Lego Expands Vietnam Production, Boosting Global Growth

|

Despite trade tensions, Lego is solidifying its global presence. A new factory in Vietnam and significant investments in the US are supporting Lego’s growth strategy, while the Danish toy giant continues to gain market share.

According to Les Echos, the current climate is challenging for champions of globalization. While the US erects systematic tariff barriers, affecting industries from automobiles to textiles, Lego, the world’s number one toy company, navigates this risky period with agility.

On August 27, Lego announced double-digit growth in its half-year financial results, both in revenue and operating profit. Lego continues to leverage long-term strategies—developing commercial licenses and expanding its customer base—while also adapting to trade tensions by diversifying its logistics chain.

“The toy market continued to grow this year, but we grew faster and gained market share,” said Lego CEO Niels Christiansen in an interview with Bloomberg, noting that the global market grew by about 7%.

Lego experienced growth across all markets. One of the levers Lego is employing is the diversification of production locations. While major economies grapple with tariff issues, Lego inaugurated the Lego Manufacturing Vietnam factory in April 2025 and a new regional headquarters for the Americas in Boston.

In a statement, Lego emphasized that the Vietnam factory will enable the company to “support long-term growth in the Asia-Pacific region.” The group now has six factories located in Denmark, Hungary, the Czech Republic, Mexico, China, and Vietnam.

In contrast, Lego’s competitors, such as Mattel and Hasbro, remain more vulnerable to tariff fluctuations. Lego’s footprint in the US will continue to expand. In addition to the new Boston headquarters, which will employ 800 people, the “plastic brick king” announced a $1.5 billion investment in a major project in Virginia. On a 185,000 square meter site, the project includes a new factory and a regional distribution center.

The project is expected to be operational by 2027. In parallel, the group is investing in new lines in its existing factories in Mexico and Hungary.

According to the financial report, the Danish toy giant recorded a 12% increase in revenue in the first half of 2025, reaching a record 34.6 billion Danish crowns (approximately €4.6 billion), with operating profit increasing by 10% to 9 billion Danish crowns (€1.2 billion). However, cash flow decreased significantly due to the large volume of investments the group is making.

Regarding core strategy, Lego maintains its proven formula, particularly in commercial licensing. According to Lego, “the group’s sales were driven by an innovative and diverse product portfolio.” In just the first six months of this year, Lego launched 314 new products—an unprecedented number.

Among the new licenses and themes—designed to keep products relevant and trendy—are those related to the world of Formula 1 and car racing, with Formula 1 itself being a license. According to Niels Christiansen, other collaborations with brands like Fortnite and Jurassic Park have boosted sales across various customer segments.

Another area of focus is expanding Lego’s player base. Adults, who are willing to spend more on iconic or aesthetically pleasing sets rather than just for play, have continued to flock to the Lego Botanicals collection.

– Huu Chien

– 06:35 09/03/2025

“Dominating the Market: The Gioi Di Dong Claims 50% of Vietnam’s iPhone Market Share”

With over 1,000 The Gioi Di Dong and Topzone stores nationwide, MWG is a powerhouse in Vietnam’s Apple product market, commanding a substantial share of up to 50% for the tech giant’s key offerings.

“Carlsberg Vietnam’s Mid-Year Performance: 133 Million Liters of Beer Sold, 1.5 Trillion VND in Tax Contributions, and Plans to Increase Capacity to 600 Million Liters by September”

The Hue Brewery expansion project, with a total investment of over VND 3,400 billion, will transform the facility into Carlsberg’s largest brewery in Asia. The project will also position the Hue Brewery as one of the company’s most productive facilities worldwide, solidifying its standing as a leading global brewer.

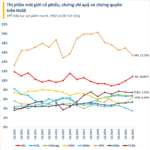

The Battle for Survival: A Small Ride-Hailing App’s Struggle

Despite their best efforts to stay afloat, smaller ride-hailing apps are finding it challenging to gain traction and break through in the market. The odds are stacked against them as they compete with well-established players who have a head start in terms of resources, brand recognition, and network effects. It seems an uphill battle for these smaller players to make a significant dent in the industry and capture a substantial market share.