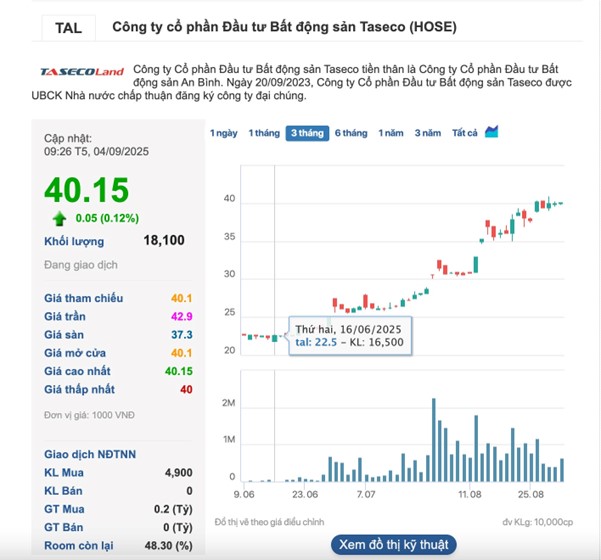

Taseco Land, a leading real estate investment company, recently announced an extraordinary general meeting resolution to deploy a private placement plan to increase its charter capital. The company also disclosed the Board of Directors’ resolution on selecting a list of professional security investors. According to the extraordinary general meeting resolution, Taseco Land approved the private placement of 48.15 million shares at a price of VND 31,000/share, expecting to raise VND 1,492.65 billion. The surplus capital is estimated to be over VND 1,000 billion. With an approval rating of over 96%, the resolution showcases the strong support of the company’s shareholders for the capital increase plan.

Trading price of TAL shares during the morning session on September 4, 2025

|

With an issuance ratio of 15.44% of the circulating shares, Taseco Land is expected to increase its charter capital to VND 3,600 billion. The offering is scheduled to take place in the third or fourth quarter of this year. The privately placed shares will be restricted from transfer for one year for professional security investors. This requirement underscores the investors’ long-term confidence in the potential of TAL shares.

