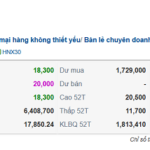

Shares of PDR, owned by Phat Dat Real Estate Development JSC, soared to a ceiling price of 26,250 VND per share on September 3, 2025, with no sellers in the market. This is the highest price PDR has reached since May 2024.

The stock’s liquidity also increased significantly, with nearly 56 million shares matched. The company’s market capitalization stands at over VND 25,700 billion.

The surge in PDR’s share price follows the announcement of Mr. Nguyen Van Dat’s decision to transfer 88 million PDR shares. Mr. Dat is the Chairman of the Board of Directors of Phat Dat.

As a result of this transaction, Mr. Dat’s ownership percentage stands at 36.45%, including the shares held by Phat Dat Holdings, his private enterprise.

It is understood that Mr. Nguyen Van Dat transferred these 88 million shares through a negotiated deal, expecting to raise approximately VND 2,000 billion to finance Phat Dat’s upcoming business plans. This is not the first time Mr. Dat has used his personal assets to support the company’s needs.

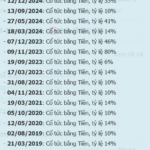

Previously, in late 2022, Mr. Dat also sold personal assets worth approximately VND 2,000 billion to help Phat Dat fully repay its bond debts and fulfill its commitments to bondholders, enabling the company to emerge from its bond crisis earlier than other real estate businesses.

Regarding his decision to sell 88 million PDR shares at this time, Mr. Nguyen Van Dat, Chairman of Phat Dat, stated: “I would like to emphasize that this is a negotiated transaction and not a sale of shares on the open market, nor is it a divestment. On the contrary, this decision is a proactive preparation on my part to support Phat Dat whenever needed.”

The Chairman of Phat Dat highlighted that the company is at a crucial stage: “After a strong restructuring, we are ready for a new growth cycle. To move quickly and decisively, we require significant and immediate resources. Therefore, both the company and I must act resolutely and choose flexibly.”

“The shares I have decided to sell are only a part of my holdings, and I still retain 36.45% of Phat Dat’s shares, remaining the largest shareholder. This affirms my commitment to accompanying the company. Phat Dat is like my flesh and blood. I intend to use the entire proceeds to support the company’s new investment plans whenever needed,” Mr. Dat shared.

Mr. Nguyen Van Dat further added: “In the context of positive changes in the real estate industry, I want to demonstrate that business leaders should not just wait for the market but must proactively create opportunities. My decision to sell shares is a concrete action to affirm that I prioritize the company’s development and our shared future.”

“With a strong capital base, we can proactively negotiate, purchase good projects, and implement them with reasonable costs and faster timelines. Without sufficient resources, we may be at a disadvantage and miss golden opportunities.”

“I choose to proactively reduce my personal interests for Phat Dat to move quickly, while also ensuring that every step the company takes is carefully calculated for both speed and sustainability.”

With the expected proceeds of nearly VND 2,000 billion, Phat Dat plans to accelerate project development and acquire new land funds in satellite cities of Ho Chi Minh City. Additionally, the company is developing another strategic focus by investing in iconic projects in the core urban areas of Ho Chi Minh City, Binh Duong, Ba Ria-Vung Tau, and Hanoi…

“We are currently in the process of negotiating several large-scale projects. Phat Dat’s new projects will feature professional infrastructure and product designs to differentiate our brand and provide higher value to our customers,” said the Chairman of Phat Dat.

In addition to Mr. Nguyen Van Dat’s personal preparations, Phat Dat is actively recovering receivables from the La Pura project, proceeding with the next sales phase of Quy Nhon Iconic, restructuring its investment portfolio, and optimizing the transfer of projects such as Q1 Tower, Thuan An 1&2, and Han River…

“A Surprising Turnaround: Stock Surges with a 63% Post-Tax Profit Jump Post-Audit”

With the release of its 2025 half-year audited financial report, TV2 has achieved a remarkable feat, surpassing 60% of its annual net profit plan for the year.

“Hodeco Scraps Plan to Pay 2024 Dividends in Stock”

Hodeco plans to hold an extraordinary general meeting on September 30, 2025, where it will propose to shareholders the cancellation of its plan to issue shares as a dividend for the fiscal year 2024.