On September 3rd, the Ho Chi Minh City Stock Exchange (HoSE) issued a notice to Searefico Joint Stock Company (Stock Code: SRF) regarding the potential delisting of their shares.

Specifically, on April 2nd, 2025, HoSE issued a decision to move SRF stock from the warning list to the controlled list starting April 10th, 2025. This decision was made because the auditing organization provided qualified opinions on the company’s audited financial statements for two consecutive years (2023 and 2024), which falls under the regulations for controlled securities.

On August 29th, 2025, HoSE received the company’s reviewed consolidated financial statements for the first half of 2025. The reviewed financial statements for the first six months of 2025 also received a qualified opinion.

Based on Clause h, Point 1, Clause 120 of the Government’s Decree No. 155/2020/ND-CP dated December 31st, 2020, detailing the implementation of a number of articles of the Securities Law dated November 26th, 2019: “1. Shares of public companies shall be delisted when one of the following cases occurs:… h) The auditing organization refuses to perform the audit or issues contradictory audit opinions or refuses to give opinions on the latest financial statements of the listing organization or issues qualified opinions on financial statements for 3 consecutive years”, HoSE noted the possibility of mandatory delisting of SRF shares if the audited financial statements for 2025 continue to receive qualified opinions.

HoSE’s Notification on SRF’s Potential Delisting

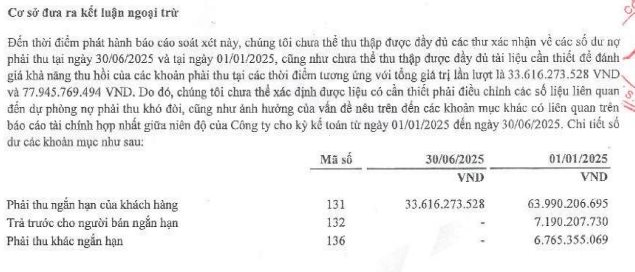

In the audited financial statements for the first half of 2025, the auditors based their conclusion on the fact that, as of the date of issuance of the review report, the auditor had not been able to fully obtain confirmation letters for the balances of receivables as of June 30th, 2025, and January 1st, 2025, nor had they been able to obtain the necessary documents to assess the collectability of these receivables at the respective dates.

Therefore, the auditor could not determine whether adjustments were necessary for provisions for doubtful accounts and the impact of this issue on other related items in the company’s mid-year consolidated financial statements.

Regarding this matter, SRF stated that the balances of receivables were recorded in accordance with actual occurrences; debts were monitored in detail for each subject and were supported by economic contracts, financial invoices, and payment vouchers as required by regulations. Confirmation letters for accounts receivable were issued by the Company in a timely manner as requested by the auditors and sent to customers/investors for reconciliation and confirmation with the auditing firm.

However, due to objective reasons, the Company could not ensure that the confirmation letters were returned by the deadline, resulting in the qualified opinion from the auditors.

In terms of financial results, SRF’s revenue for the first six months of 2025 reached nearly VND 433 billion, a 13% decrease compared to the same period last year, while after-tax profit reached over VND 5.5 billion, an eightfold increase compared to the previous year. The company attributed the significant increase in profit mainly to the rise in financial income from the transfer of long-term financial investments.

On the stock market, SRF shares closed the trading session on September 3rd at VND 8,440 per share, with a market capitalization of approximately VND 290 billion.