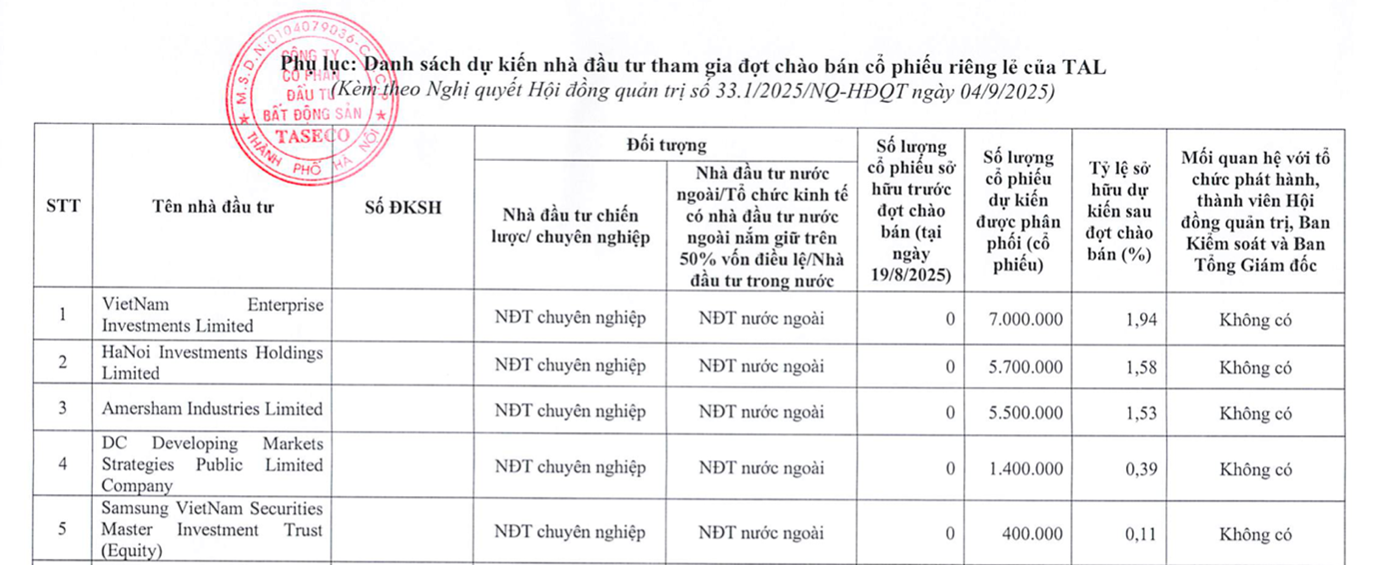

The list of investors attracted the attention of the financial investment community, with foreign investors making up a significant portion. Notably, a group of foreign funds affiliated with Dragon Capital stood out: Vietnam Enterprise Investment Limited (7 million units), Hanoi Investments Holdings Limited (5.7 million units), Amersham Industries Limited (5.5 million units), DC Developing Markets Strategies Public Limited Company (1.4 million units), and Samsung Vietnam Securities Master Investment Trust Equity (0.4 million units). Combined, this group registered to purchase 20 million units, accounting for nearly 42% of the privately placed TAL shares on offer.

Foreign investment funds registered to purchase privately placed TAL shares

|

On the domestic front, two securities companies, Saigon-Hanoi Securities JSC (SHS) and Vietnam Industrial and Commercial Bank Securities Company (CTS), registered to buy 8 million and 2 million units, respectively. Additionally, a group of individual investors registered to purchase 18.15 million units.

Post-offering, Taseco Group’s ownership in Taseco Land (TAL) is expected to decrease from 72.49% to 62.79%, maintaining its position as the dominant shareholder. Not only has TAL attracted capital, but it has also made a mark in the market. Since its official listing on the Ho Chi Minh Stock Exchange (HOSE) on August 1, 2025, with an opening price of VND 25,500/share, the share price has surged by 60% in just over a month, trading around VND 40,000/share, pushing its market capitalization to VND 12.5 trillion.

Services

– 12:00, September 4, 2025

“IPA Seeks Buyers for 50 Million Privately Placed Shares”

Introducing IPA’s latest venture: a proposed private placement of 50 million shares, with a vision to revolutionize the market. The funds raised from this offering are intended to be utilized for the sole purpose of redeeming bonds previously issued in 2024. This strategic move showcases IPA’s commitment to financial prudence and paves the way for a robust future.

“Phú Thọ Land Plunges into $15 Million Loss in the First Half of 2025”

In a stark contrast to its remarkable performance in 2024, where it achieved a staggering profit of over VND 1,680 billion, Phu Tho Land JSC ended the first half of 2025 with a notable decline, posting a loss of nearly VND 394 billion in after-tax profit. This is a significant deviation from the previous year’s success, where the company recorded a profit of almost VND 60 billion in the same period.

The Power of Vietnam’s Largest Bank: Vietcombank’s Market Capitalization Surges by a Whopping Amount, Outperforming Thousands of Listed Companies

The stock market in Vietnam witnessed an unprecedented event as Vietcombank’s market capitalization surged by a staggering $1.5 billion in a single trading session on August 27. This remarkable feat, a first in the nation’s stock market history, underscores the bank’s formidable presence and highlights the potential for significant growth in the country’s equity market.

“SSI Plans to Offer 415 Million Shares to Shareholders”

At the upcoming extraordinary general meeting, SSI Securities Corporation will propose a plan to offer a maximum of 415.58 million shares to existing shareholders through a rights issue.

The Largest Shareholder of SSI Securities Wants to Accumulate an Additional 16 Million Shares

Daiwa Securities Group Inc. is seeking to acquire nearly 16 million SSI shares directly from the issuer in a private placement. This move underscores Daiwa’s confidence in the potential of SSI and its commitment to strengthening its presence in the market. With this significant investment, Daiwa positions itself as a key player in SSI’s growth story, signaling a promising future for both companies.