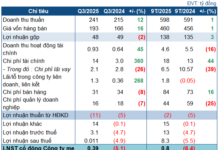

According to data from VietstockFinance, the 18 plastics/packaging businesses on the exchange generated revenue of 12.4 trillion VND, up 9.6% from the same period last year. The industry’s net profit exceeded 1 trillion VND, an increase of 27%, mainly thanks to the two leading companies, NTP and BMP.

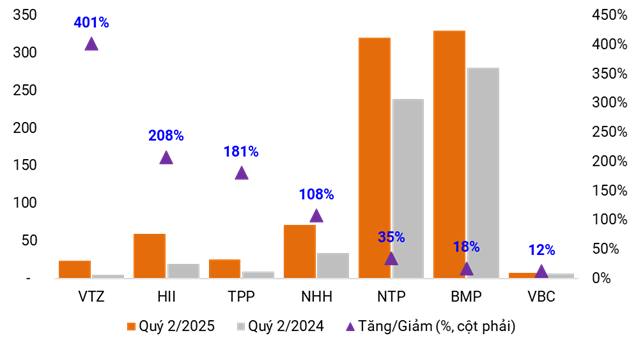

In addition, VTZ, HII, NHH, and TPP also recorded positive results, while AAA and TDP experienced setbacks.

Construction plastics maintain growth momentum

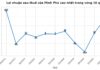

Thieu Nien Tien Phong Plastic Joint Stock Company (HNX: NTP) achieved revenue of nearly 1.99 trillion VND for the first time, an increase of 18%; net profit reached 320 billion VND, up 35%.

Binh Minh Plastic Joint Stock Company (HOSE: BMP) recorded revenue of 1.3 trillion VND, an increase of 13%, and profit of 330 billion VND, up 18%. Despite not setting a new revenue record, the gross profit margin of 46.7% helped BMP report the highest-ever net profit.

The positive performance is attributed to the low PVC resin prices and the recovery of the construction market, especially due to the acceleration of public investment projects.

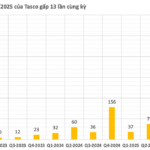

| BMP’s gross profit margin continuously improved as PVC resin prices decreased |

| NTP’s profit also increased significantly and reached a new peak |

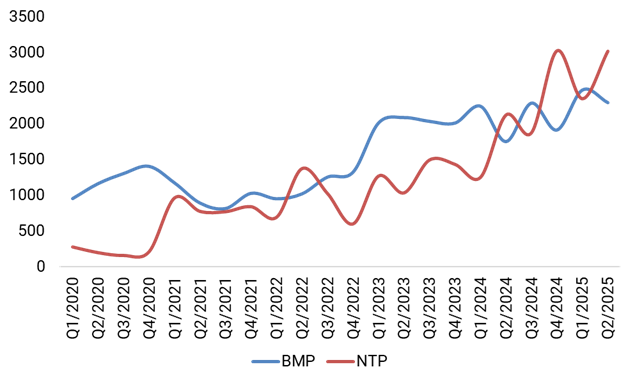

The prolonged favorable conditions have helped both companies maintain their cash levels at the highest levels ever. At the end of the second quarter, NTP held over 3 trillion VND in cash and bank deposits, while BMP held nearly 2.3 trillion VND.

Inventory and short-term receivables from customers are at multi-year lows, reflecting the smooth business operations.

|

NTP and BMP’s bank deposits have continuously increased quarter after quarter (in trillion VND)

Source: Author’s compilation

|

According to SSI Securities Corporation, PVC resin prices are likely to remain stable in the third quarter, hovering around 700 USD/ton as they have since the beginning of the year. While demand in China has improved, it is unlikely to create a significant impact on the global market.

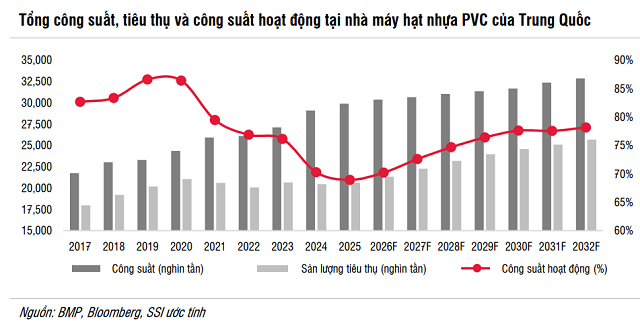

In Vietnam, the real estate market is flourishing with many restarted projects and supportive housing policies, thus boosting mid-term construction demand. However, production prospects in China remain weak, and PVC plant capacities are unlikely to return to 2021 levels before 2032, keeping prices in a potential long-term low.

