Vietnam Stock Market Update: VN-Index Continues Uptrend Despite Foreign Outflows

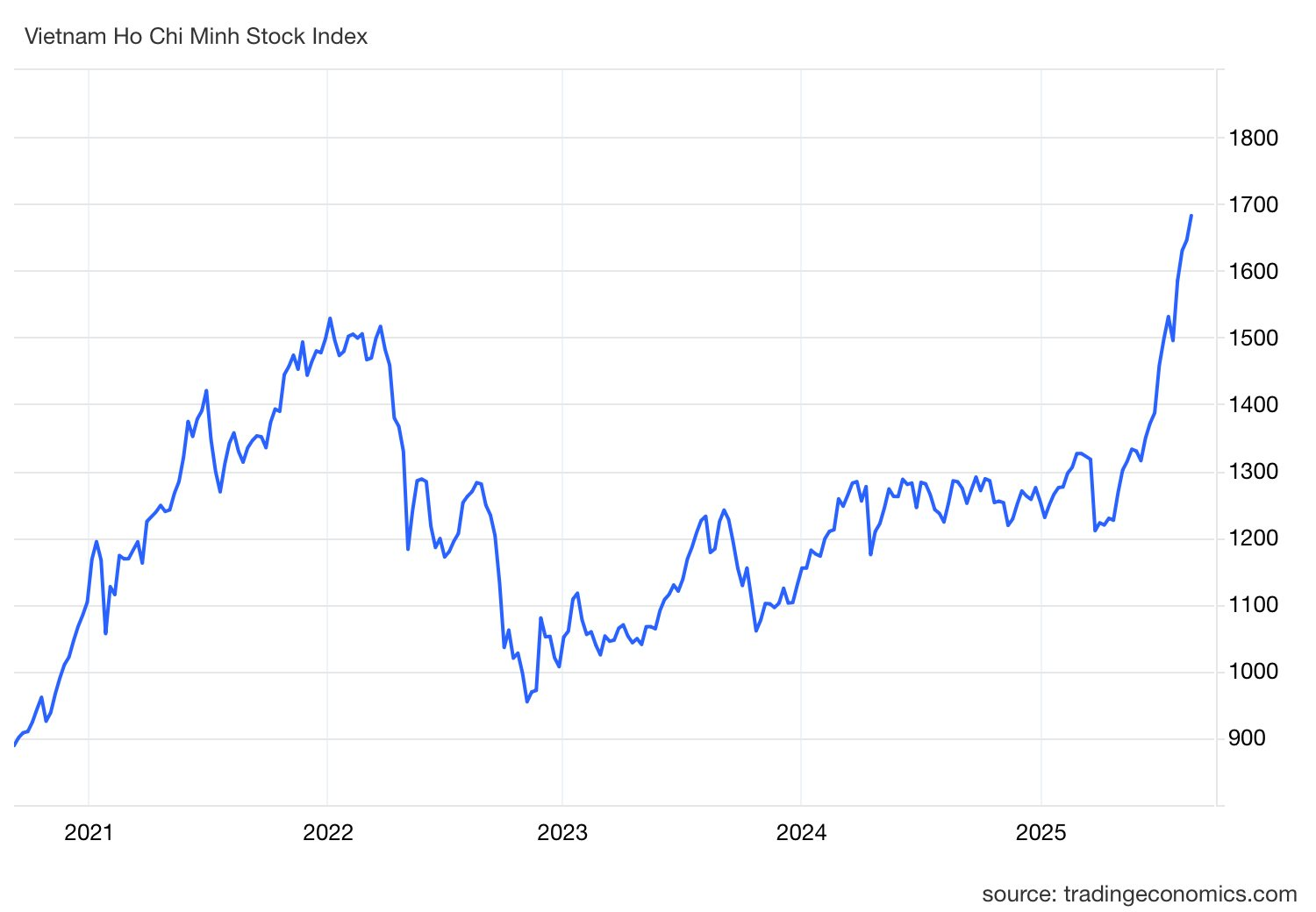

Vietnam’s stock market recorded a positive week from August 25-28, with the VN-Index extending its gains. However, increased volatility was observed as strong selling pressure at the peak caused a sharp decline in the first trading session, followed by a robust recovery in the remaining sessions. Overall, the VN-Index advanced 36.74 points (2.2%) to close at 1,682.21.

A significant downside came from foreign investors, who unexpectedly sold a net VND42.21 trillion on the Ho Chi Minh Stock Exchange (HOSE) in August, setting a new record.

VN-Index Performance

Market Mid-Way Through Uptrend: Investors Should Avoid “Wave-Riding”

According to Mr. Do Thanh Son, Investment Advisory Department Head at Mirae Asset Vietnam Securities, the stock market is likely to continue its mid-to-long-term uptrend next week after the holiday, but there could be some consolidating sessions. The VN-Index is in a “digestion” phase, similar to an athlete resting after a sprint. While selling pressure at the peak may cause market fluctuations, the uptrend is expected to persist due to substantial growth potential in the next 6-12 months, underpinned by solid corporate earnings.

