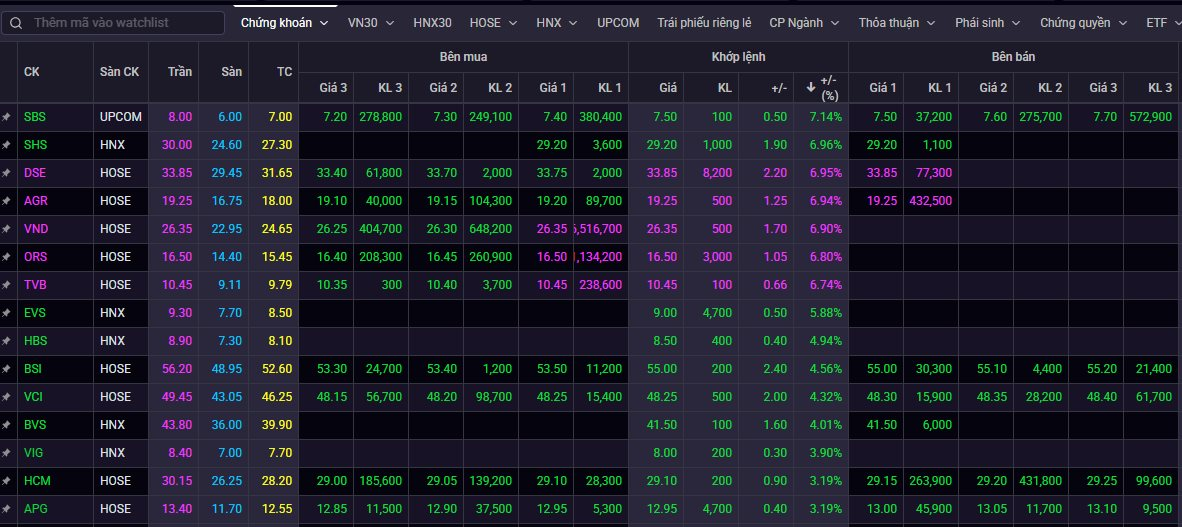

The stock market is buzzing with excitement, and securities stocks are no exception. On August 29, a host of codes simultaneously hit the ceiling, from small and medium-sized stocks such as AGR, TVB, ORS, and DSE to VND of VNDirect, all painting the town “purple” in a positive trend.

At the closing bell, VND’s market price climbed to 26,350 VND per share, with a sudden surge in trading volume to nearly 76 million units.

Since the end of April 2025, VND’s market price has surged by nearly 70% in value. Notably, the positive momentum of VND pushed the market price just 8% away from the historical peak of 28,600 VND per share.

Closing securities stock prices on August 29.

At the annual general meeting in 2025, held in late May, VNDirect’s CEO, Nguyen Vu Long, shared his thoughts on the movement of the company’s stock price.

According to Mr. Long, for the past year, the VND stock price has been unable to break through and has been in a downward trend. From the price range above 20,000 VND in March 2024, the stock traded at 16,150 VND per share in May 2025. Apart from the selling pressure in the overall market, VNDirect’s stock price performance was also influenced by internal factors such as hacker attacks and provisioning for bonds.

” Shareholders haven’t lost unless they sell. We sincerely request our shareholders’ patience and companionship on this journey,” Mr. Long shared with the shareholders.

Adding to this, Ms. Pham Minh Huong, Chairman of the Board of VNDirect, stated that she was unaware of the day’s stock price as it is determined by the market. From the Board’s perspective, Ms. Huong will focus on three aspects that constitute the company’s value: technological advancement, protection of shareholder capital, and investment in human resources. This, she acknowledged, is also the most challenging aspect.

The Chairman admitted that VNDirect has not been able to deliver short-term attractive growth in the market compared to some securities companies within the banking ecosystem, as those companies inherently benefit from low-cost capital and low transaction fees.

In related news, VNDirect has just announced the resolution of the Board of Directors to organize an extraordinary general meeting of shareholders in 2025. VNDirect will finalize the list of attending shareholders on September 3, 2025, with the time, venue, and agenda to be communicated later.

Most recently, the securities company approved the private offering and issuance of bonds in the first tranche of 2025.

The company plans to issue a maximum of VND 250 billion worth of bonds with the code VND32501 and a par value of VND 100 million per bond. These are non-convertible, non-warrant-attached, unsecured bonds that establish a direct debt obligation for the issuer.

The bonds will have a one-year term with a fixed interest rate of 7.5% per annum. The purpose of the issuance is to help VNDirect restructure a VND 550 billion debt, which is expected to mature on September 4, 2025, at the Vietnam Commercial Bank (Vietbank) Hanoi Branch.

Regarding business performance , VNDirect’s Q2 2025 financial report recorded operating revenue of VND 1,698 billion, up 16% over the same period last year. Consequently, VNDirect achieved a pre-tax profit of VND 488 billion and an after-tax profit of VND 369 billion, increasing by 14.5% and 7%, respectively, compared to the previous year.

For the first half of 2025, VNDirect’s operating revenue reached VND 2,956 billion, a 4% increase year-on-year. After expenses, the after-tax profit decreased by 22% to VND 751 billion compared to the same period.

For the year 2025, VNDirect aims for a total revenue of VND 4,412 billion and a pre-tax profit of VND 2,300 billion, an increase of 8% and 10%, respectively, compared to the previous year. The after-tax profit target is set at VND 1,840 billion. Thus, the company has accomplished 41% of its profit goal.

Maintaining Exchange Rate Stability

“With the busiest season for trade fast approaching, businesses are yearning for stable exchange rates to ease their financial worries. As the markets gear up for a frenzied few months, a predictable currency environment would be a welcome relief.”

Market Beat: Ending the Tug-of-War with a Shocking Drop

The VN-Index took a sharp turn in the latter half of the morning session, plunging 13 points to break free from the tug-of-war stalemate that characterized the early trading hours.

[IR AWARDS] September 2025 Disclosure Calendar: Mark Your Diaries

The upcoming periodic information disclosures in September encompass notable events in the stock market. These encompass the Effective Portfolio (MSCI, FTSE ETF, VNM ETF), the release of the PMI, the announcement of the constituents (FTSE ETF, VNM ETF), the socio-economic report for August, the maturity of VN30F2509, the outcome of the FOMC (Fed) meeting, the market ranking report (FTSE), and the 15th IR Awards ceremony.

![[IR AWARDS] September 2025 Disclosure Calendar: Mark Your Diaries](https://xe.today/wp-content/uploads/2025/09/T9_NoiDung-150x150.png)