**Corporate Dividend Payouts: A Snapshot of Vietnam’s Thriving Economy**

A visual representation of corporate dividend payouts, indicating a thriving economy with healthy returns for investors.

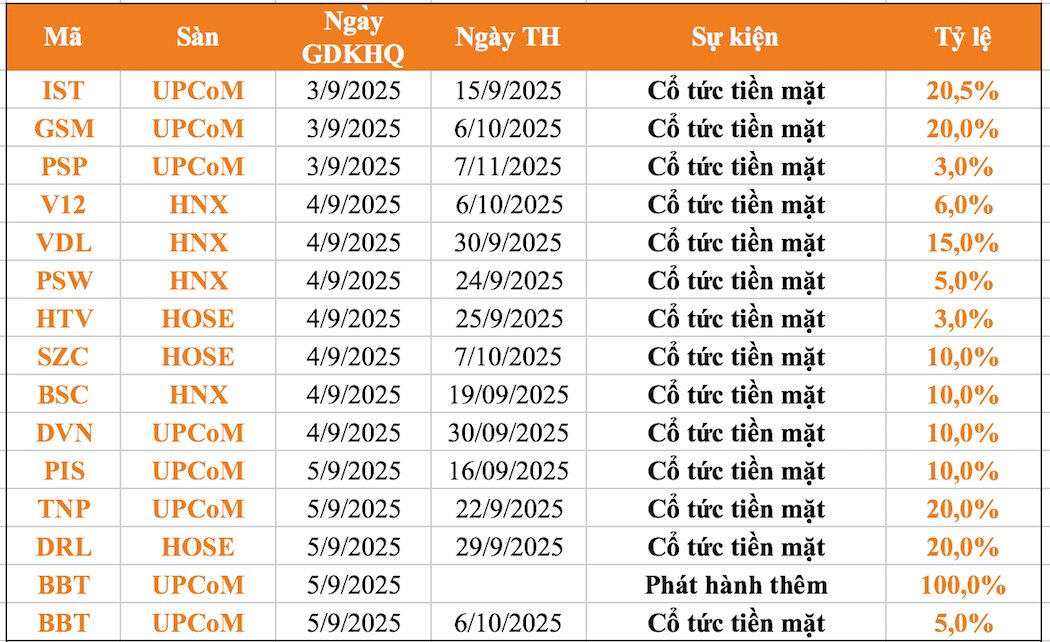

According to recent statistics, 14 companies have announced dividend payouts for the week of September 3-5, with 13 opting for cash dividends. The rates vary significantly, ranging from a high of 20.5% to a low of 3%. Additionally, one company has chosen to distribute hybrid dividends.

IST: Investors in Tan Cang Son Gong ICD Joint Stock Company (IST) are in for a treat, with the company announcing a cash dividend of 20.53% for the 2024 fiscal year. The ex-dividend date is set as September 3, and the registration deadline is September 4. Shareholders can expect to receive their dividends by September 15. With over 15 million shares, the company will disburse nearly VND 31 billion in dividends. The majority shareholder, Tan Cang Sai Gon Joint Stock Company, is set to receive approximately VND 16 billion.

GSM: Huong Son Hydropower Joint Stock Company (GSM) follows suit, declaring September 4 as the registration date for 2024 dividends. With over 28.5 million shares outstanding, the company will distribute more than VND 57 billion in dividends, expected to be paid out by October 6.

SZC: Sonadezi Chau Duc Joint Stock Company (SZC) has approved a 10% cash dividend for 2024, amounting to VND 1,000 per share. The ex-dividend date is set for September 4, with the registration deadline on September 5. With nearly 180 million shares in circulation, SZC is poised to distribute almost VND 180 billion. The majority of these funds will flow back into the “Sonadezi ecosystem.”

BBT: Bong Bach Tuyet Joint Stock Company (BBT) has unveiled a dual strategy: a rights issue to raise VND 98 billion by offering 9.8 million shares to existing shareholders at a rate of 1:1 and a price of VND 10,000 per share. Simultaneously, BBT plans to distribute a 5% cash dividend for 2024, amounting to VND 500 per share. Both events share a registration deadline of September 8, with an ex-dividend date of September 5. Shareholders can expect to receive their cash dividends by October 6.

Fast-Track Your Finances: Unlocking Flexibility with MSB’s M-Flex 4-Hour Mortgage

Businesses can now access flexible mortgage loans of up to VND 15 billion entirely online, thanks to MSB’s innovative M-Flex solution. With a swift 4-hour approval time, this digital mortgage offering is a game-changer for time-crunched entrepreneurs and businesses seeking convenient and efficient financing options.

The Highest Dividend Yields Above 20% Post-Holiday Week

“Despite only three trading sessions (September 3-5, 2025), a notable 14 companies decided to close the book on cash dividend payouts during the week following the National Day holiday on September 2. The highest rate stood at 20.53%, meaning that for every share owned, investors would pocket VND2,053.”

“Vietnam’s Economic Outlook: Positive Trajectory Ahead, Yet Credit Quality Requires Vigilant Management”

The economic outlook for Vietnam is positive, according to both domestic and foreign experts, with a stable BB+ credit rating maintained. However, three significant challenges remain: dependence on the US and Chinese markets, a lagging logistics system, and a credit-to-GDP ratio that has climbed to 135%, nearly double the international average.

The Power Players: Unveiling the $59 Billion Map of Vietnam’s Provincial Powerhouses

In every community, there are businesses that serve as the backbone of the local economy, contributing significantly to the financial well-being and pride of the region. These powerhouse enterprises, often referred to as the “big brothers,” wield immense influence, with their financial prowess impacting the province’s employment rates and fiscal landscape directly.