HDBank Offers Competitive Deposit Interest Rates for Over-the-Counter Customers in September 2025

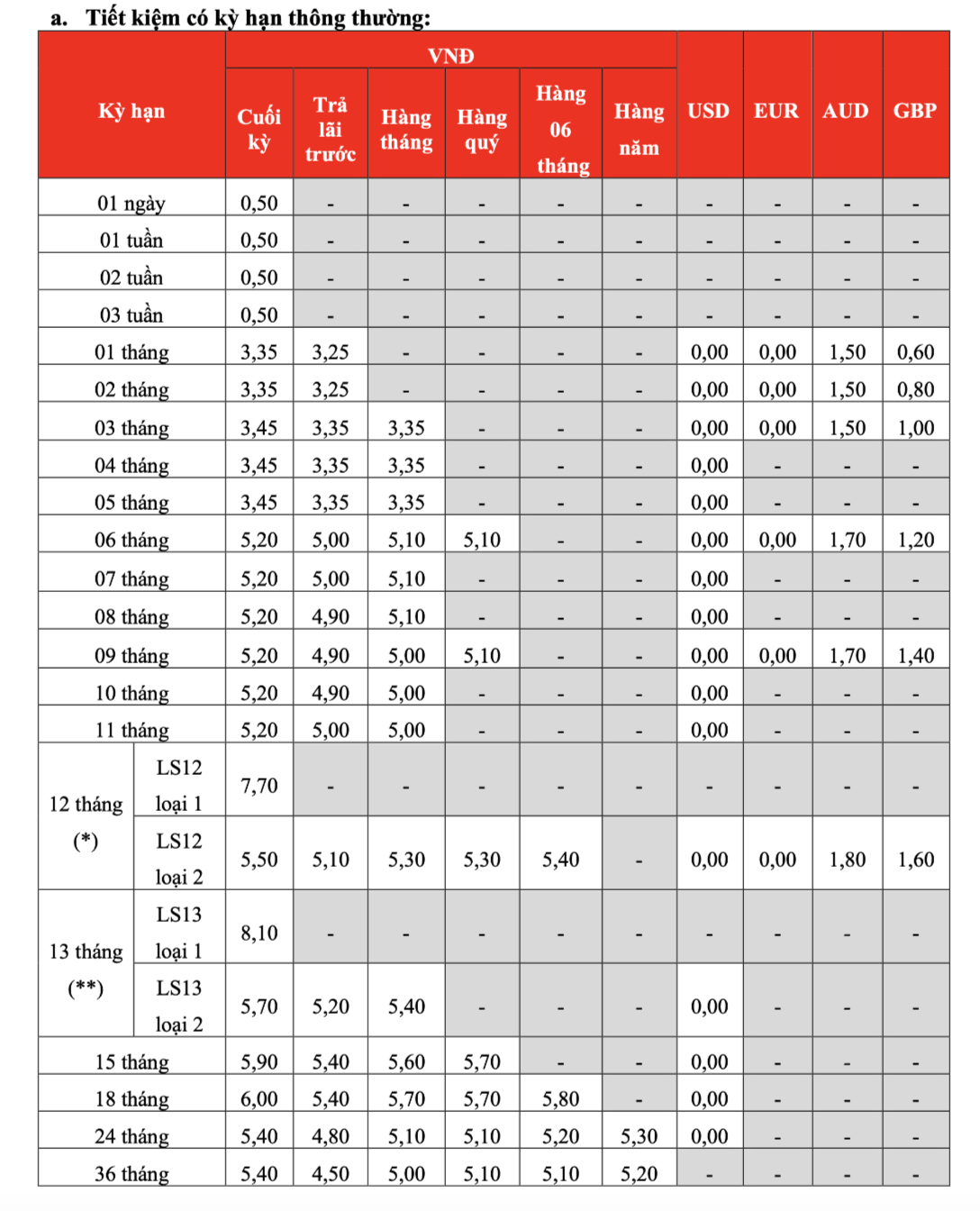

In early September 2025, HDBank, the Ho Chi Minh City Development Joint Stock Commercial Bank, introduced a range of competitive interest rates for over-the-counter deposits. Rates vary from 0.5% to 8.1% per annum, with a notable increase of 0.6% for terms of 7 to 11 months compared to the rates surveyed in early June.

