Gold Prices Surge Amid Global Economic Uncertainty

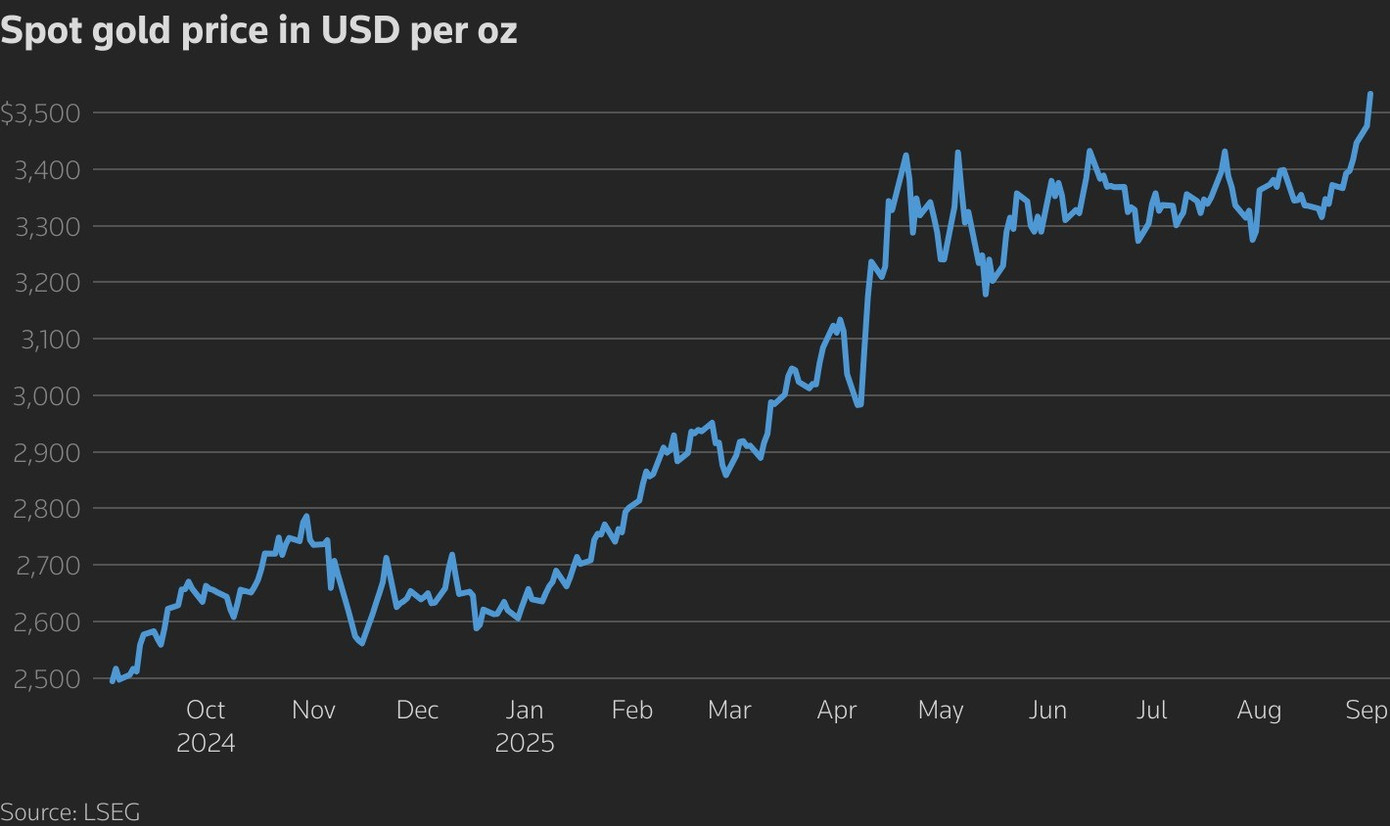

In today’s trading session (September 3rd), spot gold rose 0.1% to $3,537 per ounce, after hitting an all-time high of $3,546.99 earlier in the day. Gold futures for December delivery in the US climbed 0.3% to $3,602.50 per ounce.

Tensions escalated as the Trump administration announced it would seek a swift ruling from the Supreme Court on tariffs, which an appeals court had deemed illegal last week.

Ilya Spivak, Global Macro Economist at Tastylive, commented: “The Supreme Court’s decision seems to be a source of uncertainty for the markets, as it could drastically change the macroeconomic landscape if it doesn’t align with the president’s wishes. Any efforts to undermine the independence of the Federal Reserve, no matter how small, are a significant factor influencing gold prices.”

For months, Trump has pressured the Fed to lower interest rates and even discussed firing Chairman Jerome Powell. Last month, the President also attempted to remove Governor Lisa Cook, creating a critical legal test for the Fed’s independence.

Chart illustrating the upward trend in gold prices.

According to FedWatch by CME Group, markets are pricing in a 92% probability of a 25-basis-point cut during the Fed’s two-day policy meeting ending on September 17th. Gold, a non-yielding asset, tends to become more attractive in a low-interest-rate environment.

SPDR Gold Trust, the world’s largest gold ETF, reported a 1.32% increase in holdings to 990.56 tons on Tuesday, the highest level since August 2022. Investors are now awaiting US non-farm payroll data, expected on Friday, to gauge the potential scale of interest rate cuts.

Meanwhile, silver prices dipped 0.2% to $40.82 per ounce, following their highest level since September 2011 in the previous session. Platinum prices rose 0.4% to $1,409 per ounce, and palladium gained 0.7% to $1,142.77 per ounce.

Mixed Performance in Asia-Pacific Stock Markets

On the same day, Asia-Pacific stock markets showed mixed results as investors assessed rising global bond yields and developments on the trade front.

In China, the CSI 300 index edged up 0.24%, while Hong Kong’s Hang Seng index climbed 0.86%. The parade marking the 80th anniversary of the end of World War II, attended by 26 world leaders, including Russian President Vladimir Putin and North Korean leader Kim Jong-un, was a notable event.

In contrast, Australia’s S&P/ASX 200 fell 1.09%. The country’s GDP for the second quarter rose 1.8% year-over-year, surpassing expectations of 1.6% and marking the highest growth since September 2023.

Asia-Pacific stock markets show mixed performances.

Japan’s Nikkei 225 and Topix indices declined by 0.41% and 0.53%, respectively. Yields on Japanese government bonds continued to climb, with the 10-year yield rising 2.6 basis points to 1.629%, the 30-year yield surging nearly 7 basis points to 3.279%, and the 20-year yield touching a 26-year high of 2.684%.

In South Korea, the Kospi and Kosdaq indices rose 0.3% and 0.19%, respectively, amid volatile trading.

US stock futures advanced during the Asian session following a federal ruling in the antitrust case against Alphabet, Google’s parent company, raising hopes that big tech firms could weather legal pressures.

However, Wall Street ended the previous session in negative territory, with the Dow Jones, S&P 500, and Nasdaq Composite posting losses of 0.55%, 0.69%, and 0.82%, respectively.

The Golden Opportunity: From Gold to the New Investment Craze

The long queues outside gold shops in Ho Chi Minh City have led to a creative shift in investment strategies. With only a limited amount of gold being purchased, often just a fraction of what people desire, the focus has now turned to silver. This new investment avenue offers a distinct advantage with its affordable pricing and abundant supply.

“Decree 232: Safeguarding Public Interests, Marching Towards a Transparent Gold Market”

As of late August 2025, the domestic gold price witnessed a complex upward trajectory. By August 29, 2025, SJC gold bars had surged past VND 129 million per tael, while gold rings had also climbed above VND 123 million per tael.