Ho Chi Minh City-based SSI Securities Corporation (code: SSI, on the HoSE) has just announced the results of its offering of over 104 million shares in a private placement to professional securities investors.

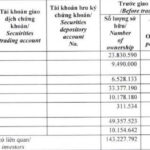

By the end of the offering period on August 29, SSI had distributed 100% of the offered shares to 18 investors. Of these, 38.14 million shares were allocated to domestic investors, and 65.89 million shares were allocated to foreign investors.

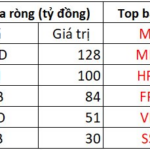

According to the published list, Vietnam Enterprise Investments Limited, a fund member of Dragon Capital, was offered the most shares at 16.8 million.

Following closely was Daiwa Securities Group Inc., a shareholder and executive director of SSI, Mr. Kosuke Mizuno, with nearly 15.9 million shares offered.

Additionally, Mr. Nguyen Duc Thong, CEO of SSI Securities, was offered 1 million shares, and Mr. Nguyen Hong Nam, a member of the Board of Directors, was offered 5 million shares.

The shares are restricted from transfer for a period of one year. With an offering price of VND 31,300 per share, SSI raised over VND 3,256.5 billion from this share offering.

SSI will use 50% of the proceeds to supplement capital for investing in deposit certificates, and the remaining 50% will be used to supplement capital for lending in margin trading activities.

With the conclusion of this offering, SSI’s chartered capital has increased from VND 19,738.6 billion to VND 20,779 billion.

Thus, SSI has completed two out of three approved plans to increase its chartered capital, as resolved at the 2025 Annual General Meeting of Shareholders. The remaining plan yet to be executed involves issuing shares under an employee stock ownership program.

In other news, SSI will hold an Extraordinary General Meeting of Shareholders in the afternoon of September 25, 2025, at the Reunification Hall – 135 Nam Ky Khoi Nghia, Ben Thanh Ward, Ho Chi Minh City.

The key agenda item for this meeting is to discuss the plan to offer a maximum of 415.58 million shares to existing shareholders through the exercise of pre-emptive rights.

The entitlement ratio is 5:1, meaning that for every five shares owned, shareholders will have the right to buy one new share. The offered shares will not be restricted from transfer. Shareholders owning restricted shares will still be entitled to purchase new shares. The expected timeline for the offering is 2025-2026.

The expected offering price is VND 15,000 per share. If the offering is successful, SSI expects to raise a maximum of VND 6,234 billion to supplement capital for investment and lending in margin trading activities. Concurrently, SSI’s chartered capital is expected to increase from VND 20,778 billion to VND 24,935 billion.

Should Investors Be Concerned About the Record Outflow from the Block?

The VN-Index continued its upward trajectory in August, closing at 1,682.21 points and instilling a sense of optimism in the market. However, domestic investors are now questioning the motives of foreign investors, as they witnessed the largest net-selling month since the beginning of the year, with cumulative outflows surpassing VND 58.9 trillion.

What Did the Investment Fund Buy and Sell in the Last Week of August?

In the final week of August (25-29 August 2025), investment funds traded cautiously ahead of the long holiday break, with a slight bias towards sellers. The VN-Index closed the last session of the month at 1,682.21 points, continuing its ascent towards the 1,700-point mark.