For deposits under 1 month, HDBank offers an interest rate of 0.5% per annum; for terms of 1 to 2 months, the rate is 3.35% per annum ;

for 3 to 5 months, it’s 3.45% per annum; the rate for a 6-month term is 5.2% per annum; and for terms of 7 to 11 months, the interest rate stands at 5.2% per annum.

For the 12-month term, HDBank offers an interest rate of 7.7% per annum for deposits of 500 billion VND and above, while deposits below 500 billion VND earn an interest rate of 5.5% per annum.

For the 13-month term, the interest rate remains attractive at 8.1% per annum for deposits of 500 billion VND and above, and 5.7% per annum for deposits below that threshold.

The interest rates for 15 and 18-month terms are set at 5.9% per annum and 6.0% per annum, respectively. For longer-term deposits of 24 to 36 months, the applied interest rate is 5.4% per annum.

In addition to the end-of-term interest payment option, HDBank offers various interest payment frequencies with competitive rates: Advance interest payment: 3.25% – 5.4% per annum; Monthly interest payment: 3.35% – 5.7% per annum; Quarterly interest payment: 4.5% – 5.7% per annum; Semi-annual interest payment: 5.1% – 5.8% per annum; Annual interest payment: 5.2% – 5.3% per annum.

HDBank’s Over-the-Counter Deposit Interest Rates as of September 1, 2025

Source: HDBank

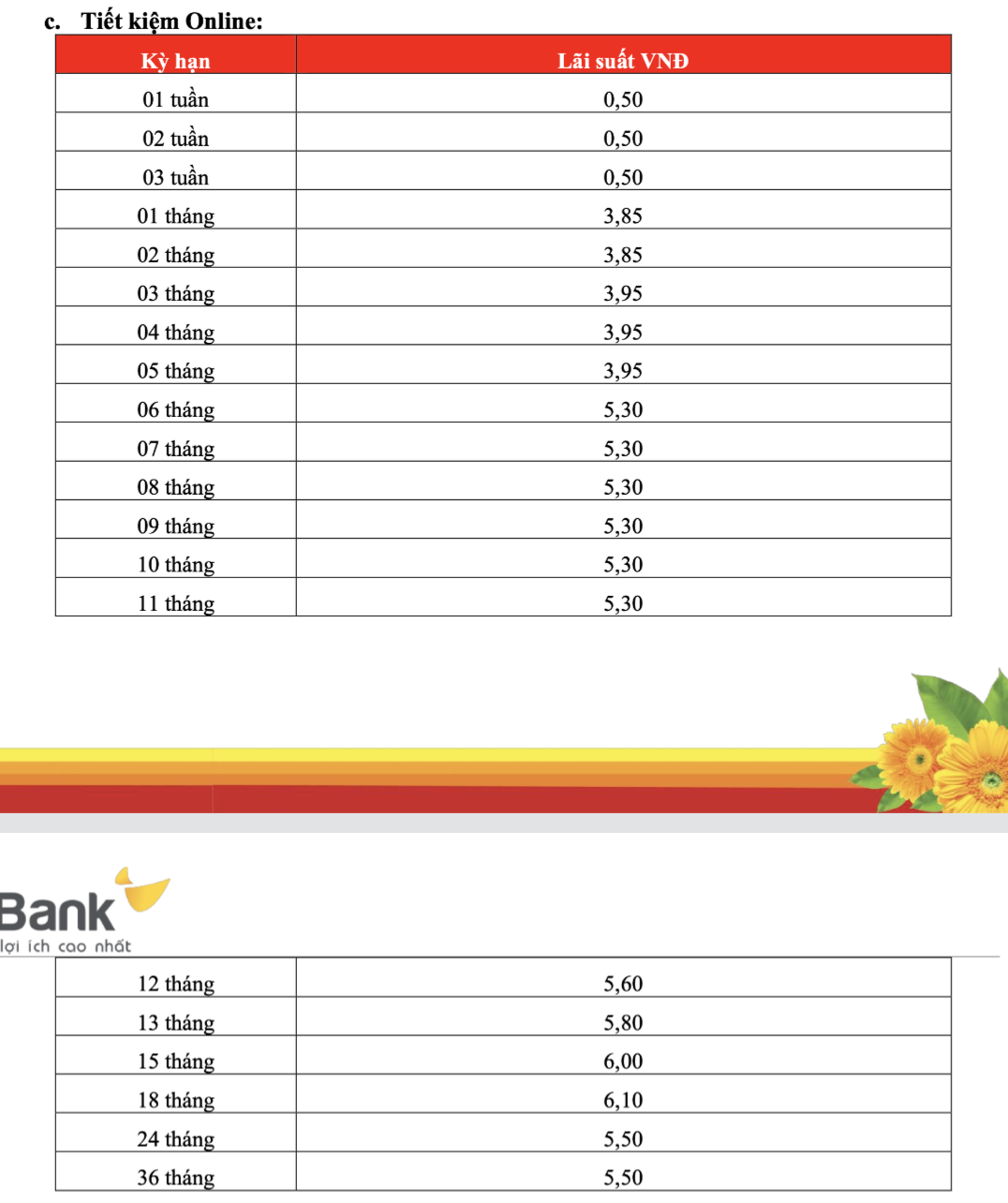

HDBank’s Online Savings Interest Rates for September 2025

HDBank’s online savings interest rates for September 2025 range from 0.5% to 6.1% per annum. Similar to the over-the-counter rates, the online rates for terms of 7 to 11 months have also been adjusted upward by 0.6% compared to the rates surveyed in early June.

