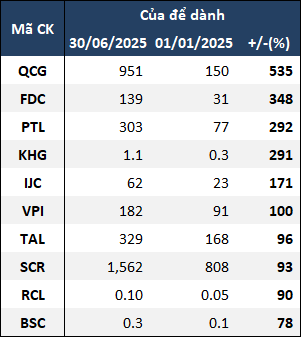

Despite the industry’s 11% growth, six businesses recorded reserves increases of up to several times over.

|

Top 10 Real Estate Companies with the Highest Increase in Reserves (in trillion VND)

Source: VietstockFinance

|

Among them, Quoc Cuong Gia Lai (HOSE: QCG) stood out with a 951 billion VND increase, six times higher than at the beginning of the year. In May 2025, the Da Nang Construction Department allowed the sale of 34 houses at the Marina Da Nang project, developed by its subsidiary, Da Nang Marina Company.

In addition to reserves, other items on QCG’s balance sheet also changed notably. In particular, short-term receivables from customers increased by over 700 billion VND to 1.1 trillion VND, while inventory slightly decreased to 1.2 trillion VND.

Following QCG, Ho Chi Minh City Foreign Trade and Investment Development Corporation (HOSE: FDC) recorded a reserve of 139 billion VND, 4.5 times higher than before, thanks to the recognition of over 88 billion VND in advance revenue from leasing activities. The company has started handing over the 28 Phung Khac Khoan office building to tenants since the end of 2024. General Director Ho Anh Tuan shared that the project is expected to generate approximately 44 billion VND in annual revenue.

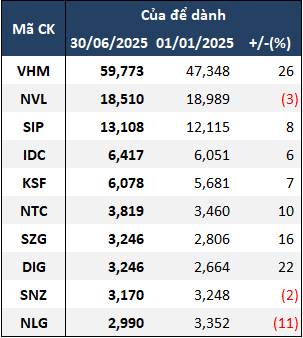

With Two New Project Launches, Vinhomes Leads the Industry in Reserves

In terms of scale, Vinhomes (HOSE: VHM) and Novaland Investment Group (HOSE: NVL) remain the industry leaders in reserves, with 59.8 trillion VND (up 26%) and 18.5 trillion VND (down 3%), respectively.

Regarding VHM, the company launched two new projects in the first half: Vinhomes Golden City (Duong Kinh) in Hai Phong’s southeastern gateway and Vinhomes Green City (Hau Nghia) in Ho Chi Minh City’s new northwestern center. The consolidated financial statements reflect a surge in money received from customers through deposits and related agreements, increasing nearly fivefold from 25 trillion VND to almost 119 trillion VND. The amount of prepayments from buyers also rose by 27%, reaching over 59 trillion VND.

Meanwhile, NVL’s reserves decreased amidst ongoing legal challenges for key projects like Aqua City, NovaWorld Phan Thiet, and NovaWorld Ho Tram. While significant progress has been made in resolving legal issues, completing the process, especially in land use fee calculations, and preparing the necessary funds to fulfill financial obligations once officially notified by the authorities, remains a lengthy process. For instance, the land use fee calculation for NovaWorld Phan Thiet is still pending, and Novaland faces the challenge of raising additional capital to pay the land use fee for over 381 hectares of commercial and service land at the project.

|

Top 10 Real Estate Companies with the Largest Reserves (in trillion VND)

Source: VietstockFinance

|

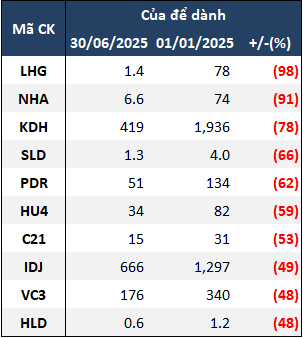

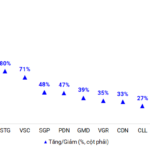

Khang Dien and Phat Dat Witness Significant Decreases in Reserves

Numerous businesses experienced substantial declines in their reserves during the first half of the year. While it is characteristic for real estate companies in the industrial sector to maintain substantial reserves, Long Hau Corporation (HOSE: LHG) witnessed a 98% decrease, leaving just over 1 billion VND. Specifically, the company recorded nearly 77 billion VND in short-term prepayments from buyers at the beginning of the year, but this amount had dropped to only 106 million VND by the end of June.

