I. MARKET DEVELOPMENT OF WARRANTS

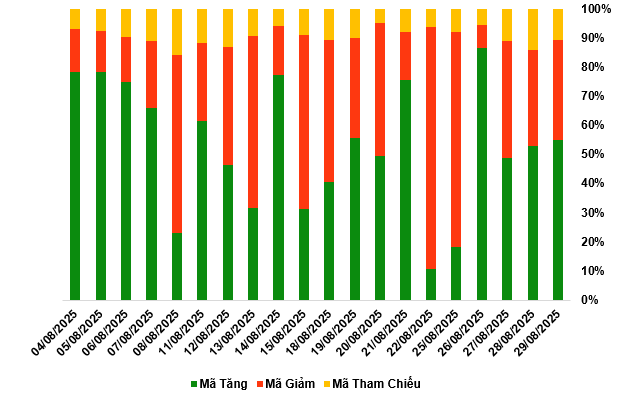

As of the trading session on August 29, 2025, the market closed with 142 advancing codes, 89 declining codes, and 28 reference codes.

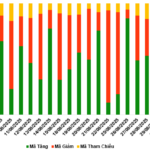

Market breadth over the last 20 sessions. Unit: Percentage

Source: VietstockFinance

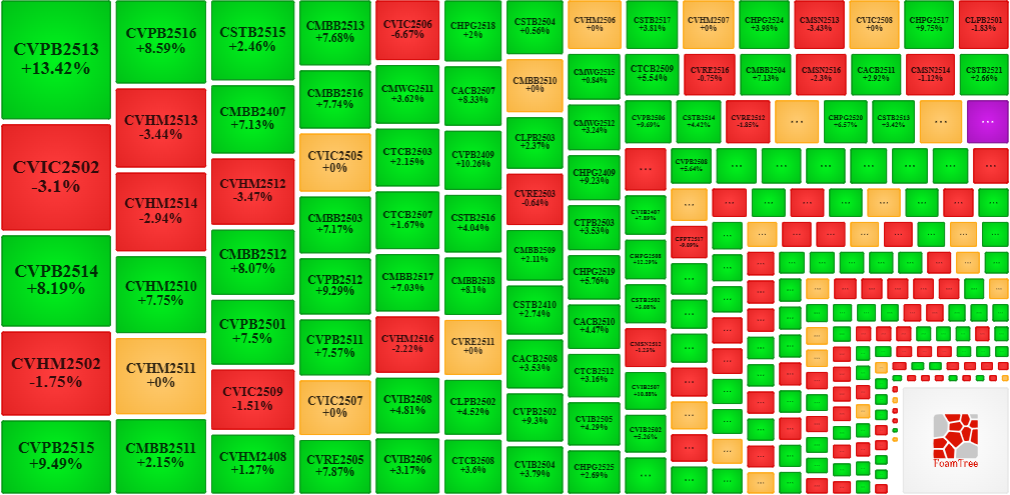

In the trading session on August 29, 2025, buyers continued to lead the market, causing most of the warrant codes to increase in price. Specifically, the large codes in the group that increased in price were CVPB2513, CVHM2510, CMBB2512, and CVRE2505.

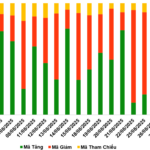

Source: VietstockFinance

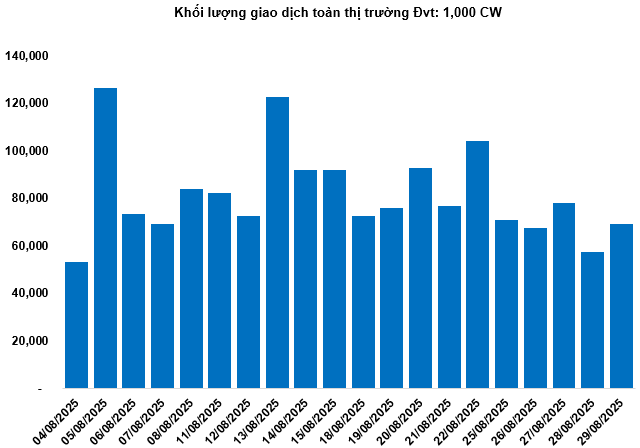

The total trading volume of the market in the session on August 29 reached 69.12 million CWs, up 20.6%; the trading value reached VND 186.58 billion, up 33.2% compared to the session on August 28. Of which, CHPG2528 was the code leading the market in volume with 2.91 million CWs; CVRE2503 led in trading value with VND 10.73 billion.

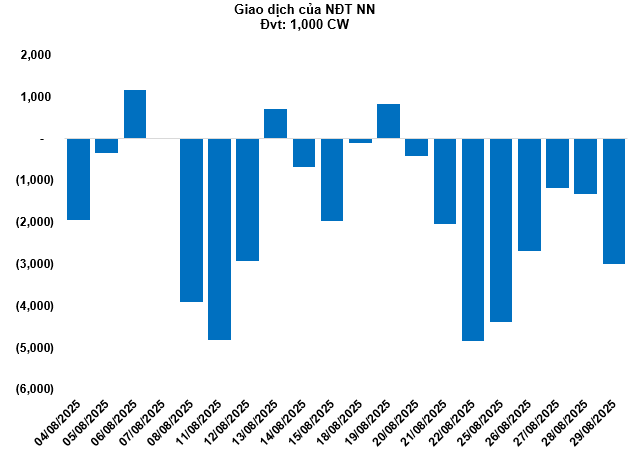

Foreign investors continued to sell a net in the session on August 29, with a total net selling volume of 3 million CWs. In particular, CSHB2510 and CMSN2508 were the two codes that were net sold the most. For the whole week, foreign investors net sold more than 12.57 million CWs.

