A business model targeting the subprime customer segment with a higher risk appetite

The pawnshop industry in Vietnam is highly fragmented with an estimated 25,000 shops as of the end of 2024, according to Fiin Group. This includes the presence of new-generation pawnshop chains, including the entry of foreign “giants” such as Srisawad. While this industry in Vietnam is very potential and does not have many barriers to entry, the challenge lies in how to effectively operate and manage the chain of stores. In fact, there are pawnshop chains that opened numerous stores with great fanfare but may disappear from the market after just a few years. That is why very few pawnshop chains have been able to expand their scale like F88, with a system of up to 888 stores nationwide.

This industry has a higher risk appetite compared to banks or financial companies because the target customers are mostly subprime individuals (those who do not meet the criteria of banks), such as freelance workers, factory workers, and small traders. At F88, the majority of customers are freelance workers (accounting for about 70%), who are inherently a vulnerable group with unstable income and a higher likelihood of bad debt. However, Mr. Phung Anh Tuan – Chairman of the Board of Directors emphasized that F88 wants to ensure that it serves all the needs of its customers and is therefore willing to accept a higher risk appetite. To compensate for this, F88 focuses on building a robust risk management model.

Sharing his “secret”, Mr. Phung Anh Tuan said that F88 spent the first five years of its development journey just packaging the formulas for its business model, building a foundation for risk management, technology, culture, and shaping its core products. Only then did they start to expand their scale. While the business model can be copied, the ability to manage risks when scaling the model is not easy, especially in the lending business where risk management is extremely challenging.

Risk management: the “survival” factor that shapes F88’s position

Mr. Phung Anh Tuan stated that the risk management and credit scoring model must be built based on two core factors: the characteristics of the customer segment being served and the company’s operating procedures. Due to the higher risk appetite, F88’s risk management model differs from that of banks and financial companies, especially in asset appraisal, debt collection, and bad debt handling.

The biggest strength of F88’s risk management model is its technology and information system, which significantly optimizes the asset appraisal process. Based on this system, F88 has built and operated a professional asset appraisal process to prevent the risks of overvaluation (leading to losses during liquidation) or undervaluation (causing customers to turn to competitors).

What sets F88 apart is its self-built and internally developed credit scoring system, which sets the standard and orientation for the company’s development. More importantly, F88 stated that it would not stop at the initial scoring but would continuously monitor risks throughout the loan lifecycle to adjust limits and policies according to the customer’s risk profile.

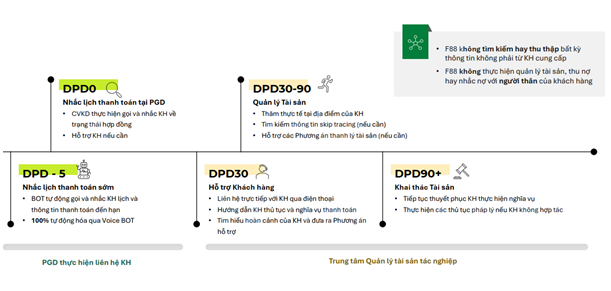

Debt Collection Process at F88

|

Technology is also thoroughly applied in F88’s debt collection process, with stages based on the time to maturity (DPD), including early payment reminders five days in advance (DPD – 5) to direct debt collection and asset recovery (DPD90+). F88’s proprietary technology involves installing GPS tracking devices on secured assets with the customer’s consent, enhancing the efficiency of collateral management. F88 designs loan products suitable for the borrowing limit based on the value of the collateral and the actual financial capacity of the customer (average disbursement limit of about VND 12 million for registered motorcycle loans and VND 146 million for registered car loans). Designing appropriately sized products for the customer segment is also an important factor influencing F88’s debt collection capability (repayment awareness is also higher when the loan amount is small and lower than the value of the asset, with the loan-to-value ratio – LTV at F88 commonly at 50-80%).

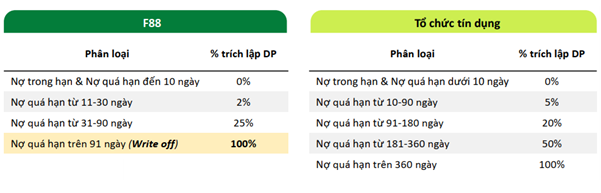

Notably, F88’s provision for credit losses is more conservative compared to credit institutions. This system is built based on advice from foreign markets and the company’s years of experience in Vietnam. Given the short-term nature of the loans, F88 makes a 100% provision for loans past due over 90 days (while credit institutions make a 100% provision for loans past due over 360 days). This written-off debt will be handled using the provision expense and transferred off-balance sheet for monitoring and collection by the Asset Management Center (recognized in the financial results if debt collection is successful).