In contrast to the decline in reserves, LHG’s business results for the first half of the year surged, with net revenue and net profit reaching 457 billion VND and 200 billion VND, up 92% and doubling from the previous year, respectively. Of this, the revenue from leasing developed infrastructure land reached nearly 238 billion VND, 2.9 times higher than before.

Khang Dien House (HOSE: KDH) also noted a 78% drop in reserves, amounting to 419 billion VND, attributable to an 80% decrease in prepayments from buyers, totaling just over 384 billion VND. Similar to LHG, KDH experienced an 80% increase in revenue in the first half of the year. However, due to significant fluctuations in financial and sales expenses, KDH’s net profit retreated by 6%, settling at nearly 321 billion VND.

Phat Dat Real Estate (HOSE: PDR) likewise experienced a 62% decline in reserves, falling from 134 billion VND to 51 billion VND. This decrease primarily resulted from an over 80% reduction in prepayments for the Bac Ha Thanh project, totaling just over 25 billion VND.

|

Top 10 Real Estate Companies with the Largest Decrease in Reserves (in trillion VND)

Source: VietstockFinance

|

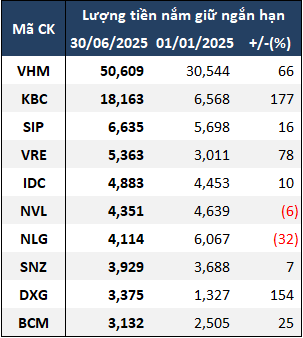

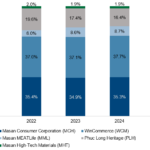

Short-Term Cash Holdings Increase by 35%

In addition to reserves, short-term cash holdings (cash and cash equivalents + short-term deposits) also underwent significant changes in the first half of the year. The total value of this item for the 104 businesses exceeded 128.8 trillion VND, reflecting a 35% increase compared to the beginning of the year.

VHM maintained its top position with over 50.6 trillion VND. Surprisingly, Kinh Bac City Development Holding Corporation (HOSE: KBC) more than doubled its short-term cash holdings, surpassing 18 trillion VND to become the second-largest holder in the industry.

KBC’s business results for the first half of the year were remarkable, with net revenue reaching nearly VND 3,696 billion, 3.5 times higher than the previous year. This growth was primarily driven by revenue from land and infrastructure leasing in industrial parks, which amounted to nearly VND 2,830 billion, a 5.3-fold increase. Additionally, revenue from real estate transfers reached nearly VND 412 billion, an 83% increase, and the company earned nearly VND 133 billion from the sale of workshops, an activity not recorded in the previous period. KBC’s net profit was VND 1,185 billion, 6.6 times higher than the previous year.

Dat Xanh Group (HOSE: DXG) also witnessed a substantial increase in short-term cash holdings, reaching nearly 3.4 trillion VND, 2.5 times higher than before. The company’s net profit for the first six months was nearly 133 billion VND, double that of the previous year, thanks to a significant reduction in financial and sales expenses.

|

Top 10 Real Estate Companies with the Highest Cash Holdings as of June 30, 2025 (in trillion VND)

Source: VietstockFinance

|

Ha Le

– 12:00 09/03/2025

The Real Estate Renaissance: Navigating the Market with Financial Savvy

The real estate market has been through a tumultuous time, and many property businesses have had to get creative to weather the storm. With core operations struggling, these enterprises have had to look beyond their traditional realms to stay afloat, turning to financial maneuvers to navigate these challenging times.

Vietjet’s Stellar Performance in the First Half of 2025: Revenue and Profit Soar, Long Thanh Project Takes Off

Vietjet Aviation Joint Stock Company (HOSE: VJC) is proud to announce stellar results in its audited financial report for the first half of 2025. The company’s performance showcases its international stature, attracting investment and positioning Vietnam as a global aviation powerhouse.

MSN – Strengthening its Position for Sustainable Growth (Part 1)

The Masan Group Corporation (HOSE: MSN) is Vietnam’s leading consumer-retail company, with a diverse portfolio spanning fast-moving consumer goods (FMCG), food and beverage retail, branded meat products, financial services, and high-tech industrial materials. MSN’s core businesses continue to deliver positive results, showcasing their adaptability to market fluctuations and reinforcing their prospects for sustainable growth.

“Brewery Giant Pours 30% Cash Dividends, Yet Profits Evaporate by 74% Despite Record-Breaking Semiannual Revenue”

With over 3.1 million shares in circulation, the company anticipates shelling out nearly VND 9.4 billion for the upcoming payment on October 17th.