Gold prices have been stagnant for months, but they’re now on the rise again, consistently breaking records. On September 2nd, gold prices surpassed the $3,500 per ounce mark for the first time since April, followed by a new high of nearly $3,550 per ounce on September 3rd.

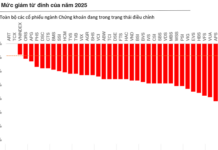

Gold prices have broken records 30 times since the beginning of the year, and many analysts believe this upward trend isn’t slowing down. Experts at Morgan Stanley predict a further 10% increase, with prices reaching up to $3,900 per ounce.

Alexander Zumpfe, a trader at precious metals specialist Heraeus, provided technical analysis in his market commentary: “If the gold price breaks through the $3,600 per ounce mark, the path towards $3,650 per ounce will become very clear.” Commerzbank also foresees gold reaching the $3,600 mark by the end of the year. UBS analysts have similarly raised their price target to a range of $3,600 to $3,700 per ounce.

Not only analysts but also major investors are showing faith in gold’s upward trajectory.

According to the World Gold Council (WGC), more than 116 tons were poured into gold exchange-traded funds (ETFs) from June to the third week of August. The world’s largest gold ETF saw the strongest inflows last Friday, August 29th, since the tariff crisis back in April, as reported by Commerzbank analyst Thu Lan Nguyen.

Asset managers often use gold ETFs as a means to invest in the precious metal. Consequently, these inflows can trigger short-term price volatility, similar to the bets placed by speculators and hedge funds. These ETFs primarily trade gold on futures markets, buying or selling contracts that guarantee gold delivery at a specific price and future date.

Bullish Positions Grow

The regulatory body, the Commodity Futures Trading Commission (CFTC), has recorded this initial growth: In the week ending August 29th, the bullish positions held by asset managers on the Comex commodities exchange increased by over 2%. At that time, gold had just shifted into a slower upward climb. With these bullish positions, investors are wagering on rising gold prices.

What’s fueling the confidence of speculators and ETF investors, who have triggered these recent surges? The Federal Reserve may cut interest rates as soon as this month. Gold truly benefits from low-interest rates as it offers no current income. Conversely, during periods of high interest, gold loses its luster compared to other investments deemed safe, such as bonds.

Investors Losing Faith in Bonds

At least, that’s the general rule of thumb. But this correlation has weakened over the past two years. Earlier this year, gold prices repeatedly hit new record highs, even as yields on 10-year US Treasury notes traded above 4%.

The debt of industrialized nations is rising globally, leading to sell-offs in multiple bond markets. Prices are falling, and yields are rising—for instance, in Germany, the yield on 30-year government bonds climbed to its highest level since 2011. In the UK, the yield on 30-year government bonds soared to levels last seen in 1998. And in France, yields are at their highest in 14 years.

As a result, investor confidence in the solvency of these nations is waning. The same is true for the US. The debt of the world’s largest economy has climbed to over $37 trillion. The US now spends more on interest on its debt than it does on its military.

In this context, an interest rate cut would be a welcome development for the US government. Hence, President Donald Trump is attempting to exert influence over the central bank, an institution meant to be independent of governmental power.

The latest move in the power struggle between Trump and the Fed: an attempt to oust Fed governor Lisa Cook over allegations of mortgage fraud. Cook has filed a lawsuit against this action, arguing that the allegations are merely a pretext to influence US monetary policy. Recently, she voted to keep interest rates unchanged.

Power Struggle with the Fed

Commerzbank analyst Thu Lan Nguyen believes this move is intended to put the Fed’s policy-setting committee, the FOMC, on the defensive. “The allegations against Cook serve as a clear warning to other FOMC members to succumb to government pressure for significant rate cuts,” she writes.

As a result, the market is losing faith in the Fed’s independence and, by extension, the US dollar. The alternative currency—gold—is becoming increasingly attractive, as no central bank or government can arbitrarily increase or decrease its value.

Gold is also appealing from the perspective of non-Western countries due to the absence of counterparty risk. Russia’s example illustrates this point. After Russia’s special military operation in Ukraine in 2022, the US froze its foreign exchange reserves. However, Russia still has free access to its gold.

Central Banks Holding Fewer Dollars

Other countries have followed suit: since 2022, annual gold purchases by central banks have exceeded 1,000 tons, double the amount from a decade ago.

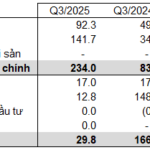

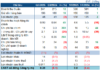

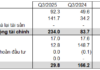

Central bank demand has slowed recently. According to the WGC, demand in Q2 was 20% lower than the same period last year, totaling 166 tons. However, experts believe this figure could be significantly higher this year compared to pre-2022, before Russia’s special military operation in Ukraine. WGC’s chief market strategist, John Reade, expects annual demand to range from 750 to 800 tons.

Consultancy Metals Focus predicts an even higher figure of 900 tons. They observe that the trend of central banks reducing their USD reserves remains intact. First, Q2 purchases were still about 30% higher than the quarterly average from 2010 to 2019. “The continued effort to reduce dependence on USD-denominated assets continues to drive central banks toward alternative investments.” Second, despite high gold prices, central banks are only selling at a limited scale. Lastly, sales in the first half of the year dropped 23% from 2024’s already low baseline.

Non-Western countries are not only becoming increasingly reliant on gold instead of USD reserves, but they’re also increasingly settling trades in their local currencies. However, the USD remains dominant, accounting for roughly half of all cross-border transactions over the SWIFT network, as American financial expert Jennifer Johnson-Calari wrote in a post on the WGC website. A true alternative has yet to emerge.

Turning Point in the Monetary System

Nonetheless, the surge in gold prices since 2022 could “signal a turning point in the international monetary system—the beginning of a transition, albeit a slow one, from a USD-centric system to a multipolar one,” says Johnson-Calari.

She refers to a world order with multiple power centers. The Trump administration is accelerating this trend by abandoning free global trade and a strong dollar. “These developments are driving both central bank gold purchases for reserve diversification and private investor interest in hedging against tariffs and stagflation risks.”