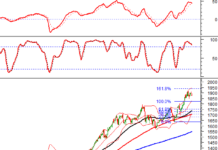

The Vietnamese stock market witnessed a vibrant trading session, despite the persistent volatility. The VN-Index surged by nearly 15 points (+0.89%), closing at its intraday high of 1,696.29 on September 4th, setting a new record. This positive session pushed the index very close to the 1,700 mark, a level that Vietnamese investors could not have even dreamed of a few months ago.

Looking back to early April when the US first announced retaliatory tariffs, the Vietnamese stock market experienced one of its most severe downturns in history. The VN-Index even dipped below 1,100 points at one point before reversing course. Since then, the index has climbed by over 600 points, despite persistent foreign net selling.

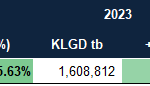

Year-to-date, foreign investors have net sold over VND 77,000 billion on the HoSE. Notably, in August 2025, as the VN-Index hovered near its peak, foreign investors intensified their net selling with consecutive sessions of net selling in the thousands of billions. The total net selling value of foreign investors in August exceeded VND 42,000 billion on the HoSE, the highest in many years.

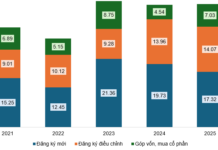

In this context, domestic capital has been the main driver, helping the market weather challenges. The low-interest-rate environment is one of the factors that encouraged a massive influx of money into the stock market. This trend may continue as Fed Chairman Jerome Powell has signaled the possibility of an interest rate cut as soon as September 2025, potentially providing the State Bank of Vietnam (SBV) with more room to maintain its loose monetary policy.

Additionally, the Ministry of Finance has dropped the proposal to impose a 20% tax on taxable income from securities transfers in the draft Law on Personal Income Tax (amended). This news is expected to positively impact individual investors, who account for the majority of daily transactions in the stock market.

In fact, with the positive developments in the stock market recently, many large organizations and analysts have projected that the VN-Index could reach unprecedented levels in the coming period.

In a recent analysis report, Maybank Securities (MSVN) maintained its target of 1,800 points for the VN-Index by the end of 2025, driven mainly by the financial and real estate sectors, while export industries need more time to recover.

Sharing the same viewpoint, VCBS expects the VN-Index to continue striving towards the positive scenario of 1,838 points (with the market’s updated EPS reaching 18%) in the last months of 2025, backed by expectations of market upgrade, decisive policies to boost growth, and flexible diplomatic strategies.

According to VCBS, the market’s current P/E is attractive compared to the regional average (~15.3x) and the 5-year average (~14.4x). Additionally, the low-interest-rate environment and strong credit growth in the final months are anticipated to further boost market liquidity and lift the P/E valuation of various sectors.

Also forecasting a possible rise of the VN-Index to 1,800 points this year, a recent report by NH Securities (NHSV) pointed out several favorable factors for the stock market: (1) Government policies to stimulate economic growth (fiscal and monetary policies); (2) The story of market upgrade; (3) Reasonable market valuation, etc. NHSV projected that the VN-Index’s P/E in 2025 would be 16.5 times, equivalent to 1 standard deviation above the 5-year average.

Earlier, in a post on his personal Facebook page, Mr. La Giang Trung, CEO of Passion Investment, argued that compared to the 2020–2021 period, the current market is witnessing a stronger inflow of capital, while valuations are not yet as high. “The amount of money flowing into the stock market and liquidity are two to three times higher than in the previous cycle of 2020-2021, and market valuations have only reached halfway compared to the previous cycle. The VN-Index will surpass all scenarios in the most imaginative expectations of investors,” emphasized the expert.

Similarly, in a letter to investors, Mr. Petri Deryng, head of the foreign fund Pyn Elite Fund, assessed that the stock market is experiencing good growth momentum, and the pace could even accelerate. Based on the current fundamentals, this could be a “Big Year” for the stock market’s performance, according to the fund manager.

