The Vietnamese stock market opened on September 3rd with a mild tug-of-war. Funds quickly flowed into real estate and steel stocks, pushing many to the upper limit and helping to narrow the decline towards the end of the session. At the close, the VN-Index edged down 0.91 points to 1,681.30. Matching value on HoSE reached VND35.5 trillion.

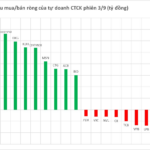

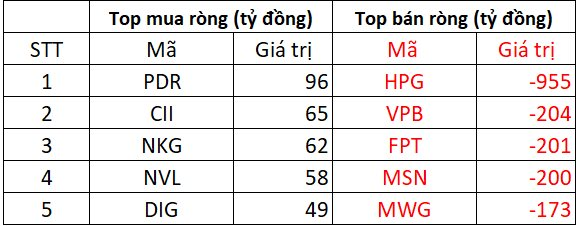

In this context, foreign trading continued to be a downside, with a strong net sell-off of VND2,939 billion across the board. Specifically:

On HoSE, foreign investors net sold about VND2,885 billion

In the buying side, PDR shares were the most net bought by foreign investors with a value of VND96 billion. They also net bought CII, NKG, NVL, and DIG shares, with values ranging from VND49 billion to VND65 billion in the session.

On the opposite side, HPG shares witnessed a strong net sell-off of VND955 billion. Other large-cap stocks that were sold off heavily, with values of around VND200 billion, included VPB, FPT, and MSN. MWG shares were also offloaded with a net value of VND173 billion.

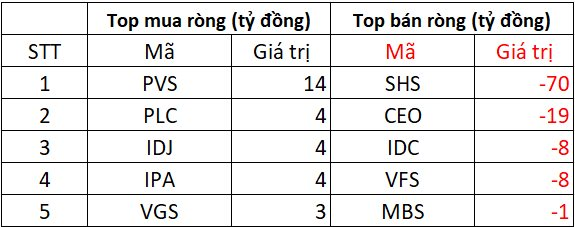

On HNX, foreign investors net sold about VND51 billion

In terms of net bought shares, PVS led with a value of VND14 billion, followed by PLC, IDJ, and IPA, with net bought values of VND4 billion each. Additionally, VGS witnessed a mild net buying of VND3 billion.

Conversely, SHS shares experienced a net sell-off of VND70 billion, and CEO shares were net sold for VND19 billion. IDC and VFS shares were also net sold by foreign investors, with values of VND8 billion each.

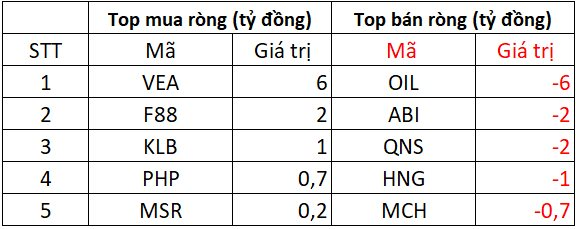

On UPCOM, foreign investors net sold VND3 billion

In terms of net bought shares, VEA led with a value of VND6 billion. F88, KLB, MSR, and PHP were also net bought, ranging from a few hundred million to a few billion VND.

Conversely, OIL shares witnessed a net sell-off of VND6 billion. ABI, QNS, and HNG shares were also net sold, with values ranging from VND1-2 billion.

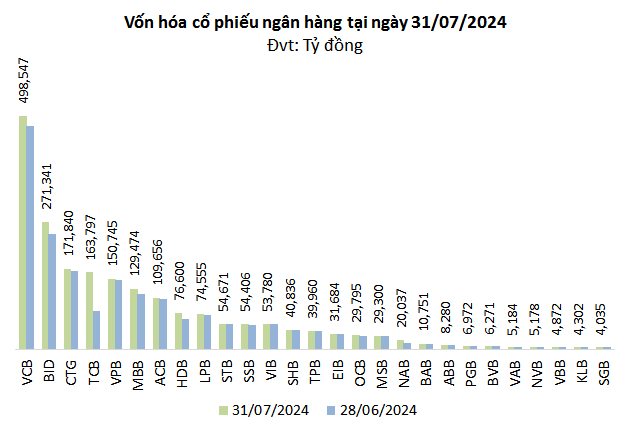

The Bank Stock Surprise: A Proprietary Trading Boost

The proprietary trading arms of securities companies returned to net buying with a value of VND435 billion on the HoSE.

“Beating the Heat and the Rain”, Vietnam’s Stock Market Soars to New Heights: VN-Index Nears 1,700 Points

The domestic money flow has been the primary driving force behind the robust performance of Vietnamese stocks, despite persistent net foreign selling in the past.