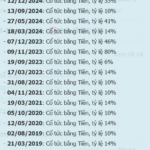

IJC has announced a dividend payout of 5%, equivalent to VND 500 per share. With over 377.7 million shares in circulation, the total payout is estimated to be nearly VND 189 billion. The payment is expected to be made on October 7.

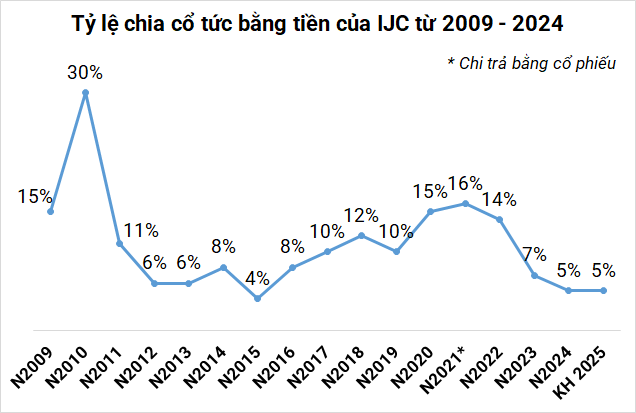

IJC has consistently paid dividends since 2009, mostly in cash (except in 2021 when it was in stocks). The highest dividend payout was in 2010, with a rate of 30%. In 2025, the company plans to continue with a 5% dividend payout.

Source: VietstockFinance

|

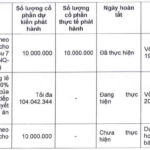

In addition to dividends, IJC has also announced a rights issue of over 251.8 million new shares to existing shareholders, equivalent to nearly 67% of the circulating shares, at a price of VND 10,000 per share. The offered shares will not be restricted from transfer. The subscription and payment period will be from September 24 to October 23. If successful, IJC is expected to raise its charter capital to nearly VND 6,296 billion, equivalent to nearly 629.6 million shares.

The total proceeds from the offering, estimated at over VND 2,518 billion, will be used by IJC to invest in the following:

- Contributing capital to the Ho Chi Minh City – Thu Dau Mot – Chon Thanh Highway Investment Joint Stock Company to invest in the highway project in Binh Duong province.

- Investing in the Becamex – Binh Phuoc Infrastructure Development Joint Stock Company to supplement capital for the Becamex – Binh Phuoc Industrial Park project and repay bank loans.

- Contributing capital to the Ring Road 4 Joint Stock Company to invest in the construction of the Ring Road 4 project, from Thu Bien Bridge to Saigon River (phase 1).

- Repaying principal and interest on bonds (IJCH2025001) issued in 2020 and bank loans.

- Investing in the construction of the Sunflower II (expanded) and Prince Town II (expanded) residential projects.

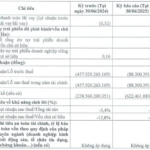

Profit decrease after audit

IJC’s audited semi-annual financial statements for 2025 show a significant difference compared to the self-prepared figures. Specifically, revenue was nearly VND 352 billion, an increase of 9%, but net profit decreased to nearly VND 143 billion, a decrease of 17%.

Compared to the same period last year, revenue decreased by 34%, while profit increased by 27%. Against the full-year plan, the company has achieved only 20% of the revenue target and 38% of the profit target.

According to explanations, IJC attributed the profit increase compared to the previous year mainly to the positive results of associated companies and a 45% reduction in expenses.

| IJC’s Financial Results for the first 6 months from 2015 – 2025 |

– 10:58 04/09/2025

The Real Estate Renaissance: Navigating the Market with Financial Savvy

The real estate market has been through a tumultuous time, and many property businesses have had to get creative to weather the storm. With core operations struggling, these enterprises have had to look beyond their traditional realms to stay afloat, turning to financial maneuvers to navigate these challenging times.

“SSI Plans to Offer 415 Million Shares to Shareholders”

At the upcoming extraordinary general meeting, SSI Securities Corporation will propose a plan to offer a maximum of 415.58 million shares to existing shareholders through a rights issue.