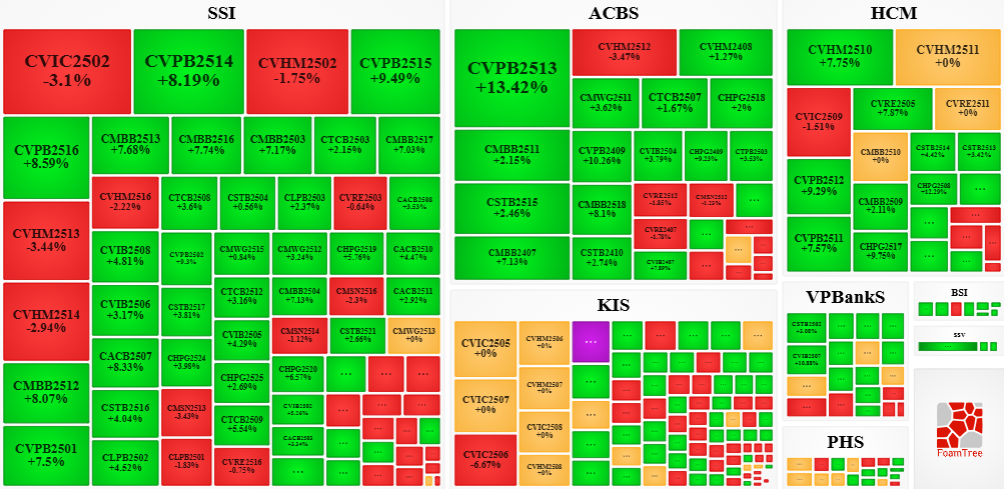

Securities companies SSI, ACBS, KIS, HCM, and VPBankS are currently the organizations with the most warrant codes in the market.

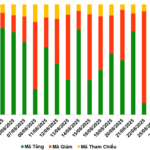

Source: VietstockFinance

II. MARKET STATISTICS

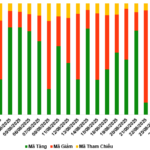

Source: VietstockFinance

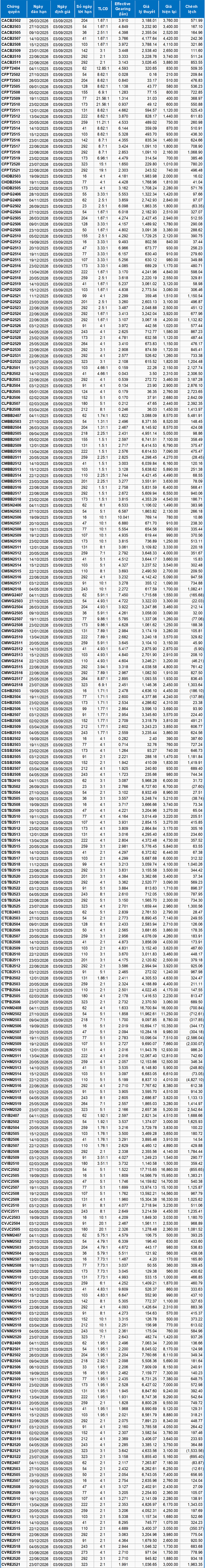

III. WARRANT VALUATION

Based on the valuation method suitable for the starting point of September 03, 2025, the reasonable prices of the warrants currently being traded in the market are as follows:

Source: VietstockFinance

Note: The opportunity cost in the valuation model is adjusted to suit the Vietnamese market. Specifically, the risk-free bill interest rate (government bills) will be replaced by the average deposit interest rate of large banks with term adjustments suitable for each type of warrant.

According to the above valuation, CVHM2515 and CVHM2508 are currently the two warrant codes with the most attractive valuations.

The higher the effective gearing ratio of a warrant code, the greater its increase/decrease relative to the underlying stock. Currently, CMSN2506 and CVNM2512 are the two codes with the highest effective gearing ratios in the market.

Economic Analysis and Market Strategy Division, Vietstock Consulting Department

– 18:58 09/02/2025

“Warrant Market Update: The Polarization Phenomenon Unveiled”

The trading session on September 3rd, 2025, concluded with a mixed performance across the market. A total of 117 stocks advanced, while 107 declined, and 35 remained unchanged. Foreign investors continued their net-selling trend, offloading a net value of 944,800 CW worth of shares.

The Warrant Market on August 28, 2025: A Mosaic of Green and Red

The trading session on August 27, 2025, concluded with a mixed performance across the market. Out of all the stocks traded, there were 126 gainers, 104 losers, and 29 stocks that remained unchanged. Foreign investors continued their net-selling trend, offloading a total of 1.18 million covered warrants.

The Ultimate Guide to Reaching New Heights: Vietstock Daily 27/08/2025

The VN-Index demonstrated resilience by maintaining its position above the middle of the Bollinger Bands, and its impressive recovery was highlighted by a surge of nearly 54 points. To ensure a more sustainable upward trajectory, an improvement in trading volume is necessary. If the index surpasses the previous peak of 1,680-1,693 points in upcoming sessions, it will pave the way for reaching new heights.