**Hodeco’s Q2 2025 Financial Results:**

During the second quarter of 2025, Hodeco earned a revenue of over 80 billion VND, a 53% decrease from the previous year. This decline was mainly due to a significant 89% drop in revenue from the real estate business, amounting to nearly 12 billion VND.

A bright spot was the financial revenue of nearly 72 billion VND, a 10.6-fold increase from the same period last year, thanks to profits from the sale of shares in Ocean Entertainment Construction Investment Joint Stock Company.

Earlier, in early July 2025, Hodeco approved the resolution to carry out the necessary procedures to complete the transfer of more than 24.1 million shares (37.37%) of Ocean Entertainment Construction Investment Joint Stock Company to Tan Cuong Trading Consulting Investment Joint Stock Company and/or organizations/individuals designated by Tan Cuong Company.

At the same time, the HDC Board of Directors agreed to continue signing a contract to transfer the remaining nearly 6.4 million shares (9.9%) of Ocean Entertainment Joint Stock Company to another partner. As a result, Hodeco recorded a net profit of nearly 58 billion VND, a 15% increase compared to the previous year.

In the first six months, Hodeco’s cumulative revenue exceeded 179 billion VND, a 30% decrease, but its net profit was nearly 72 billion VND, a 39% increase over the same period last year.

For 2025, HDC has set ambitious business plans with a revenue target of 1,459 billion VND, 3.5 times higher than the previous year, and a net profit of 530 billion VND, more than 7 times higher. Thus, the company has achieved only 12% and 14% of its targets in the first half of the year.

CEO Group’s Q2 2025 Performance:

In the second quarter of 2025, CEO Group recorded a revenue of 421 billion VND, an increase of nearly 8% over the same period. The main contributor to this revenue was the provision of services, while revenue from the real estate business decreased by 6%, amounting to 233 billion VND.

Due to a 12% decrease in cost of goods sold, gross profit reached 164.5 billion VND, a 64% increase compared to the previous year.

During this period, financial revenue also surged by 67% to nearly 21 billion VND. Meanwhile, all types of expenses were reduced. Only the “other expenses” increased significantly to over 27 billion VND, compared to a refund of over 1 billion VND in the same period last year. As a result, CEO Group reported an after-tax profit of 39 billion VND, up 118% from the second quarter of 2024.

In the first six months of 2025, CEO Group’s revenue reached 747 billion VND, a 10% increase. The increase in revenue, along with cost reduction, helped the company achieve an after-tax profit of 95 billion VND, a 79% increase over the same period last year.

For the full year 2025, CEO Group aims for a consolidated revenue of 1,543 billion VND and a consolidated after-tax profit of 182 billion VND, a 10% increase compared to the previous year. Thus, the company has accomplished 48% of its revenue target and 52% of its profit target in the first half of the year.

HQC’s Q2 2025 Results:

In contrast, HQC recorded a negative revenue of nearly 11 billion VND. This was due to sales and services revenue of nearly 22 billion VND, but returns amounted to 33 billion VND. This resulted in a gross loss of nearly 18 billion VND, while in the same period last year, there was a gross profit of 52.5 billion VND.

According to the company’s explanation, some customers lost their ability to pay for subsequent installments, so the company agreed to cancel the contract, take back the product, and sell it to other customers at a higher price. This decision helped adjust the selling price but also resulted in a negative revenue adjustment for the period.

A positive aspect of this quarter was the financial revenue of nearly 29 billion VND, a 57% increase, mainly from investment cooperation profits, which did not exist in the same period last year. Along with this, selling and management expenses decreased significantly by 79.1%, amounting to 5.29 billion VND.

Notably, HQC had additional other income of nearly 38 billion VND, 11.5 times higher than the previous year, with details undisclosed. Consequently, Dia Oc Hoang Quan recorded an after-tax profit of 4.9 billion VND, a 54% decrease compared to the previous year.

In the first six months of 2025, HQC recorded a revenue of over 38 billion VND, a 5% increase, and an after-tax profit of over 10 billion VND, a 35% decrease. Compared to the 2025 targets of 1,000 billion VND in revenue and 70 billion VND in after-tax profit, the company has achieved only 4% and 14% of these goals, respectively.

Lideco’s Performance in Q2 2025:

On the other hand, Lideco escaped losses in the second quarter of 2025 thanks to investments in securities. The company’s revenue for this period was just over 6 billion VND, a 99.6% decrease from the previous year, as the real estate business segment brought in less than 3 billion VND.

Despite high costs, Lideco benefited from financial revenue of nearly 21 billion VND, 2.6 times higher than the same period, mainly from interest income and investment in securities. Along with a reduction in financial, selling, and management expenses by 41%, amounting to 10 billion VND, the company managed to turn a profit.

As a result, Nha Tu Liem escaped losses this quarter, earning a net profit of nearly 2 billion VND, a 99.7% decrease from the previous year. NTL explained that the real estate projects in this period are still in the process of completing legal procedures, so revenue cannot be recognized. All income for this quarter came from financial activities.

In the first half of the year, Lideco recorded a revenue of nearly 10 billion VND and a net profit of over 8 billion VND, both of which decreased by 99% compared to the previous year.

For 2025, NTL has set a cautious target with a total revenue of 80 billion VND, a 95% decrease from 2024, and a net profit of only 24 billion VND, a 96% decrease. With these plans, the company has achieved 54% and 35% of its targets, respectively, in the first six months.

“IPA Seeks Buyers for 50 Million Privately Placed Shares”

Introducing IPA’s latest venture: a proposed private placement of 50 million shares, with a vision to revolutionize the market. The funds raised from this offering are intended to be utilized for the sole purpose of redeeming bonds previously issued in 2024. This strategic move showcases IPA’s commitment to financial prudence and paves the way for a robust future.

Vietjet’s Stellar Performance in the First Half of 2025: Revenue and Profit Soar, Long Thanh Project Takes Off

Vietjet Aviation Joint Stock Company (HOSE: VJC) is proud to announce stellar results in its audited financial report for the first half of 2025. The company’s performance showcases its international stature, attracting investment and positioning Vietnam as a global aviation powerhouse.

MSN – Strengthening its Position for Sustainable Growth (Part 1)

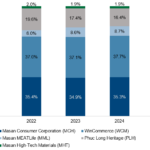

The Masan Group Corporation (HOSE: MSN) is Vietnam’s leading consumer-retail company, with a diverse portfolio spanning fast-moving consumer goods (FMCG), food and beverage retail, branded meat products, financial services, and high-tech industrial materials. MSN’s core businesses continue to deliver positive results, showcasing their adaptability to market fluctuations and reinforcing their prospects for sustainable growth.