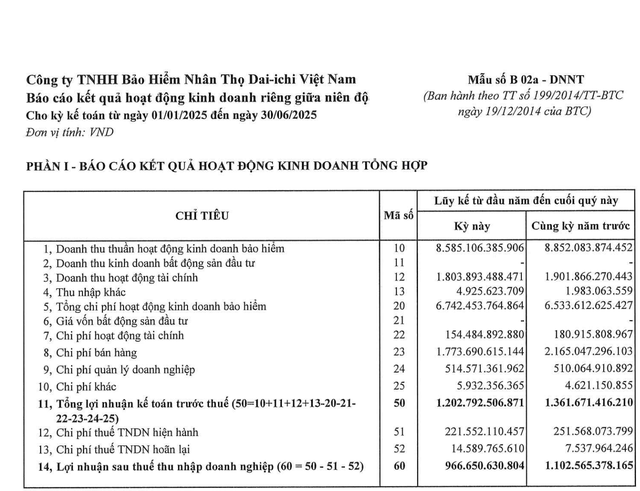

Dai-ichi Life Insurance Joint Stock Company (Dai-ichi Life) has released its semi-annual financial report for 2025, revealing a 11.7% year-on-year decrease in pre-tax profits, which stood at VND 1,203 billion for the first six months of the year.

The company’s insurance business witnessed a 20.5% decline in profits compared to the same period in 2024, amounting to VND 1,843 billion. This was attributed to a 3% drop in pure premium income, coupled with a 3.2% increase in expenses.

Breaking down the figures, Dai-ichi Life experienced a 2% decrease in original insurance premiums to VND 8,985 billion. Linked unit insurance premiums fell by 16% to VND 4,054 billion, while term life insurance premiums surged by 65% to reach VND 190 billion during the first half of the year.

On the other hand, the company’s total claims and insurance payments rose by 5.9% to VND 6,147 billion. While insurance commissions were significantly reduced to nearly VND 590 billion, it was insufficient to offset the decline in profits in the insurance segment.

Mirroring the insurance business, Dai-ichi Life’s investment activities also witnessed a 4.2% dip in profits compared to the first half of 2024, totaling VND 1,649 billion.

Selling expenses for the first six months stood at VND 1,774 billion, marking an 18.1% decrease year-on-year. In contrast, administrative expenses rose by 0.9% to reach VND 515 billion.

(Source: Dai-ichi Life Financial Statements)

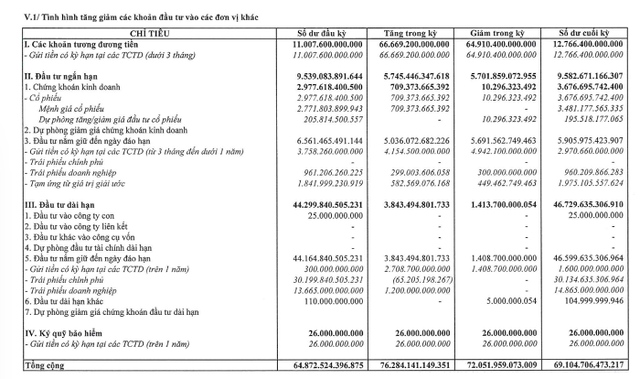

As of June 30, 2025, Dai-ichi Life’s total assets amounted to VND 79,602 billion, reflecting a 6% increase from the end of 2024. Long-term investments constituted the largest component, nearly five times the size of short-term investments.

(Source: Dai-ichi Life Financial Statements)

The company’s long-term investments were predominantly focused on bonds. Specifically, Dai-ichi Life held VND 30,135 billion in government bonds, VND 14,865 billion in corporate bonds, and VND 1,600 billion in time deposits with financial institutions with a term of over one year.

In terms of short-term investments, the company owned stocks valued at nearly VND 3,677 billion at the end of the second quarter of 2025, marking an increase of approximately VND 700 billion compared to the end of 2024. Additionally, Dai-ichi Life held nearly VND 2,971 billion in time deposits with a term of between three months and one year, along with over VND 960 billion in corporate bonds maturing within one year.

The Top 10 Most Profitable Private Companies in Vietnam: A Shift in Fortune for the Nation’s Giants.

“Billionaire Tran Dinh Long’s company witnessed a significant decline in their 2023 pre-tax profits, which stood at VND 7,800 billion, a notable drop from the nearly VND 10,000 billion achieved in 2022. This downturn can be attributed to the falling steel prices and volatile exchange rates. As a result of this decline, Hoa Phat has fallen out of the top 10 list of Vietnam’s most profitable private enterprises in 2024.”

The Lowdown on Smaller Capital-based Banks: How Did They Fare in H1 2024?

Small-scale banks are grappling with a rising tide of non-performing loans, a trend that is putting pressure on these financial institutions to bolster their risk provisions.