Specifically, for terms under 1 month, the applied interest rate is 0.5% per annum; for terms of 1 to 2 months, it’s 3.85% per annum; for terms of 3 to 5 months, the rate is 3.95% per annum; the 6-month term earns an interest rate of 5.3% per annum; the 7 to 11-month term is at 5.3% per annum; the 12-month term offers an interest rate of 5.6% per annum; the 13-month term is at 5.8% per annum; the 15-month term is at 6.0% per annum; and the 18-month term stands at 6.1% per annum. The 24 and 36-month terms share the same interest rate of 5.5% per annum.

With a maximum interest rate of 6.1% per annum for the 18-month term, HDBank remains one of the banks offering the highest deposit interest rates in the market today.

HDBank’s Online Deposit Interest Rates as of September 1, 2025

Source: HDBank

By Tin Vu

The Power of Compounding: Maximizing Your Savings with Strategic Deposit Rates in September 2025

“Savings accounts are a popular way to grow your money, and with interest rates on the rise, it’s an opportune time to explore your options. As of September 2025, Vietnamese banks are offering attractive rates on VND savings accounts, with interest rates ranging from 3.0%-6.0% p.a. This wide range of rates across different tenure options empowers customers to make informed choices and maximize their savings potential.”

“How Can Banks Retain Customers Amidst Intensifying Competition?”

The banking industry is evolving, and with it, the way banks retain customers is also changing. Institutions are now diversifying their services, embracing digital transformation, and focusing on sustainable practices to stay competitive in the race for deposits.

“The Billionaire’s Vision: Saigon Marina IFC – A Hub for Financial Institutions, Tech Giants, and Logistics Experts with Over 10,000 Professionals Working Daily.”

“The inauguration of Saigon Marina IFC is a pivotal moment for Ho Chi Minh City’s aspirations to become an international financial hub. This milestone event, witnessed by government leaders, the State Bank of Vietnam, and HDBank, signifies the city’s embrace of a new era of integration, innovation, and global capital attraction.