Steel Stocks Continue to Soar

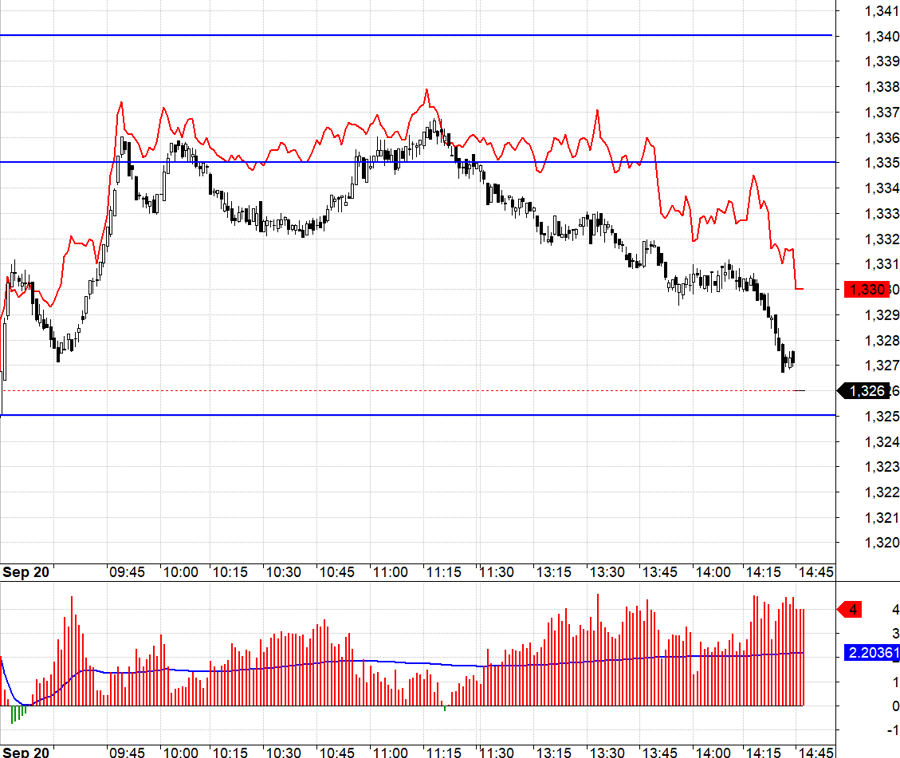

The HPG, HSG, NKG, and TLH stock series witnessed an unprecedented surge in liquidity, skyrocketing in the trading session on September 4th.

The Stock Market Race: VN-Index Breaks Barriers, Shaping the Future

Will the VN-Index continue its record-breaking streak for the rest of the year? Could the prospect of an upgrade be the main catalyst for the market’s breakthrough in the coming period? Find out as our panel of experts discuss these topics and more on Vietstock LIVE #20, broadcasting online at 3 PM on Friday, September 5th, 2025.

Navigating the Next Bull Run: Overcoming the Challenges Ahead

The potential for Vietnam’s stock market to surge is immense, according to Lã Giang Trung, CEO of Passion Investment. Speaking at the Vietnam and the Indices event on September 4th, he shared his insights on the market’s prospects. While the most robust growth phase may have passed, there’s still room for significant upside. However, investors should be aware that the landscape is changing, and strategic adjustments are necessary to navigate the upcoming challenges successfully.

Market Beat: The Triumphant Trio Revives, VN-Index Rallies in the Afternoon

The Vietnamese stock market indices witnessed a remarkable turnaround on Thursday, September 4th. After a challenging morning session, the VN-Index surged in the afternoon, closing at 1,696.29, a gain of nearly 15 points. The HNX-Index and UPCoM-Index mirrored this positive sentiment, with the former climbing 1.29 points to 283.99 and the latter rising 0.8 points to finish at 111.85. This unexpected rally has injected a dose of optimism into the market, setting the stage for a potential upward trajectory in the coming sessions.