Conditions for the seizure of collateral for non-performing loans

According to Article 4 of the draft Decree, the proposed conditions for the seizure of collateral for non-performing loans are as follows:

Article 4. Conditions for the seizure of collateral for non-performing loans

1. The collateral for a non-performing loan may be seized when it meets the conditions prescribed in Article 198a of Law No. 32/2024/QH15, as amended and supplemented by Law No. 96/2025/QH15, and the following conditions:

a) The collateral is not the borrower’s only residence;

b) The collateral is not the borrower’s primary or sole means of livelihood.

2. Collateral for non-performing loans that do not meet the conditions specified in Clause 1 of this Article may be seized when they meet the conditions prescribed in Article 198a of Law No. 32/2024/QH14, as amended and supplemented by Law No. 96/2025/QH15.”

The draft decree emphasizes the non-seizure of the borrower’s only residence or primary means of livelihood, ensuring that borrowers do not lose their homes or main source of income in times of financial hardship. This regulation demonstrates the development of humane credit policies, balancing the interests of banks and individuals.

Article 3, Clause 1 of the draft states: “A single-family dwelling is a single construction work owned by the guarantor where the guarantor lives and resides stably, long-term, or regularly.” As such, credit institutions, when receiving collateral, must verify and be responsible for not seizing this type of asset when handling debt. In addition, the draft requires the guarantor to provide documents proving that the collateral is unique, as stipulated in Clause 2, Article 5. This is necessary to prevent fraud or policy exploitation.

In addition to not seizing the only residence, the draft decree indirectly restricts the use of this asset as collateral in credit contracts. Since a single-family home cannot be seized in the event of a non-performing loan, it will not provide security for the bank, leading to a potential refusal to accept the mortgage of this house as a condition for capital disbursement.

Illustrative image

|

Limitations on borrowing rights and pressure on homeowners

The draft decree’s provision on the non-seizure of single-family homes by banks leads to difficulties for homeowners in using their assets to borrow from financial institutions. Banks, for risk control reasons, will restrict lending for loans secured by single-family homes or refuse to lend altogether. As a result, this group’s access to formal sources of capital is narrowed, forcing them to turn to informal credit or suffer negative personal financial impacts.

In reality, some financial institutions and banks have chosen additional collateral contract solutions with third parties. The borrower will enter into a mortgage contract with a third-party organization, a unit closely related to the bank but legally separate, managing the collateral independently of the borrower’s single-family home. This allows the bank to avoid the legal constraint of not seizing the borrower’s home while still having a legal asset to handle debt recovery if the borrower defaults. However, this approach is potentially opaque, complex in terms of interests, and may lead to disputes in credit operations without a well-managed process.

Impact on credit institutions and the financial market

The regulation on non-seizure of single-family homes as collateral will put significant pressure on credit institutions in risk management and prudent lending decisions. The increased risk level will force banks to raise lending rates or reduce the number of secured loans. This will affect the financial performance of the banking system and reduce the practical loan accessibility for individuals and small and medium-sized enterprises.

In addition to single-family homes, the draft decree also protects the borrower’s primary or sole means of livelihood used to generate their main income. Credit institutions are not allowed to seize this asset to ensure that borrowers do not lose their means of living and working, thus maintaining their debt repayment capacity. This regulation contributes to safeguarding the essential rights of individuals, preventing them from falling into dire straits, and maintaining social stability in the context of handling bad debts.

Challenges in implementation and suggestions for improvement

The new regulation on non-seizure of single-family homes and primary means of livelihood presents challenges in implementation. Banks need enhanced capacity in appraisal and coordination with state agencies to tightly control the legal and practical aspects of collateral. Additionally, there should be measures to support liquidity, restructure debts, or diversify credit products to ensure a flexible credit market and avoid a scarcity of loans for those in need.

The regulation on protecting single-family homes in the draft decree reflects international trends in safeguarding borrowers’ rights and aligns with humanitarian and social stability goals. Some developed countries have also implemented policies restricting the seizure of single-family homes to minimize social risks and protect low-income individuals.

Therefore, it is necessary to continuously improve the legal framework, providing synchronized and transparent regulations to protect individuals without creating opportunities for exploitation, while promoting sustainable credit growth.

The draft decree on the non-seizure of collateral, specifically single-family homes and primary means of livelihood, is a significant step in credit management and bad debt resolution. This regulation affirms the ownership and protection of the borrower’s single-family home, preventing severe social welfare losses. However, it also restricts the use of single-family homes as collateral, directly impacting the banking loan rights of those who own only one house. Therefore, a comprehensive review and consideration from multiple perspectives are necessary to maximize the effectiveness of this policy, protect the legitimate rights of individuals, and maintain the stability and sustainable development of the credit market.

Master of Science. Attorney Huynh Thi My Hang (Anh Si Law Firm)

The Case for Reducing the Statutory Reserve Requirement by 50% for Four Banks

The 50% reduction in the statutory reserve requirement for banks taking over specially controlled banks is a significant move. This measure enables these banks to extend their credit offerings, reduce costs, and promote the restructuring of subsidiary banks. However, it is imperative to identify and implement control measures to prevent any potential misuse of this supportive mechanism.

“The Rise of Non-Performing Loans Stalls, Many Banks Improve Loan Quality”

The silver lining in the cloud of non-performing loans is that the upward trajectory of total bad debt at the end of the second quarter showed signs of abating. This improvement can be attributed to a combination of factors: prudent monetary policies, a cautious approach to credit strategies, and the gradual recovery of the economy. As a result, many banks have successfully enhanced their loan quality and mitigated bad debt risks.

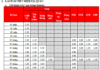

The Race to the Top: How Vietcombank, MB, VPBank, and HDBank Soar After a 50% Cut in Reserve Requirements

The decision by the State Bank of Vietnam to reduce the mandatory reserve ratio by 50% for credit institutions participating in the restructuring process has provided a significant liquidity boost for the four banks involved in the transfer. This policy move has had a multifaceted impact, simultaneously reducing funding costs, directly enhancing liquidity, and promoting credit growth.