Gold Prices Surge as Fed’s Dovish Pivot Boosts Bullion’s Appeal

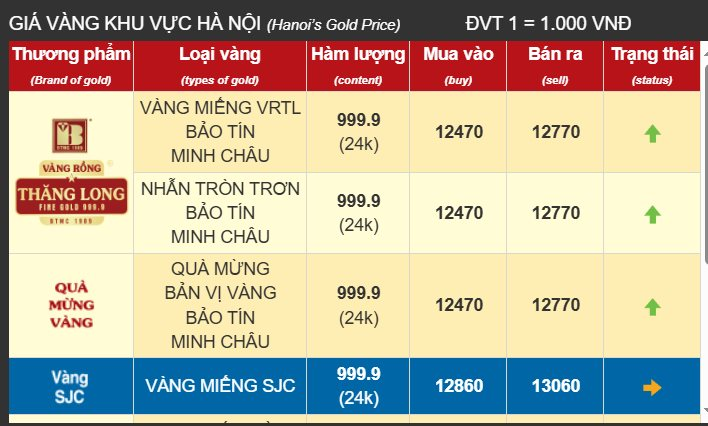

Hanoi, Vietnam – Local gold prices surged during morning trade, with gold rings witnessing substantial increases across prominent jewelry companies. DOJI led the pack with a significant jump of 2 million VND per tael, quoting buy-sell prices at 124.5 – 127.5 million VND per tael. Similarly, Bao Tin Minh Chau raised their rates by 1.9 million VND, settling at 124.7 – 127.7 million VND per tael. PNJ followed suit with a matching increase, offering gold rings at 122.5 – 125.4 million VND per tael.

Meanwhile, SJC maintained their gold ring prices at 122.5 – 125 million VND per tael. Gold bars continued to hover around 128.6 – 130.6 million VND per tael across various enterprises, marking the second consecutive day without adjustments following a prolonged upward trend.

Globally, spot gold climbed to $3,491 per ounce, inching closer to the pivotal $3,500 mark. This upward momentum was largely attributed to Fed Chair Jerome Powell’s dovish remarks at the Jackson Hole symposium, signaling a potential shift in focus from inflation to economic slowdown and labor market conditions.

Market strategist Michele Schneider reinforced this view, indicating that the Fed’s softened stance on inflation targets became evident last week. She elaborated that Powell appeared less adamant about achieving the 2% inflation goal, instead expressing heightened concerns regarding economic deceleration and labor market weakness.

Supporting this narrative, the US Commerce Department revealed that the core PCE price index, the Fed’s preferred inflation measure, rose 2.9% year-over-year in July, meeting market expectations. Despite this, investors are confident that the Fed will proceed with an interest rate cut in September, barring any significant inflation surprises in the upcoming PPI and CPI reports.

Analysts from Blue Line Futures foresee further upside potential for gold in the near term, anticipating a decisive break above $3,500 in spot and futures prices to solidify the bullish trend. The precious metal’s trajectory is influenced by mounting inflationary pressures coupled with subdued economic growth, according to Phillip Streible, Chief Market Strategist at Blue Line Futures.

The upcoming non-farm payrolls data will be a pivotal factor in shaping market sentiment. A weak jobs report for August could reinforce the case for a Fed rate cut, as predicted by Comerica Bank’s Chief Economist, Bill Adams. He forecasts a modest addition of 45,000 new jobs and anticipates the unemployment rate to hold steady at 4.2%.

Beyond economic factors, political tensions between President Donald Trump and the Fed are eroding confidence in the US dollar. Trump’s recent focus on ousting Fed Governor Lael Brainard, based on allegations related to a mortgage contract, underscores his ongoing attempts to influence the central bank’s policies.

According to Naeem Aslam, Chief Investment Officer at Zaye Capital Markets, Trump’s efforts to control the Fed’s narrative imply that interest rates will likely head lower, benefiting gold. Chantelle Schieven, Head of Research at Capitalight Research, concurs, adding that the political conflict undermines the US dollar’s status as a global reserve currency. She predicts that gold will continue its upward trajectory, surpassing previous highs.

How Gold Buyers Profit from a Bull Market

This morning (September 1st), the SJC gold bar price peaked at a staggering 130.6 million dong per tael, marking a significant surge of over 4 million dong per tael within just one week. Investors witnessed a remarkable profit margin of nearly 3 million dong per tael during this short period.

No More Waiting to Buy Gold, Now It’s Silver’s Turn

Amid the relentless surge in global gold and silver prices, domestic prices of these precious metals have also skyrocketed to unprecedented levels. In a notable development, following the frenzy of gold buyers queuing up, a similar scene is now unfolding with long lines of people eagerly waiting to purchase silver.

The Ever-Rising Gold Prices: Experts Predict Further Gains

The gold bar selling price surges past 129 million VND per tael, while the gold ring price surpasses 124 million VND per tael, marking a significant increase that has caught the attention of investors and consumers alike.