEF) report indicating that bank tellers and secretaries are among the occupations at high risk of being displaced by technology. “Account opening, lending processes, and transaction checks have all been digitized. Repetitive tasks such as data entry and report generation will soon disappear,” said Ms. Oanh. “At the same time, technology creates opportunities for data specialists, cybersecurity experts, and risk managers.”

Sacombank’s headcount reduction is attributed to their embrace of digital transformation.

The Looming Threat of Job Displacement

According to the International Labour Organization (ILO), currently, 47% of jobs are still held by humans. However, by 2030, this number could drop to just 33%. With the rapid pace of digitization, the banking industry, being a pioneer in digital transformation, is likely to experience these changes sooner rather than later.

Earlier this year, DBS, a Singaporean bank, startled the Asian financial sector by announcing plans to cut 4,000 jobs over three years, equivalent to nearly 10% of its workforce. The bank openly attributed this decision to the increasing role of AI in their operations.

In Vietnam, financial expert Le Hoai An predicts a similar scenario for the local banking industry, anticipating a time lag of 2-3 years compared to the region. By 2027, a 10% system-wide staff reduction is a plausible scenario, in contrast to the current annual reduction rate of 1-2%.

Over the past five years, bank staffing has increased by a mere 1-2% annually, while profits and average incomes have maintained a 10-15% growth rate. This improvement in labor productivity is a testament to the successful implementation of technology, reflecting the emerging trend of “doing more with less.”

Ms. Tran Thi Nguyet Oanh suggested that banks should view this transition as an opportunity for restructuring. While technology may replace certain positions, it also creates new ones. The key, she emphasized, is to proactively retrain the workforce to adapt to these changes.

In contrast, Mr. An warned that AI could increase productivity fivefold, while the economy might not be able to generate a corresponding volume of work. Therefore, the risk of job displacement should not be taken lightly.

The recent staff reductions are not mere statistics in financial reports. They signify a significant turning point, reflecting a shift in business models, the spread of automation, and the increasing influence of AI on the banking labor market.

While many tasks are being automated, AI cannot replace essential skills such as communication, negotiation, and relationship-building,” emphasized Dinh Duc Quang, Head of Currency Trading at UOB Vietnam.

An Inevitable Shift

According to expert Le Hoai An, the influence of Big Data, AI, and changing customer behavior has led to the reduction of traditional positions and an increased demand for technology, data, consulting, and customer service professionals. This shift indicates that the banking industry is rapidly moving towards a leaner, more agile, and digital model.

The Great Manufacturing Reboot: China’s Surprising Strategy to Revive its Industries

“China continues to defy expectations, maintaining robust growth in labor-intensive industries despite a rising labor force. The country has leveraged a remarkable strategy to achieve this feat, one that has become an economic ‘miracle’.”

The Future of Industrial Zones: THACO’s $340 Million Venture into AI, Robotics, and Green Tech

The project is a visionary undertaking, embodying the next-generation industrial park model. With a focus on sustainable development, automation, and smart technology, the project integrates digital innovation and artificial intelligence to create a modern, efficient, and environmentally conscious ecosystem.

The Blockchain Company Proposed a Significant Initiative for Da Nang

The Vietnam Blockchain Multi-chain Service Network, or VBSN, is proud to announce its proposal to implement three innovative solutions in the public service area of Da Nang. With a focus on revolutionizing the way services are delivered, VBSN is set to make a significant impact with its cutting-edge technology.

“Vietnam Aims to Master 20 Strategic Tech Products by 2027”

By 2027, Vietnam aims to master at least 20 strategic technology products and forge a path towards a technology industry contributing to 20% of its GDP.

“FE CREDIT: Illuminating Dreams for 15 Years and Beyond”

“For over a decade, FE CREDIT has been a pioneer in the consumer finance industry, serving as a conduit for capital to reach millions of customers who were previously unable to access traditional banking services. FE CREDIT has revolutionized the financial landscape, empowering individuals to achieve their goals and aspirations by providing them with the financial tools and resources they need to thrive.”