The Hanoi Stock Exchange (HNX) has just published a disclosure on the payment of principal and interest on bonds of Investment and Industrial Development Corporation (HNX: IPA).

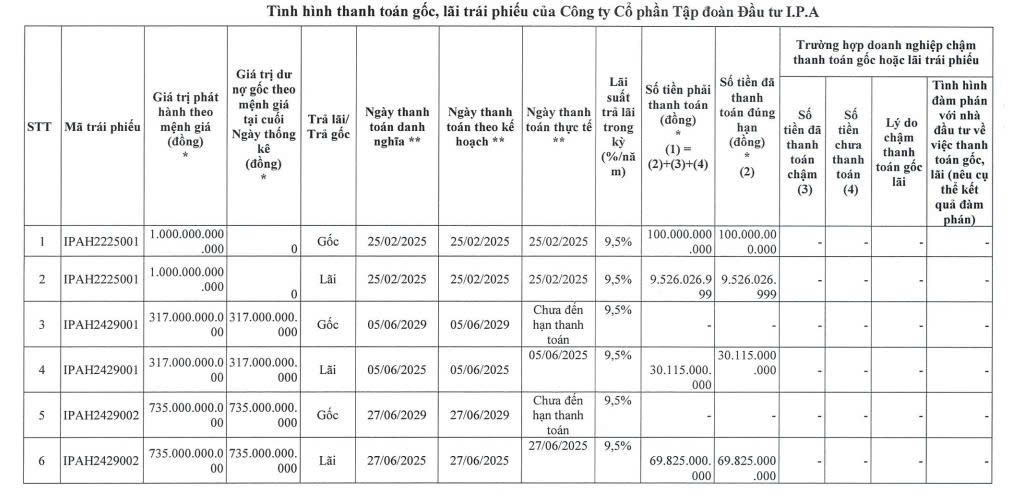

According to the disclosure, IPA paid a total of over VND 209.4 billion to settle the principal and interest of three bond lots on time in the first half of 2025.

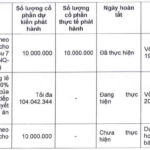

In particular, the company paid VND 100 billion in principal and over VND 9.5 billion in interest for the bond lot coded IPAH2225001, thereby settling the bond lot as scheduled.

It is known that this lot of bonds includes 10 million bonds with a par value of VND 100,000/bond, with a total issuance value of VND 1,000 billion, issued on February 25, 2022. With a term of 3 years, the bonds matured on February 25, 2025.

Source: HNX

Previously, in 2024, IPA had twice repurchased a portion of this bond lot ahead of schedule. Specifically, on August 15, 2024, VND 600 billion worth of bonds were repurchased, followed by another repurchase of VND 300 billion on December 26, 2024.

In the first half of 2025, IPA also made interest payments of over VND 30.1 billion and VND 69.8 billion for the bond lots coded IPAH2429001 and IРАН2429002, respectively.

Both of these bond lots were issued by the company in 2024, with total issuance values of VND 317 billion and VND 735 billion, respectively. The bonds have a 5-year term and are expected to mature in 2029.

In another development, IPA recently announced a resolution of its Board of Directors on obtaining shareholders’ approval via written consent.

The consent seeks approval for a private placement of the company’s shares. The consent solicitation period will run from August 29, 2025, to 5:00 PM on September 19, 2025.

In the proposal to shareholders, IPA stated that the annual general meeting of shareholders in 2025 approved the issuance of shares to increase charter capital from equity sources. Accordingly, the company will issue bonus shares to shareholders at a ratio of 20%. However, the issuance of bonus shares will not increase the company’s actual capital receipts but only adjust the capital structure internally.

Therefore, to supplement operating capital and enhance financial capacity, the Board of Directors proposes that shareholders consider and approve the plan for a private placement.

Specifically, the company intends to offer 50 million shares to professional securities investors at a price not lower than VND 20,000/share and not lower than 90% of the average closing price of the last 10 consecutive trading sessions before the Board of Directors decides on the detailed issuance plan.

The proceeds from this private placement will be used by IPA to repurchase the bonds issued by the company in 2024 ahead of their maturity.

The transaction is expected to be carried out in 2025 and/or 2026, after the State Securities Commission (SSC) announces the receipt of complete documents for the private placement of shares to professional securities investors by the company.

If the private placement is successful, IPA’s charter capital is expected to increase from nearly VND 2,138.4 billion to nearly VND 2,638.4 billion.

“Unveiling the Investors Behind Taseco Land’s Success”

Taseco Land (HOSE: TAL) has unveiled a list of 15 investors who registered to purchase its private placement shares, with foreign funds affiliated with Dragon Capital registering to buy nearly 42% of the private placement shares offered by TAL.

“IPA Seeks Buyers for 50 Million Privately Placed Shares”

Introducing IPA’s latest venture: a proposed private placement of 50 million shares, with a vision to revolutionize the market. The funds raised from this offering are intended to be utilized for the sole purpose of redeeming bonds previously issued in 2024. This strategic move showcases IPA’s commitment to financial prudence and paves the way for a robust future.

“SSI Plans to Offer 415 Million Shares to Shareholders”

At the upcoming extraordinary general meeting, SSI Securities Corporation will propose a plan to offer a maximum of 415.58 million shares to existing shareholders through a rights issue.