F88’s Provision Ratio Compared to Credit Institutions

|

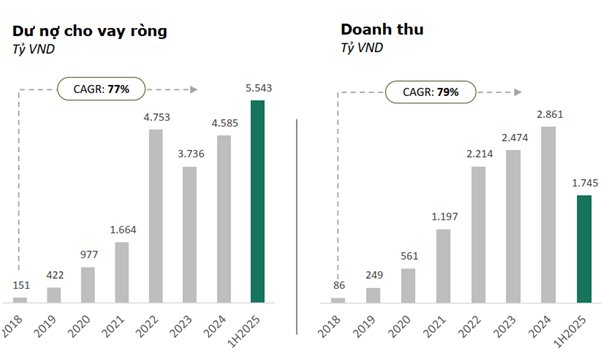

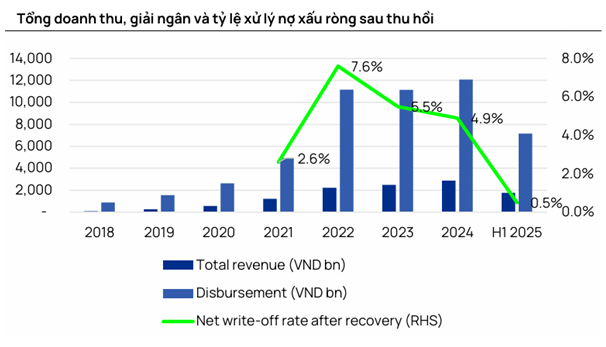

In 2025, F88’s risk ratio was the lowest ever

F88 was established in 2013, and the first five years were spent packaging the formulas for its business model. 2028 marked a turning point for the company as it transitioned from traditional operations to a new model (registered vehicle title loans). Ms. Tran Mai Thao – F88’s CFO shared that after changing the model, from 2018 to the present, F88’s business has grown remarkably, with a compound annual growth rate (CAGR) of net loan balances reaching 77% and revenue reaching 79%. This remarkable result is attributed to the strategy of adjusting the product portfolio and, more importantly, the credit risk management policy.

According to a report by Vietcap Securities, the bad debt ratio of pawnshops is high at 10-20% (industry average of about 14%), while consumer finance companies have a ratio of 5-10% and commercial banks at 1-5%. However, F88 does not monitor the bad debt ratio like credit institutions but instead focuses on the write-off ratio (as loans past due over 90 days are written off and moved off-balance sheet). Additionally, due to the nature of short-term loans, F88 typically measures asset quality based on the amount of loan disbursed (assuming a VND 10 million loan with a four-month term is rolled over continuously for 12 months, the disbursed loan amount would be VND 30 million).

Based on this calculation, F88’s net bad debt ratio after recovery has decreased significantly from 7.6% in 2022 to 4.9% in 2024, and in the first half of 2025, this ratio stood at just 0.5%.

F88’s Net Bad Debt Ratio After Recovery (Report by Vietcap Securities)

|

Mr. Phung Anh Tuan stated that F88’s goal for the following years is to maintain this ratio below 5%, and the Board of Directors will annually review it to align with the company’s risk appetite. In Q2/2025, the on-time payment ratio for loans at F88 reached 85%. For handled debt, the recovery ratio of written-off debt at F88 was 34%.

Vietcap Securities assessed that despite significantly expanding its loan portfolio, F88 has maintained a stable debt handling ratio, reflecting its solid credit risk management capability. Additionally, operational efficiency has improved, with costs slightly reduced even as disbursements and customer numbers increased significantly. “In the first half of 2025, F88 demonstrated strong financial performance, marking a clear shift from a cautious recovery phase to a breakthrough growth phase. Revenue increased thanks to stable lending activities and surging insurance income, while after-tax profit tripled, driven by improved asset quality, tight cost control, and enhanced profit margins“. F88’s after-tax profit reached VND 255 billion, with a monthly ROE of 2.37%.

Mr. Nguyen Quang Thuan (Chairman of FiinGroup) stated that the alternative finance sector has great potential and ample room for development. The critical aspect is how to transition to a new-generation model and apply technology to optimize operations. Technology and data are the most significant valuation factors for F88, apart from its people and systems, Mr. Thuan emphasized.

It is evident that F88 has built a comprehensive credit risk management ecosystem that goes beyond the scope of a traditional pawnshop business. This enables the company to replicate its packaged model to increase its scale while ensuring high business growth, solidifying its leading position in the industry.

– 09:42 04/09/2025

The Year-End Credit Sprint: Optimistic Expectations, Quality Assurance Needed

As we move into the final quarter of 2025, a surge in credit is expected, potentially surpassing the annual target set by the State Bank of Vietnam. This presents both opportunities and challenges for the financial and banking system. Experts emphasize the critical need to direct credit to the right sectors, primarily production and business, while effectively managing risks to ensure sustainable development.

What Do Rising Bank Bad Debts Tell Us?

The mounting bad debt in Vietnam’s banking sector, which has risen to a worrisome level of over VND 294,000 billion since the beginning of the year, poses a significant concern for the country’s economy. To address this issue, a multifaceted approach is necessary. This includes regulating and controlling credit in the economy, expediting the resolution of bad debts, and continuing the restructuring of weak banks to fortify and promote a robust and healthy banking system.

Unlocking Legal Hurdles: How Resolution 42 Continues to Enhance VPBank’s Asset Quality

In a challenging environment where the asset quality of the banking industry showed signs of deterioration in the first half of 2025, VPBank stood out as a rare exception. The bank proactively strengthened its internal capabilities, enhanced debt recovery efficiency, and improved its non-performing loan ratio. Additionally, the legalization of Resolution 42 provided a crucial legal impetus, enabling VPBank to accelerate its asset handling processes.

“A Challenging Road Ahead: Tackling Bad Debt”

The latest bad debt situation in the banking industry paints a more optimistic picture, with a significant slowdown in growth, reflecting the banks’ efforts to manage their asset quality. While the industry-wide non-performing loan ratio remains higher than pre-pandemic levels, the trend is heading in the right direction. This indicates that although challenges persist, the banks’ strategies to tackle bad debt are showing signs of success.