The Vietnamese stock market opened on September 3rd with a slight tug-of-war. Money quickly flowed into real estate and steel stocks, pushing many codes to break through the ceiling, helping to narrow the decline towards the end of the session. Closing, VN-Index edged down 0.91 points to 1,681.30. Matching value on HoSE reached VND 35,500 billion.

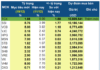

In this context, foreign transactions continued to be a downside, net selling heavily VND 2,939 billion in the market. Specifically:

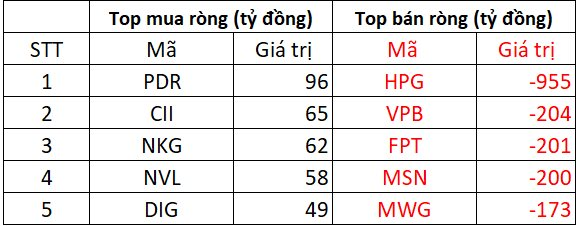

On HoSE, foreign investors net sold about VND 2,885 billion

In the buying direction, the PDR stock was net bought the strongest in the market by foreign investors with a value of VND 96 billion. Foreign investors also net bought from VND 49-65 billion in the stocks of CII, NKG, NVL, and DIG in today’s session.

In the opposite direction, HPG stock was net sold the most by foreign investors with a value of up to VND 955 billion. Other blue-chip stocks were also heavily sold off, with net selling values of about VND 200 billion, including VPB, FPT, and MSN. MWG stock was also net sold about VND 173 billion.

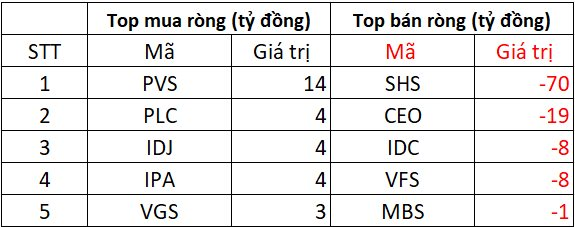

On HNX, foreign investors net sold about VND 51 billion

In the buying direction, PVS stock was the most net bought with a value of VND 14 billion; PLC, IDJ, and IPA followed suit with a net buying value of VND 4 billion. In addition, VGS was also slightly net bought by foreign investors with VND 3 billion.

On the selling side, SHS stock was net sold the most with VND 70 billion; CEO was also net sold with a value of VND 19 billion. Foreign investors also net sold IDC and VFS, with each code valued at VND 8 billion.

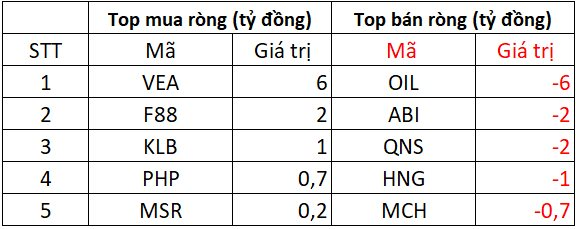

On UPCOM, foreign investors net sold VND 3 billion

In the buying direction, VEA stock was the most net bought with a value of VND 6 billion. Following that, F88, KLB, MSR, and PHP were net bought in the range of a few hundred million to a few billion.

In the opposite direction, OIL stock was net sold with a value of VND 6 billion. ABI, QNS, and HNG were also net sold in the range of VND 1-2 billion.