The State Securities Commission (SSC) of Vietnam has issued Decision 229/QD-XPHC, imposing administrative sanctions for violations in the securities and stock market field on Thai Nguyen Refractory Material Group Joint Stock Company (located in Ward Gia Sang, Thai Nguyen province).

Illustrative image

The company has been fined VND 85 million (approximately USD 3,600) for failing to disclose information as required by law, according to Clause a, Point 4, Article 42 of the Government’s Decree No. 156/2020/ND-CP dated December 31, 2020, on sanctions for administrative violations in the securities and stock market field. Specifically, the company did not publish the following reports and documents on the SSC’s disclosure system: Corporate Governance Reports for 2022, the first half of 2023, 2023, the first half of 2024, 2024, and the first half of 2025; Audited Financial Statements for 2022, 2023, and 2024; Annual Reports for 2022, 2023, and 2024; and Resolutions and Minutes of the Annual General Meeting of Shareholders for 2023, 2024, and 2025.

Additionally, Thai Nguyen Refractory Material Group was fined VND 15 million (approximately USD 630) for non-compliance with regulations on means and forms of information disclosure, as they did not have a website for information disclosure.

Thai Nguyen Refractory Material Group Joint Stock Company is a leading manufacturer of refractory materials in Vietnam, established in 1965. Their products are widely supplied in the domestic market, serving various industries such as metallurgy, cement, chemicals, construction materials, ceramics, and other industries. Their product range includes refractory bricks (high-aluminum bricks, alkaline bricks, zirconia bricks, and chamotte bricks), refractory concrete (CA13-CA18), other refractory materials (acid bricks, refractory pebbles, refractory mortar, alumina pebbles, and Garnex cold-lining plates), and industrial furnace construction (consultancy in furnace design for steel and cement industries, and industrial furnace construction).

The company also produces high-quality refractory bricks for foreign-invested enterprises in Vietnam and exports to countries such as South Korea, Taiwan, Japan, and Indonesia.

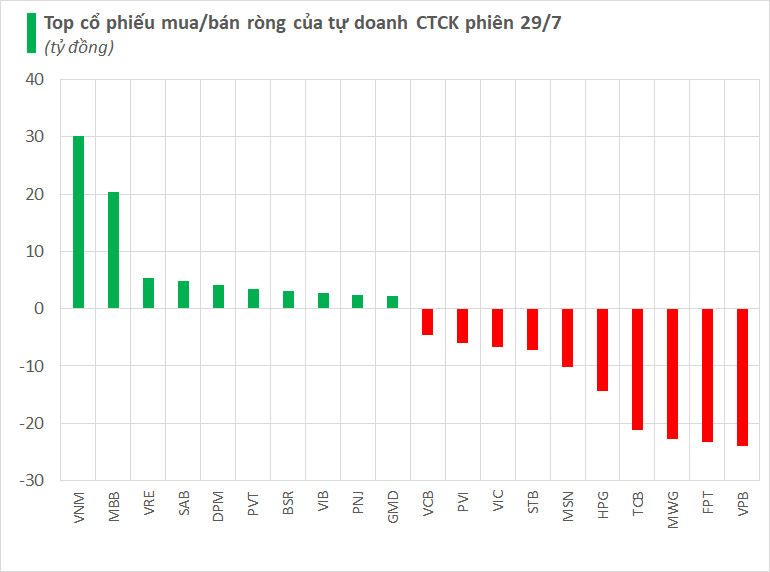

Market Beat: Ending the Tug-of-War with a Shocking Drop

The VN-Index took a sharp turn in the latter half of the morning session, plunging 13 points to break free from the tug-of-war stalemate that characterized the early trading hours.

[IR AWARDS] September 2025 Disclosure Calendar: Mark Your Diaries

The upcoming periodic information disclosures in September encompass notable events in the stock market. These encompass the Effective Portfolio (MSCI, FTSE ETF, VNM ETF), the release of the PMI, the announcement of the constituents (FTSE ETF, VNM ETF), the socio-economic report for August, the maturity of VN30F2509, the outcome of the FOMC (Fed) meeting, the market ranking report (FTSE), and the 15th IR Awards ceremony.

![[IR AWARDS] September 2025 Disclosure Calendar: Mark Your Diaries](https://xe.today/wp-content/uploads/2025/09/T9_NoiDung-150x150.png)