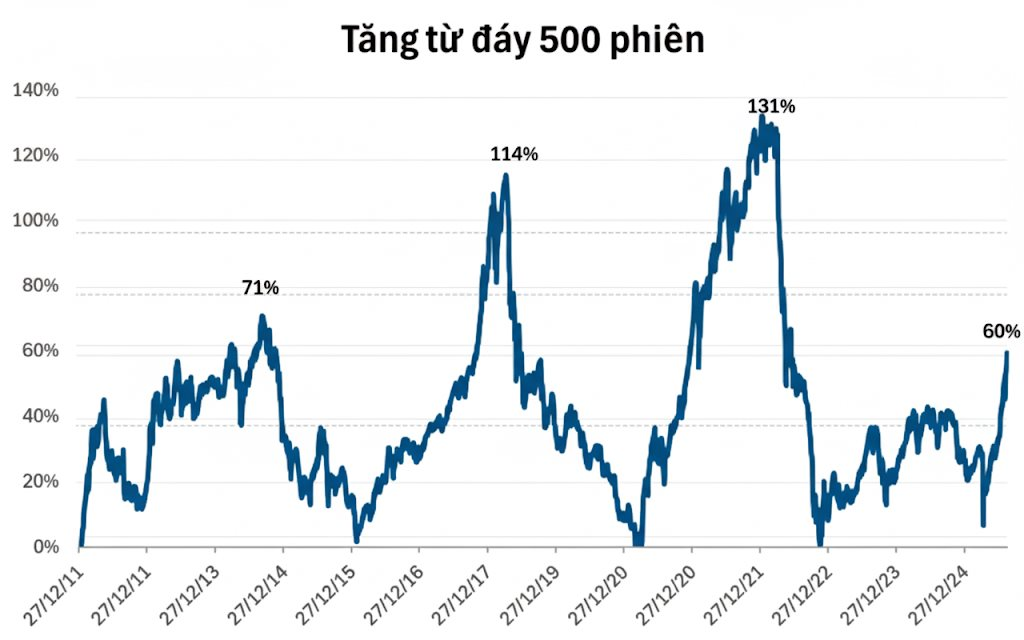

Looking ahead to September, Mr. Son forecasts that the Vietnamese stock market will maintain its upward trajectory but at a slower pace, with a pronounced divergence among sectors. The VN-Index has risen over 50% from its bottom, but a typical uptrend lasts around 500 sessions, and the market has only completed half of that journey.

VN-Index: Mid-Way Through Uptrend

In terms of valuation, Mr. Son notes that while many stocks are no longer considered cheap, the overall VN-Index still has room for growth. The current P/E ratio stands at around 15, and the forward P/E is approximately 13.4x, which is significantly lower than previous cycle peaks (25.3x, 18.0x). Moreover, with corporate profits expected to rise by 15.6% in 2025, this uptrend is supported by solid fundamentals rather than solely speculative money.

Regarding fund flows, drawing from the experience of the 2020-2022 upcycle, after a few leading sectors complete their initial surge, money is expected to rotate towards fundamentally strong opportunities, especially sectors benefiting from economic policies, public investment, and market upgrades.

Market Outlook: Rotation Towards Fundamentals

On the record foreign net selling of over VND42.2 trillion while the market remained resilient,

Mr. Son attributes this to differing perspectives and strategies.

Foreign investors may be exercising caution due to global macroeconomic factors or portfolio restructuring, taking profits as the VN-Index has rallied nearly

50%

from its lows. Secondly, and more importantly, the strength of domestic money flow is evident. The market’s continued ascent to new highs demonstrates

the robust absorptive capacity of local money

. Local investors are now the primary drivers, capable of absorbing foreign outflows and sustaining the market’s upward momentum. This reflects the maturity and robustness of Vietnam’s stock market.

This net selling is not a negative sign but rather a part of the money flow adjustment process, paving the way for new investment opportunities.

With valuations no longer extremely cheap but growth potential remaining, Mirae Asset’s expert believes that investment strategies in the latter part of the year should focus on individual companies’ fundamentals. As the market has only completed half of the typical uptrend cycle, lessons from 2021, coupled with 2025 year-end earnings and compelling individual stories, suggest:

“

Investors should shift from “wave-riding” to a

stock-picking strategy

. Avoid chasing rallies and instead capitalize on corrections to accumulate stocks. Conducting thorough analyses of specific companies, rather than merely following short-term market trends, will yield higher returns,” advises Mr. Son.

What’s in Store for the Stock Market Post the 2nd of September Holidays?

The stock market closed off an impressive August rally, with the VN-Index soaring past 1,680 points and consecutive record-breaking liquidity. Experts believe that several variables, such as expectations of a Federal Reserve rate cut in September, exchange rate dynamics, and the potential for an FTSE upgrade for the Vietnamese stock market, will keep investor sentiment buoyant post the September 2nd holiday.

What Sectors Will Be the Focus for Investors as the VN-Index is Predicted to Surpass 1,800 Points by Year-End?

“VCBS foresees a bullish trajectory for the VN-Index, targeting the lofty heights of 1,838 points in the final stretch of 2025. This optimistic outlook is underpinned by the latest market-wide EPS update, which stands at an impressive 18%.”

Technical Analysis for Session on September 04: Re-testing the August 2025 Highs

The VN-Index and HNX-Index showed contrasting movements in the morning session. The VN-Index retested the old peak of August 2025 (equivalent to the 1,680-1,696 range) and fluctuated with the emergence of a Black Body pattern.