Bamboo Capital Group Stocks Surge: A Surprising Turn of Events

BCG Shares Surge as Investors Pile In (Source: Cafef)

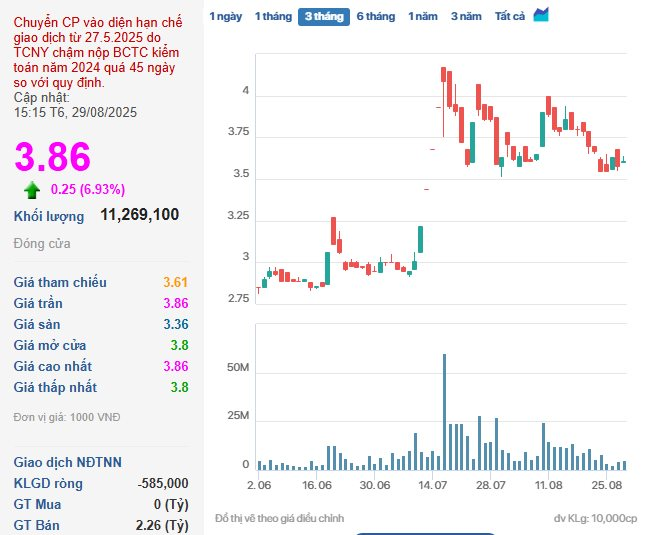

In a surprising turn of events, BCG shares of Bamboo Capital Joint Stock Company witnessed a sudden surge in investor interest, skyrocketing in the trading session on August 29, 2025.

Specifically, at the close of the session, the BCG share price soared by 6.93%, reaching 3,860 VND per share, with a staggering increase in trading volume of nearly 11.3 million units—over 2.2 times higher than the previous session.

TCD Shares Attract Heavy Trading on August 29 (Source: Cafef)

Similarly, shares of TCD, belonging to Tracodi Construction Group Joint Stock Company—a part of the Bamboo Capital ecosystem—also witnessed a remarkable surge, climbing by 6.72% to reach 2,860 VND per share. The trading volume for TCD shares spiked by over three times compared to the previous session, reaching more than 1.6 million units.

On the UPCoM exchange, two other stocks from the Bamboo Capital family, BGE of BCG Energy and BCR of BCG Land, also made significant gains.

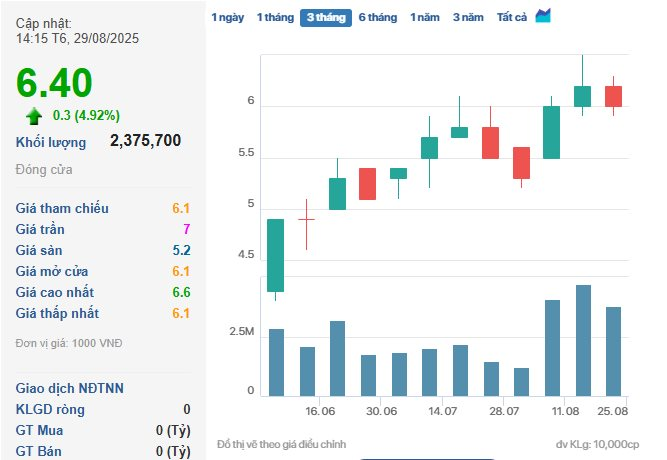

BGE Shares Continue Their Recovery Trend (Source: Cafef)

At the close of the session on August 29, BGE shares of BCG Energy stood at 6,400 VND per share, reflecting a 4.92% increase from the previous session. The trading volume for BGE shares was nearly 2.4 million units.

BCR Shares Surge with High Trading Volume (Source: Cafef)

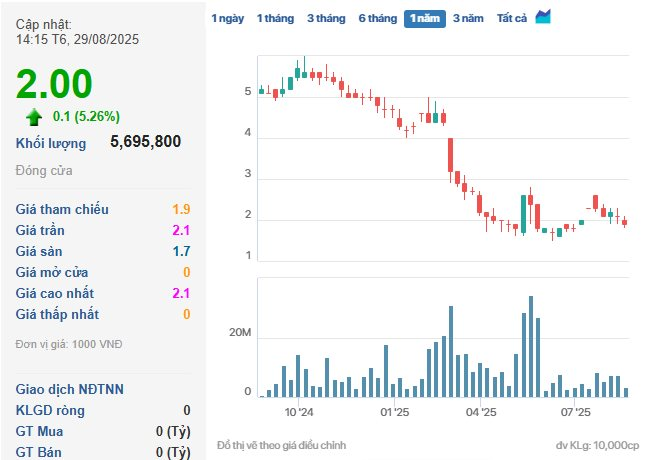

Likewise, BCR shares of BCG Land witnessed a robust increase of 5.26% from the previous session, reaching 2,000 VND per share. The trading volume for BCR shares nearly doubled compared to the previous session, reaching nearly 5.7 million units.

In related news, on August 27, Tracodi (HoSE: TCD) announced that it had received the resignation of Mr. Pham Huu Quoc from his position as a member of the Board of Directors, effective immediately, due to personal reasons.

The Board of Directors assured that Mr. Quoc’s departure would not affect the required number of members, and his resignation would be presented to shareholders for approval at the upcoming General Meeting of Shareholders. Notably, Mr. Quoc had only been elected to the Board of Directors for the 2022-2027 term since July 1, 2025, just shy of two months ago.

On the same day, Tracodi appointed Mr. Nguyen Ngoc Anh as Deputy General Director in charge of Construction, effective September 1, 2025, for a term of one year.

The simultaneous surge in the “Bamboo Capital family” of stocks indicates a resurgence of speculative money flowing back into these stocks, despite ongoing concerns about transparency and the delayed convening of the General Meeting of Shareholders. If the high trading volume persists, this group of stocks could remain a hot spot for investors in the short term.

The Green Rush: Bamboo Capital Stocks Soar, Attracting Investors

The August 29 session witnessed a breakthrough rally, attracting strong cash flow from investors to the group of stocks known as the Baboo Capital “family”: BCG, TCD, BGE, and BCR.

Masterise Group: Elevating the Art of Living, Capturing the Essence of Vietnam

At Masterise Group, we understand that a truly fulfilling lifestyle goes beyond mere convenience and modern infrastructure. It’s about preserving cultural values and creating a sense of belonging. Our philosophy of urban creation embodies this very essence, infusing every architectural detail with a vibrant yet familiar pace of life.

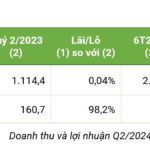

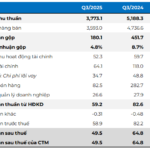

“Bamboo Capital (BCG) Reports Impressive 98% Growth with a Net Profit of VND 319 Billion in Q2 2024”

As of the end of Q2 2024, Bamboo Capital Group has successfully achieved 34.4% of its revenue plan and 43.8% of its after-tax profit plan, as presented at the 2024 Annual General Meeting of Shareholders.