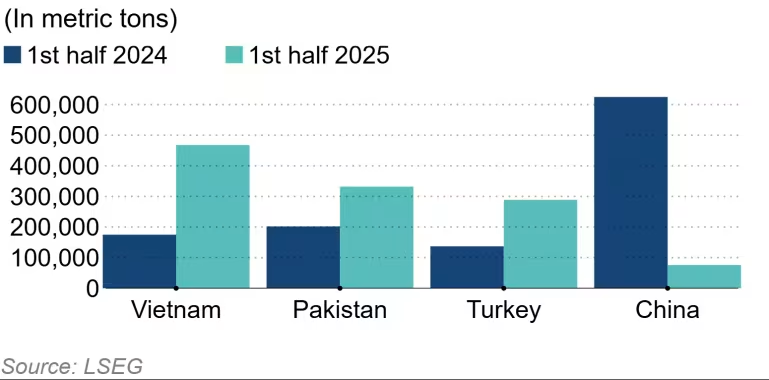

Data from LSEG reveals a significant shift in cotton exports from the US to China, with a 90% decrease in shipments during the first half of 2025 compared to the previous year. Meanwhile, US cotton exports to countries like Pakistan, Turkey, and especially Vietnam, have surged, with volumes nearly tripling to the latter.

In April 2025, President Donald Trump imposed retaliatory tariffs of up to 145% on Chinese goods. While these were later reduced to 30% after negotiations in May, the future trajectory of trade talks remains uncertain, posing a risk to production systems heavily reliant on China.

The apparel industry has been relocating its production for the US market out of China in recent years, favoring South and Southeast Asian countries with lower labor costs. This trend appears to have accelerated in the first half of 2025 amid escalating US-China tensions and concerns over tariffs.

Countries in South Asia, Southeast Asia, and the Middle East maintain their competitive edge as manufacturing hubs, even after the US re-imposed reciprocal tariffs. Washington reduced tariff rates from 46% to 20% for Vietnam and from 29% to 19% for Pakistan. With no signs of slowing down, US cotton exports to markets outside of Beijing are likely to continue their upward trajectory.

US Cotton Exports to Vietnam, Pakistan, Turkey, and China

However, US authorities are stepping up their monitoring of transshipment activities to avoid higher tariffs, particularly for goods originating from China. Chinese companies with garment bases in Vietnam often import yarn and fabric from China, and according to Nikkei Asia, these bases could be considered transshipment if they rely too heavily on this supply. The surge in US cotton imports by Vietnam indicates a shift towards on-site production of raw materials.

Meanwhile, since Trump’s first term, Beijing has been working to reduce its dependence on the US for agricultural products to ensure stable supplies. Cotton is part of this strategy, along with soybeans and corn. According to the International Trade Centre, Brazil was the largest exporter of cotton to China in 2024, and this trend is likely to continue this year.

The key question now is how the evolving tariff landscape and trade patterns will impact production volumes and prices. According to a report by the US Department of Agriculture, the country exported 11.9 million bales of cotton in the year ending July, a 1% increase from the previous year, with the decline in shipments to China offset by growth in other markets. The department projects 12 million bales will be exported in the current fiscal year.

However, cotton prices have been stagnant. The benchmark futures contract in New York hovered around 66 cents per pound on September 2, 2025, a slight decrease from 69 cents at the start of the year.

“There’s a lot of uncertainty about retaliatory tariffs, and it’s hard to predict when demand for textile products will recover,” said Nobuo Oshimo of the Japan Cotton Trade Association.

The Southern US, a major cotton-growing region, has long been a Republican stronghold. If tariffs harm cotton growers through reduced exports or price declines, it could impact Trump’s standing ahead of the 2026 midterm elections. The president may exert pressure on trading partners during tariff negotiations to purchase more cotton and other agricultural goods.

In August 2025, India temporarily removed cotton tariffs, a move likely to boost US cotton imports. This measure aimed not only to support India’s apparel industry but also to curry favor with the Trump administration.

Vu Hao (According to Nikkei Asia)

‘They Owe Us a Debt’ – Trump Warns of 200% Tariffs on China if Exports of This One Thing Are Disrupted

Introducing a product that China almost entirely dominates in the global market. With their vast manufacturing capabilities and competitive pricing, Chinese manufacturers have firmly established themselves as the go-to source for this particular item. However, it is now time to challenge this monopoly and offer consumers an alternative. Stay tuned as we unveil a new player in the game, ready to revolutionize the industry and provide a fresh perspective on this ubiquitous product.

Is the US Dollar About to Weaken?

“The U.S. dollar is projected to remain weak in the short and long term, according to UOB Bank. This prognosis takes into account the combined effects of America’s trade policies, the Federal Reserve’s interest rate strategies, and the global trend towards de-dollarization. The perfect storm of these factors paints a clear picture of an impending greenback decline.”