Source: SSI Securities Corporation

|

Positive developments in the household plastics sector

The household plastics segment is also a bright spot. Viet Thanh Plastic Joint Stock Company (HNX: VTZ) recorded revenue of 1.2 trillion VND, an increase of nearly 49%. Profit reached 24 billion VND, five times higher than the same period last year, thanks to the expansion of distribution channels and online sales.

Tan Phu Plastic Joint Stock Company (HNX: TPP) set a new record with revenue of 859 billion VND, a slight increase. However, net profit surged 181% to 25 billion VND due to optimized sales expenses.

Mixed performance in the An Phat Holdings group

Some companies under An Phat Holdings reported significant profit increases, mainly due to the recovery of financial investments from divesting capital from An Phat Bio Degradable Plastic Joint Stock Company.

Hanoi Plastic Joint Stock Company (HOSE: NHH) reported a doubling of profit to 71 billion VND. Its main business also improved, with revenue reaching 636 billion VND, the highest in ten quarters. An Tien Industries Joint Stock Company (HOSE: HII) earned a substantial profit of 59 billion VND, triple that of the previous year. However, the core business showed signs of weakening as the gross profit margin continuously declined to 6.7%.

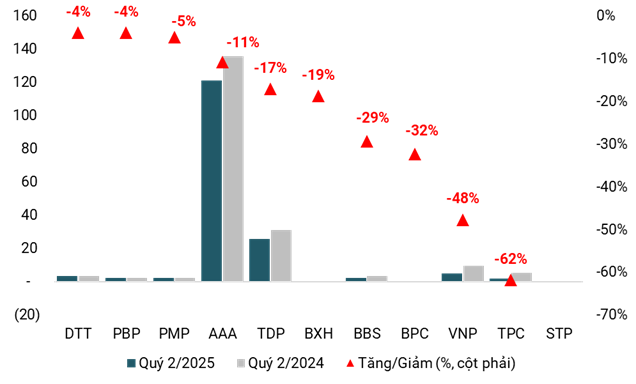

An Phat Green Environment Joint Stock Company (HOSE: AAA) went against the trend, with revenue decreasing by 17% to 2.3 trillion VND. Profit fell by 11% to 121 billion VND. The reason for this decrease is the exclusion of HII‘s data from consolidation, resulting in a significant increase in the profit attributable to minority shareholders from 2 billion VND to 50 billion VND.

|

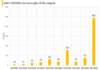

The construction and household plastics groups had a positive quarter (in trillion VND)

Source: Author’s compilation

|

Divergence in the packaging plastics sector

The packaging plastics segment reported mixed results. VICEM Hai Phong Packaging Joint Stock Company (HNX: BXH) attracted attention with revenue of 65 billion VND, a 58% increase and the highest since 2019. Vinh Packaging Joint Stock Company (HNX: VBC) reported a profit of 7.6 billion VND, up 12%.

On the other hand, many companies experienced profit declines. Thuan Duc Plastic Joint Stock Company (HOSE: TDP) achieved revenue of 1.12 trillion VND, an increase of 12%, but profit decreased by 17% due to higher expenses.

Tan Dai Hung Plastic Joint Stock Company (HOSE: TPC) reported a profit of only 2 billion VND, a drop of over 60%. But Son Packaging Joint Stock Company (HNX: BBS) saw a 29% decline in profit to 2.5 billion VND, while Bim Son Packaging Joint Stock Company (HNX: BPC) experienced a 32% drop due to higher raw material costs.

|

Many companies reported decreased profits in the second quarter of 2025 (in trillion VND)

Source: Author’s compilation

|

– 10:00 04/09/2025

The Rise of Vietnamese UAVs: A Story of Innovation and Global Reach

A New Era of Aerial Excellence: Unveiling the Secrets Behind Vietnam’s Leading Drone Developers

The Vietnamese UAV industry is garnering significant attention, and for good reason. Beyond the inspiring success stories, there’s a tantalizing prospect of tapping into a global UAV market valued at over $36 billion in 2024 and projected to soar past $125 billion by 2032.

The Electric Revolution: Unveiling Honda’s Upcoming E-Bike Models for Vietnam

These are the electric motorcycles that Honda could be bringing to the Vietnamese market in the near future. With their cutting-edge technology and sleek designs, these models are set to revolutionize the way we commute and perceive electric vehicles in Vietnam. Stay tuned as we uncover more about these exciting additions to the country’s automotive landscape.

“Vietnam’s ‘Goldmine’ Deal: US Spends Over $6 Billion; Making Vietnam the Second Largest Exporter with Tax Exemptions.”

As of late, economic powerhouses such as China and the United States have been vying for a particular resource from Vietnam, akin to a modern-day gold rush.