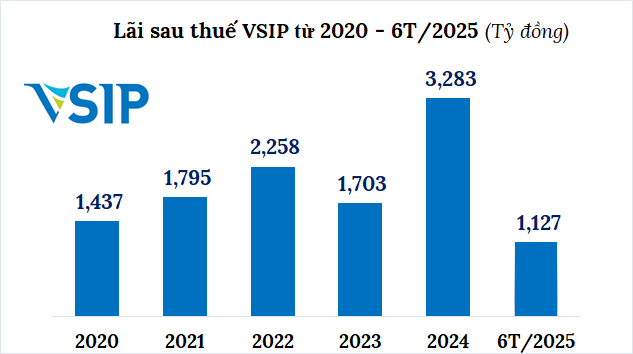

**VSIP Announces Profitable First Half of 2025 with a 3% Profit Increase**

The Vietnam-Singapore Industrial Park Joint Venture Company Limited (VSIP) has released its financial results for the first half of 2025, reporting a 3% increase in profit after tax to nearly VND 1,127 billion compared to the same period last year. In 2024, VSIP achieved a record profit of nearly VND 3,300 billion.

Source: Consolidated by the author

|

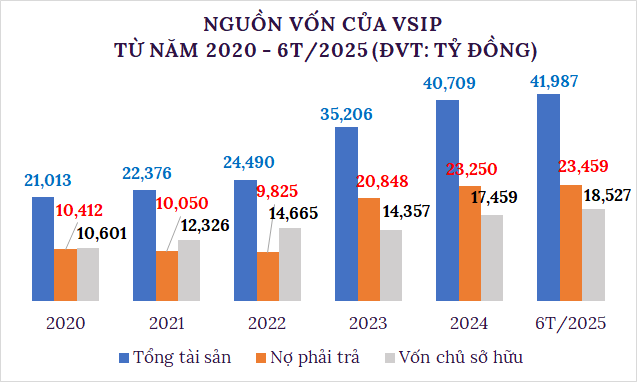

As of the end of June, VSIP’s total assets reached nearly VND 42,000 billion. Owner’s equity exceeded VND 18,527 billion, a 12% increase compared to the first half of 2024, of which more than VND 9,943 billion was accumulated undistributed profit.

Payable debt increased significantly by 22% to over VND 23,459 billion, including nearly VND 13,557 billion in bank loans, over VND 6,900 billion in other payable debt, and VND 3,000 billion in bond debt.

Source: Consolidated by the author

|

According to data from the Hanoi Stock Exchange (HNX), VSIP currently has three lots of bonds in circulation, each with a value of VND 1,000 billion. Two lots of bonds were issued in September 2023, with a term of 7 years and a maturity date of September 2030, at an interest rate of 10.5% per annum. The third lot was issued in July 2021, with a 9% interest rate and a maturity date of July 2028.

Not only has VSIP maintained stable profits, but it has also accelerated its expansion strategy in Vietnam. On March 12, the company inaugurated the construction of VSIP II Quang Ngai Industrial Park. During this period, VSIP also received investment registration certificates for VSIP Nghe An 3 Industrial Park and Hai Long Industrial Park (VSIP Nam Dinh) Phase 1. VSIP has also proposed investing in an industrial park, urban, and service project with a scale of 3,000 hectares in Dien Khanh, Ninh Hoa, Khanh Hoa province.

Established in July 2008, VSIP is a joint venture between Becamex IDC (BCM) and Sembcorp Development Ltd (Singapore), with BCM holding a 49% ownership stake. VSIP is currently investing in the development of a chain of 18 industrial parks, urban areas, and service areas, spanning over 11,000 hectares in Vietnam.

Thanh Tu

– 14:04 01/09/2025

“SHB’s Steadfast Commitment to Sustainable Growth: A Comprehensive Partnership Strategy.”

SHB, or the Saigon – Hanoi Commercial Joint Stock Bank, is committed to a strategy of comprehensive and sustainable development. We forge strong partnerships with leading state-owned and private economic groups, both domestic and international, as well as businesses with robust ecosystems, supply chains, and satellite companies. Our focus also extends to small and medium-sized enterprises, and we are dedicated to expanding our reach to individual customers.

“ACBS Raises $86 Million in Bond Offering to Refinance Debt.”

On August 18th, ACBS issued a bond with the code ASS12501, valued at VND 200 billion with a 2-year maturity, as part of their debt restructuring strategy.

HDBank: Among the Top 50 Listed Companies of 2025

As of August 21, 2025, Forbes Vietnam unveiled its list of Vietnam’s 50 Best Listed Companies for 2025, featuring leading enterprises across vital sectors. Among them, HDBank stands out as a prominent multi-functional retail bank, solidifying its position and pioneering role in the private sector of Vietnam’s financial and banking system.